Success Stories – Real-Life Cases

The following stories are Real-Life Cases of our international clients. The anonymity of our clients is very important to us. Therefore, we changed the personal client information to protect the identity of our clients (no names, different country names, different places etc.).

I am sitting in an aircraft of Swiss International Air Lines (Swiss) flying to Nairobi, Kenya. The scope of the fight consisted of collecting documents on the economic background of the client (gold mining).

However, all the Real-Life Cases are genuine.

You will become an overview of how we solve problems. You will receive an overview on how we find practical and war-proven solutions solving the client’s problem.

Our success stories are evidence that:

- Long practical banking experience with international clients,

- Immediately applicable portable knowledge and

- Commitment will pay off; even in unpredictable situations.

Sometimes, reality is harder than fiction!

Success Story #1

95 years old lady kicked out of the bank after 45 years

⚠️ The problem of the client

A married couple with Greek passports opened a Swiss bank account 45 years ago. The husband passed away 15-years ago. The Swiss bank asked the surviving spouse, a 95-year-old lady living in the U. K., for documentary evidence showing tax compliance, or to close the bank account.

No evidence for tax-compliance was available. The money was earned a few decades ago when the couple lived in South Africa. The lady had no chance for opening a new bank account without having the evidence that the funds have been taxed. Without providing documentary evidence that the funds have been taxed it was impossible to find and open a new bank account. No Swiss bank will accept funds without crystal clear evidence that the funds have been taxed. Today, Swiss banks are scared of accepting non-tax-compliant money. They paid billions of fines for having facilitated tax evasion.

How to open a Swiss bank account without sufficient documents?

Offshore Banking isn’t illegal but hiding it is.

🛡️ Read here how we helped the client.

The lady maintained an impeccable business relationship for the last 45-years with one of the big Swiss banks. She came to my office with her 70-years-old daughter. The Swiss bank insisted on evidence that the money is taxed. She told me that their husband managed the tax filings. He passed away 15 years ago. The lady told me that there is no documentary evidence available, after so many years. The funds have been taxed in South Africa, she said. However, she was not in a position to prove tax-compliance.

Both ladies were shocked at being kicked out of the bank after so many years without receiving a viable solution. They desperately asked for help. It was impossible to find a new bank without having the ability to produce evidence that the funds have been taxed. Swiss banks are not accepting untaxed funds anymore. Swiss banks are very strict. They reject clients if there is no crystal-clear documentary evidence proving tax compliance.

The amount of ca. 800’000 GBP on the account represents 90% of the entire wealth. The wealth has been earned by the husband in South Africa, a decade before relocating to the U. K.

They had several meetings with junior bankers before engaging me. Clients with big money are served by senior bankers. Clients with small accounts and tax neutral money are managed by junior bankers or by a so-called Exit Desk. Senior bankers are always busy.

The junior bankers accused the lady of tax evasion. They said that she abused the Swiss banking system and the Swiss bank secrecy for tax evasion. They said that the lady stashed money in Switzerland in order to avoid taxation in the country of residence. The lady told me that the funds were generated in South Africa with honest business activities. She said that the husband always paid taxes but she has no documents to prove that the funds have been taxed in South Africa.

The ladies have no other assets to pay the living expenses. They absolutely need the money kept in Switzerland. Otherwise, they are forced to live on the streets. I tranquilized the ladies and I told them that there is always a solution. I promised to find the most appropriate solution for the ladies. I invented a very practical solution.

💣 Read here how we solve the tricky situation!

Solution for the client

I fixed a meeting with the junior banker. The banker was very gentle with me. We closed the account. I advised the ladies to go out of the banking system. The ladies invested in physical gold. We sold all investments with the bank.

We converted all foreign currencies in Swiss Francs with the goal of avoiding a wire transfer connecting with other jurisdictions. Having a transaction in EUR, the European currency will pass over Frankfurt in Germany. A transaction in CHF is much more confidential in comparison with EUR or USD transactions. Transactions in CHF can be executed on a domestic level without the involvement of foreign countries.

Therefore, the funds were sent within Switzerland to a company specialized with physical gold bars in Zurich. Here is the result. The entire account balance has been transformed into physical gold bars. The gold is physically kept in a safety box in the name of the lady.

Zurich, Switzerland:

I made a snapshot with my mobile Phone, inside a Private Vault in Zürich, mainly used for Gold Storage “Out of the Banking System”.

For security reasons, I am not authorized to disclose the name of the Private Vault Company.

The solution was very simple. The lady was very happy about the simple solution. Gold does not generate income which can be subject to tax declaration. The result is that we have no taxable income anymore. In case of a future decrease of the lady, the heirs are going to report the funds inherited to the tax authorities. They will have a much better tax treatment.

The heirs had no active part in the hiding process of the funds. Instead, to disclose the funds to the tax authorities in U. K. acting according to the instructions of the bank, my clients are going to wait until the account holder passes away. They will declare the funds when they will become owners after the lady’s death. Due to their position as heirs, there will be a more favorable tax treatment.

Moreover, my clients will sleep well because they are backed with the physical gold solution having their wealth out of the banking system and stored in a very safe place. The lady is very happy with this gold solution. Since then, the gold price exploded. She made a very profitable investment.

There is always a solution.

Istanbul, Turkey: I am helping a client with a small gold transaction in Turkey.

Success Story #2

How we have unfrozen 65 Million EUR for a Russian client with a second Italian passport

The passport was a real Italian passport. It was not a fake version as offered at the railway stations. He opened bank accounts with the new Italian passport for 65 Million Euros distributed in seven offshore companies. He showed his passport to the Italian embassy asking if the passport is faked or not. The Italian embassy confirmed that the passport was genuine.

Our client used his passport as asset protection instrument for many years. He was afraid that the Federal Security Service of the Russian Federation (FSB)

can take his legitimate business and his money away by inventing a criminal scenario. The Swiss Federal Supreme Court is aware that Russian authorities can ask for international legal assistance to Switzerland with the intent of taking money from competitors claiming back the funds to Russia.

Based on his new passport he could hide and protect his fortune from the takeover by the FSB. Unfortunately, his trustee had offered the passport not exclusively to him but sold such Italian Passports to multiple clients. One such clients with an Italian passport was involved in a money-laundering investigation. During the investigation, a list came up with the names of the Italian passport holders. All accounts in the names appearing on the list were frozen by the Swiss authorities.

During the investigation, we learned that the Italian passports sold by the trustee are special passports issued with a special program for the protection of witness in a criminal trial against organized crime in Italy in compliance with specific anti-mafia legislation enacted in Italy. According to the Italian Witness Protection Program, a witness has the right to claim for a new identity receiving a new name, new address and a new birth certificate.

▶️ Click on the Video: “How to get a new identity legally”

🎞️ Table of Content of the Video

00:00 👉 How to get a new Identity legally (Asset Protection)

01:16 👉 Today, the Authorities first shoot and explain later

03:10 👉 The new beneficial owner register eliminates financial privacy

04:18 👉 The European Union and Non-Governmental Organizations attacked the Citizenship by Investment & Golden Visa Programs

05:30 👉 Warning against Criminal Abuse!

06:24 👉 Who owns your Passport?

07:41 👉 There are multiple ways of getting a passport

08:57 👉 Change of the Name

09:29 👉 Steeling Money with False Accusations

10:20 👉 The Atomic Bomb for Asset Protection

11:04 👉 Multiple Passports became a Status Symbol

Normally, it takes years and years before such blocked funds are coming in the hands of the account holders again. In a meeting with the prosecutor, we wanted to find a more rapid solution for our client and we came finally to a deal.

Here is the deal. The prosecutor will activate the accounts under the condition that our client will testify against his trustee who sold the Italian passport for 500’000 EUR in cash. It was the firm intention of the prosecutor to collect sufficient evidence to bring the trustee to justice. We convinced our client to come to Switzerland and testify.

A few weeks later, the prosecutor separated our case form the rest of the case by giving a new number to the procedure. From a formal legal point of view, it was a separate case now. The prosecutor activated the accounts of our client after we demonstrated by the edition of around 40 kg on documentary evidence in hard copies that the funds were legally earned and of the non-criminal source. In co-operation with the prosecutor, we negotiated a small fine to be paid by our client for having misused the wrong passports for account opening.

By segregation of the case from the big investigation, it was easy for the prosecutor to close our case separately in a very short period of time if provided with a different number. We gained years due to the formal segregation of procedures and our client is happy again to have unrestricted access to his Swiss accounts. We have solved the frozen accounts situation unfreezing 65 Million EUR. Meanwhile, our client entered a Citizenship by Investment program to get a legitimate passport.

Success Story #3

Abuse with the innocent client’s account

Our client from St. Petersburg had a couple of accounts with Swiss banks in the name of his offshore companies. A Swiss trustee managed his offshore companies, including many other offshore companies belonging to other clients.

The trustee abused of the bank account of our client for a transaction in order to avoid disclosure of the effective beneficial owner. It was a critical flow-through transaction. Unfortunately, this account became under investigation in a big criminal case with hundreds of accounts blocked. Our client had nothing to do with the beneficial owner. The prosecutor in Geneva blocked hundreds of accounts just to make sure to block as many funds as possible.

Therefore, he blocked the account of our client’s offshore company with 12 million USD. We checked the entire account documentation with the bank. We collected sufficient documents allowing us to convince the prosecutor about the legal background of our client. We found the transaction report in the bank.

The explanation on the background of the transaction was very poor to convince the prosecutor to activate the account again. Together with the client, we collected more documents. We translated the content and we presented everything to the prosecutor. We explained to the prosecutor again that our client had nothing to do with the people investigated. Shortly after, the account was activated by the prosecutor.

The client became access to his money again after 4 months only.

➕ Here is the Take-Away.

If you keep your funds in the name of cheap offshore companies managed by cheap corporate service providers appointing dishonest nominee-directors many unexpected things can happen.

You should carefully select your business partners. The cheapest is not always the most convenient at the end of the day.

Check this video.

The video shows how a super-market was stolen because of dishonest cheap offshore company providers.

You should always make adequate due diligence on your future business partners.

We help you to find reliable business partners.

▶️ Click on the Video: “80 Million USD Supermarket stolen from cheap offshore corporate service providers”

🎞️ Table of Content of the Video

00:00 👉 Supermarket stolen, 80 million USD damage with an offshore company

01:23 👉 BVI Companies are the most frequently used companies in the world

02:05 👉 The BVI Company has become transparent, no secrecy, no bearer shares anymore

02:25 👉 For secrecy purposes BVI Companies have become useless

02:18 👉 Swiss banks are rejecting the BVI company owners

04:41 👉 Don’t trust the advice of the faceless corporate service providers from the internet

05:29 👉 When the client discovered that his supermarket has been stolen – it was too late

06:10 👉 In Switzerland it’s impossible to bribe the officers of the Cantonal Commercial Register

06:58 👉 The Swiss company is definitely the best holding company money can buy

07:40 👉 If you need the best protection for your expensive asset you must definitely choose a Swiss company

Success Story #4

A bank account has been frozen by the compliance officer. How to successfully negotiate with a compliance officer?

A Russian client involved in international business had Swiss bank accounts with offshore companies managed in Switzerland. Some important documents are written in the Russian language. Nobody knowing the business can understand the Russian language and Russian agreements. We discovered that the compliance officer was not capable to understand the economic background of a specific transaction.

According to Swiss anti-money-laundering laws and regulations, the economic background of a transaction has to be evidenced by documents enabling a neutral third party to understand the architecture of the transaction. The documents must be collected by the Swiss bank before the transaction will take place. The compliance officer simply blocked the account because he was not sure to have fully understood the economic background of the transaction.

I called the bank. I spoke directly with the compliance officer. Together with the client, we composed a chart evidencing the flow of funds. The most important agreements were translated. Together with the client, we made a meeting with the relationship manager and the compliance officer of the bank. We explained the architecture of the transaction.

The account was immediately released and the transaction has been successfully executed. No litigation has taken place.

In this case, it was the compliance officer freezing the Swiss bank account and not the federal prosecutor. Such cases are very frequent. They can be solved in a short period if a simple chart can explain the economic background.

➕ Here is the Take-Away:

Important transactions with big amounts of money must be prepared. Before sending big money to the banks the bank has to be informed on the economic background of the transaction. The economic background information must be documented with appropriate documents, including agreements, invoices, charts with the flow of funds, passport copies of people involved.

In case the bank does not feel comfortable with the planned transaction, you should stop everything and chose another bank. By doing so, you can avoid a frozen bank account.

▶️ Click on the Video: “Bank Account Frozen – How to unfreeze a bank account”

🎞️ Table of Content of the Video

00:00 👉 Bank Account Frozen – How to unfreeze a bank account – 3 Tips

01:26 👉 You don’t need to be a criminal to have your bank account frozen

02:11 👉 Why can your bank account be frozen

02:50 👉 If your payment execution is not done within 2 or max. 3 days that means red flag

03:53 👉 Tip No 1 Do not communicate with your bank because in the communication you can make mistakes

04:39 👉 Tip No 2 Appoint a lawyer with professional banking experience

05:13 👉 Tip No 3 Don’t tell short stories or modified stories to the bank. Don’t lie.

Success Story #5

Italian moved to Thailand without informing the bank. Read what happened.

A client from Italy had a Swiss bank account for many years. Eight years ago he went to Thailand, first for vacation, subsequently to establish a new residence.

He has informed me over the phone from Thailand that he is traveling to Zurich, Switzerland and he invited me for participating in the meeting with his banker in Zurich.

He told me that he feels that the bank did mistakes which can cost money. He wants to check the file of the bank account with me. He insisted on having me beside him during the meeting with his banker. He said to me that he wants to negotiate with his bank at the same eye level. I fixed a meeting with the Swiss bank for the day of his arrival at Zurich. I went with him to the meeting with the banker. We checked the entire bank account documentation, including the transaction papers, credit advice, and debt advice. No mistakes have been detected so far.

I meet a Client in a Hotel Lobby after the Flight and taking immediate action.

At the end of the meeting, the banker asked some questions about his family situation. We have realized that the banker was informed that he went to Thailand 8 years ago and I decided to verify if the banker made a note in the file evidencing the chance of residence. The note was correct. We discovered that the residence in Thailand was marked in the file.

I asked the banker to give me a print out of the computer system evidencing the electronic KYC-Profile (Know-Your-Customer Profile). In the electronic KYC mask, I have realized that the residence was still Italy and not Thailand. No trace in the electronic file on his new residence. As an Italian resident, the client was subject to the EU Directive on Taxation of Savings. That means that the bank has collected the withholding tax on all his savings for the last 8 years despite his domicile in Thailand.

This mistake was expensive for my client because he paid taxes without any obligation to do so. The bank has not adjusted the electronic mask according to the client’s input given 8 years ago. Therefore, the bank has compensated my client for the non-justified taxation he has suffered in the last 8 years. My client has been compensated with an amount between EUR 15000 to EUR 30000 per year, for the last 8 years. It’s a nice amount of money.

The client asked for my physical presence in order to ensure the same eye level confrontation with his banker and we came out of the bank as the winner with the right to be compensated a substantial amount of money. My client has paid me a flat fee amounting to EUR 3500 (agreed before the meeting) for my services in connection with this half-day meeting. The client was so happy to have engaged me, that he invited me to meet him in Thailand for an extended fishing charter weekend.

➕ Here is the Take-Away!

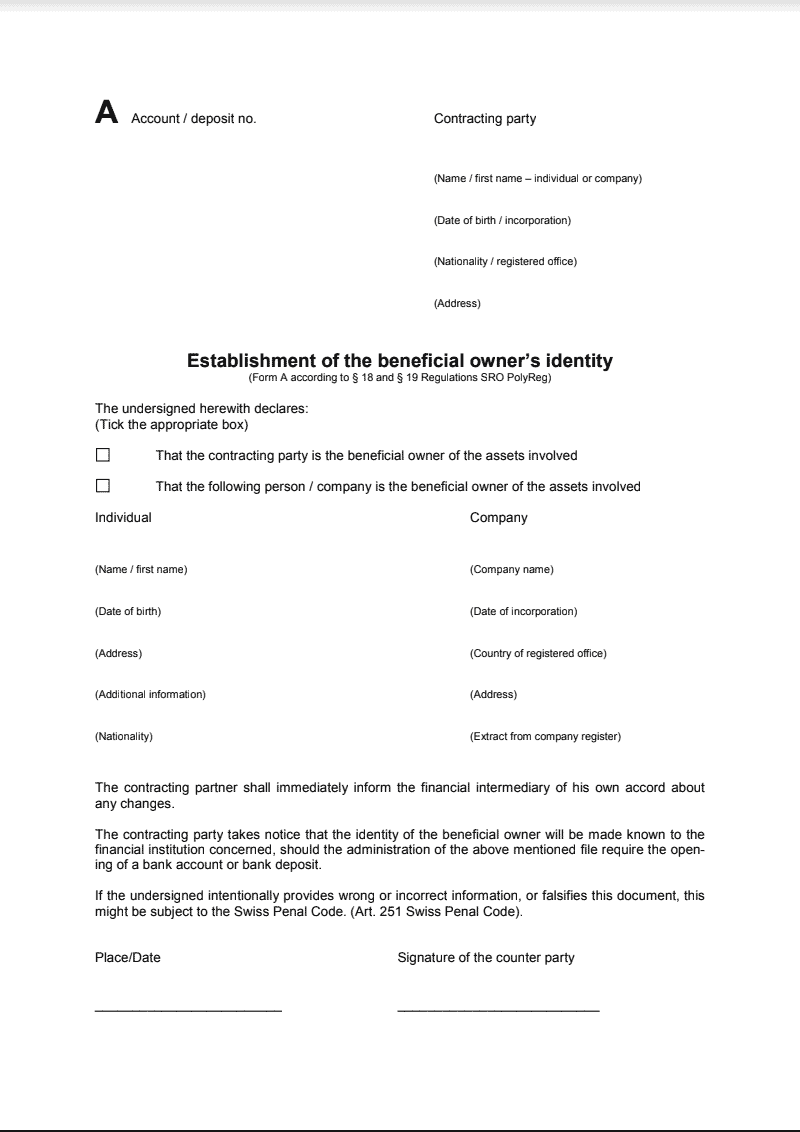

You have to make sure that the Swiss bank is updated with your personal information. The most important Form is famous Form A.

Form A must be always updated with the right information of the Beneficial Owner.

Success Story #6

Jordanian Client lost money due to speculative investments

We asked the bank to send us all the documentation. Fifteen files arrived. When we checked the documentation we learned that the bank account relationship started more than ten years ago with very conservative investments. A few years after the beginning of the account relationship, the bank designated a new Arabic speaking relationship manager for the client.

The new banker advised to disinvest his conservative investments and to reinvest in some more profitable products. In the beginning, the strategy was successful. Every day, the banker contacted his client in order to convince him to invest more and more. The client invested more. Both parties were happy. It was an intensive relationship between the client and his banker.

The bank made huge commissions, the banker (product pusher) made an impressive bonus and the client made money. In 2008 the situation changed. The portfolio lost substantial value. From his initial investment of USD 15 million the client had afterward less than USD 5 million. He realized a loss for the amount of USD 10 million.

According to a leading court case of the Swiss Federal Supreme Court, the contractual basis of a bank account relationship exceeding two years has to be considered as an advisory agreement under the condition that the relationship between the bank and the client is very intensive. Even if there is no advisory agreement in writing, an oral advisory agreement has to be assumed if we have a long relationship with the bank and intensive communication between the client and the bank.

We contacted the bank and we discussed the situation. Professional advice takes care of sufficient diversification – which was not the case here, because 85% of the assets were invested in the same product.

A lack of diversification constitutes a serious breach of the most basic principles in the classic Swiss asset management industry. The high concentration of risks was admitted by the bank and the bank compensated our client. After some hard negotiations on the effective value on the damage suffered by our client, we negotiated a settlement with the bank.

In a case like this, it is not sufficient to speak about the account and the damage. What we need is the edition of all account documentation. We are in a position to discover very quickly if the bank made mistakes.

In this case, no advisory agreement in writing was in place. A meticulous reconstruction of the case history was imperative to solve this case successfully. Without file inspection and accurate study of the account history, it would have been impossible to be compensated from the bank for the damages suffered by our client.

➕ Here is the Take-Away!

▶️ Click on the Video: “What is the best way to invest money (Investment Strategies 2019)”

🎞️ Table of Content of the Video

00:00 👉 The best way to invest money (Investment Strategies 2019)

00:51 👉 The best learnings are based on the proven mistakes of financially successful people

04:01 👉 Over 2.7 million of US citizens have offshore accounts. US investors are concerned about the pure capitalization of US banks.

04:34 👉 The best way to invest money is doing it out of the influence of the home jurisdiction

07:31 👉 Global entrepreneurs have to be prepared to deal with lawsuits

12:32 👉 How to achieve peace of mind with long-term wealth preservation measures

12:59 👉 Wealth needs to be cured and protected

15:10 👉 A bonus driven inexperienced banker can burn your assets

17:55 👉 They will buy the best product on the market for the client, and not the best product for the bank

18:20 👉 The higher the assets under management are, the lower the fees will be

📧 [email protected]

If you need urgent help take your mobile phone in your hands and call me now

☎️ Call +41 44 212 4404

The first Case Evaluation (limited to 15 minutes) is free of charge. Do not hesitate to call us.

It’s never too early… but often too late. Protect your assets today! Be rich and remain rich.