Your best Tax Attorney & Financial Lawyer in Switzerland

International Boutique Law Firm will solve your global Tax, Banking and Business Problems – Even in Difficult Cases

We act across Borders, Time Zones and Cultures!

Your battle-proven lawyer defending your interests in Switzerland – international boutique law firm in Zurich will solve your tax, banking and business problem cases in Switzerland and abroad. We are fast and creative in finding solutions – Even in seemingly hopeless cases.

You feel uncomfortable with your Swiss bank account?

Are you looking for support for your business in Switzerland?

Do you have disputes with your Swiss bank or are you in disagreement?

Would you like to have your documents reviewed before meeting the bank?

Do you have a secret bank account? Do you need fast tax help?

Your bank does not speak plain English. It comes up with various excuses and lies.

They demand your signature on documents you do not understand the content?

Pay Attention! You are in danger! Do not go alone to the bank and hope for a solution from them. They are no longer your friends. Limit your damages and call us immediately.

We accompany you to the bank today. We negotiate directly at the table with the bank director. Together with us, we are going to discuss with same weapons with the private bank (also with the prosecutor, if necessary).

Click on the Google Button and read our Google Reviews.

Table of Contents

- The Mission of Enzo Caputo

- Caputo & Partners are Insiders of the Swiss private banking industry

- Negotiate with the bank with equal knowledge

- Our Insider-links to Swiss baking directors – your Winning Factors

- My Education

- Professional Career

- Caputo & Partners AG

- Jordanian gets compensation for risky investments

- Help-Videos on YouTube

- Voluntary Disclosure Program to legalize black money

- TV-Interviews with Swiss banking expert Enzo Caputo

- Services offered by Caputo & Partners

- Solving problem cases with Swiss bank accounts

- Due Diligence, Economic Background Investigation, Special Investigation/Clarifications

- International transfer of residence

- Real Estate Off-Market, M & A, Trophy Assets, Club Deals

- International Tax Optimization and Tax Help

- International Request for International Legal Assistance in Criminal & Tax Matters

- International Inheritance & Succession Cases

- Asset Protection

- Formation/Acquisition & Management of Swiss Companies AG

- White-Collar Crime

- FINMA Licenses

1. The Mission of Enzo Caputo

Enzo Caputo is the founder of the boutique law firm Caputo & Partners AG.

- Explaining Swiss Private Banking with simple words to a broad international audience

- Case studies and educational Help-Videos with solutions to practical cases

- I want to help you in making the right decisions in connection with your wealth.

- Right decisions can only be made by those who understand the mechanisms, the actors and the conflicts of interest.

- Protecting the hard-earned assets from unauthorized access (including the State).

- How to avoid the worst mistakes and dangers with your investments and how to grow your fortune with a few simple tricks and precautions.

- We are always here for you as your international law office, should something go wrong. Together, we will protect your assets and save you millions in damages.

2. Caputo & Partners are Insiders of the Swiss Private Banking Industry

- Solving your problem cases and disputes with private banks

- Solving problems with the international transactions

- International Tax Law: Your international tax attorney in Switzerland

- International Relocation and Citizenship by Investment

- Business Coaching and Start-ups in Switzerland

We are a business law firm in Zurich, at Paradeplatz, within walking distance of the largest Swiss banks and serve successful entrepreneurs from all over the world. My name is Enzo Caputo. I am the founding partner and registered attorney and barrister in Switzerland. We solve problem cases with Swiss banks and Swiss bank accounts, even seemingly hopeless cases. Often bank problems are connected with international tax problems. We do not write long letters to banks, as other lawyers in Switzerland usually do. These letters mostly end up on the desk of a legal counsel in the legal department of the bank. Once the legal department of the bank is involved, there is a risk that the fronts will harden. Time will pass. Nothing will happen.

That’s why, as your lawyer in Switzerland, we seek personal discussions directly with the bank’s decision-makers – at the highest level of management. We know most banks and senior bankers personally. We are known for achieving fast results for our customers physically at the table in the bank. All partners of Caputo & Partners have gained professional experience as insiders with Swiss banks. I am known for being the best lawyer in Switzerland for immediate results with bank problems and as an international tax attorney to solve problems with secret bank accounts. Immediate personal presence in the bank is crucial for immediate results. I will become operative for you as per the firsts day of the first contact with the client. We are not theoreticians but practitioners who know the banking business and the Swiss banks from the inside. All partners have collected years of professional banking experience. We understand how Swiss banks work and think.

Did you know that banks have to report their clients in case of suspicious activities of money-laundering? If you present fake documents to a bank, you are at risk to be reported to the competent authorities. In the hustle and bustle of the case, nobody cares if you have forged the documents or if an unknown third party was responsible for them. We are happy to check for you if the documents you want to present to the bank are genuine.

In many cases, our clients themselves are the victims of fraud, without knowing it. They are given documents to participate in a seemingly lucrative business with Swiss banks. Be sceptical if someone suggests a deal with Swiss banks, which will enable you to make millions in a short time without investing your own money. The higher the prospective profit, the more cautious you must act. After a few minutes, we know immediately what you have in your hands. After the first minutes of our meeting, we will find out, whether the documents submitted to us are genuine or falsified.

Never start solving your problem with the bank alone. You will lose. Too big is the knowledge of the bank. If you solve your problem with us, we negotiate on equal terms with the bank. We know the market, the pricing, the bank, the bankers, the standards of the industry. We know which bank specializes in which types of business. Many of our private clients have already opened bank accounts in Switzerland.

What can you expect from us?

- We help you with a sophisticated account opening (also for Politically Exposed Person)

- We give you an independent second opinion.

- We check your documents before going to the bank.

- We support you immediately in difficult negotiations with tax authorities.

- We make sure that you as a customer can negotiate with the bank on an equal level.

- We ensure that your assets are managed by senior private bankers.

- We are independent, fast and competent – without conflict of interests.

“If you go to the bank alone, you do not negotiate on equal terms. The knowledge advantage of the bank is enormous. When it comes to your money, do not leave anything to chance. We are independent. We make sure that your money is managed by competent senior bankers who are able to show a successful track-record. With us, we will not allow bonus-obsessed bankers to speculate with your money.”

Have a financial lawyer from our law firm Switzerland check which bank and above all which banker is allowed to manage your assets. The banker can promise you the blue of the sky. Good bankers are always busy. It’s close to impossible that you will meet a top banker if you go alone to the bank.

- Are you able to verify the promises of the banker?

- Who guarantees that your banker is a senior banker with adequate experience?

- How do you ensure that your banker follows your interest and not that of his own or that of the bank?

The bank has an easy game to convince you. You risk your fortune when a bonus-centric junior banker experiments with your money on the stock market. You need an independent consultant like us to help you choose the bank and banker. Good bankers like to work with people they trust.

Difference between Caputo & Partners and Other Big Law Firms

3. Negotiate with the bank with equal knowledge

In contrast to the big law firms, our boutique law firm in Zurich does not appear on the payroll of the powerful Swiss banks. We deliberately avoid conflicts of interest by not accepting mandates from banks. We are completely independent and act only in one interest – yours!

We are fast and flexible. We are small and smart. Our portable knowledge produces immediate results. We address the decision makers directly. We do not waste time in laborious and time-consuming negotiations with the legal department of the bank. We are known for flexibility. Our ready availability is a strategic asset small firms only can provide. Big firms consume two weeks with the due diligence procedure. At the end of the two weeks, they may decide to reject you as a client.

One hour after your call, we may sit with you in the bank with your banker and we negotiate with same weapons.

As an insider of the Swiss private baking industry, we know precisely how a Swiss bank works and thinks. We know the banking business from the field and not only from scientific publications of the universities. Our team is practice-oriented and result driven.

“Among the financial media such as Bloomberg, O Globo, Al Jazeera, TV channels” La Sette “, Italia Oggi and others, I am considered the best lawyer in Switzerland in the representation of international private clients of private banks for the legalization of black money and the release of blocked bank accounts. We have legalized over 350 bank accounts. “

As a financial lawyer and tax lawyer in Switzerland, Mr Enzo Caputo built-up a 30-years old network with the best banks and the best experts in the world. Our network is priceless. Our connections to international experts are based on many years of trust and have always proven themselves. We are all insiders of the Swiss Private Banking industry. All of our partners have collected their professional experiences working inside and for Swiss Banks. We know how banks are working. We know the Swiss banker’s mentality.

4. Our Insider-links to the Swiss banking directors – your Winning Factors

Our unique knowledge of the Swiss private banking industry and our insider connections to Swiss banking directors are the winning factors to solve our client’s problems unconventionally, successfully and quickly.

As an insider in Swiss Private Banking, we quickly get to the point. The portable know-how of our tax office is immediately applicable. Practical, portable and battle-tested know-how is critical to producing fast results for High Net-Worth Individuals (HNWIs). This is more important to us than the academic reputation. The knowledge of our tax team does not come from universities or the internet, but comes from day-to-day business practice with Swiss banks, tax agencies and international tax law firms.

A motivated, experienced and handpicked team of financial lawyers, asset protection lawyers, banking specialists, private bankers, hedge fund specialists, accountants, international tax experts and trade finance specialists solves complex cases of international High Net-Worth Individuals (HNWI).

We are motivated to tackle your problems quickly and efficiently. We think and work in a multicultural, multilingual and international environment.

“We act beyond borders, cultures and time zones.”

In all likelihood, the typology of your case is already known to us. As an international tax office, we draw on the experience of tens of thousands of cases. That’s the reason why we are so efficient. We accompany you to the appointment with the bank. Our experience as an international tax firm, financial lawyer and asset protection lawyer shows that having a personal conversation with the bank’s management brings much better results than mile-long letters with the legal terminology to banks’ legal departments. Mostly, we solve the problems of our clients with the management and not with the legal department of the bank. Once the legal department is involved your case can draw to a long time for a satisfactory solution. That’s why, based on our legal know-how, we try to settle out of the court.

“We always find a solution – even in seemingly hopeless cases where others resign. Often we achieve better results with unconventional ideas than with purely legal arguments. We are there for you, where others can’t find the time. Our offices are located at Paradeplatz, at walking distance from the main Swiss banks.”

In case of emergency, a Financial Lawyer or a Tax Attorney will sit with you in the bank – just a few hours after your call.

Do you need tax help? Our tax attorney is ready. With us, you solve your problem quickly and with same weapons.

Unfortunately, a problem with the tax authority or with the bank is not like good wine, which gets better over time. Do not hesitate to call us first. It is never too early, but often too late. Successful people always look for professional high-quality advice. Engage your Swiss lawyer, today.

We do not delay your case due to our lengthy client on boarding due diligence procedures. Our competitors such as KMPG, PWC, Deloitte and all other big law firms on the payroll of the Swiss banks take 2 weeks if you are accepted as their client. During this period your case can end up in the court and cost you an enormous sum of money. During this time we will solve your case with an out of court arrangement with the bank which will be far cheaper and convenient for you.

An insider of the Swiss Private Banking Industry with 30 years of professional experience is at your side. He is a Swiss lawyer for international tax law, business and banking. As a lawyer in Switzerland, he gained the most valuable experience in the legal department of banks (UBS, Credit Agricole, Swiss Association of Asset Managers (VSV/SAAM). As an insider, he knows both sides.

The typical needs and expectations of wealthy international private clients are well known to us. Supporting HNWI from all over the world is our daily business and there is always a solution even for seemingly hopeless situations – sometimes we have to invent a solution – with creativity and intuition.

5. Education

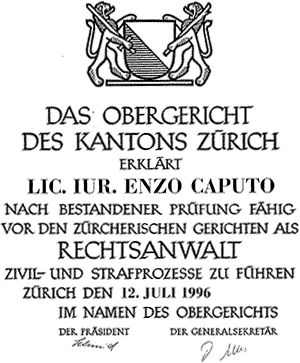

The name of the founder of Caputo & Partners is Enzo Caputo. He was born in Switzerland with Italian roots. He grows up in the simplest of circumstances and past my bar-exam in the 90s. He has dual citizenship (Switzerland, Italy). He successfully accomplished the law studies at the University of Zurich. He has been awarded receiving the academic predicate “Cum Laude” in February 1986. He has collected more than 30 years of professional experience.

Once upon a time, when he was working as a young lawyer for UBS, a well-known entrepreneur, who had come to the bank with some issues, told Mr Enzo Caputo: “Enzo, I do not trust the opinion of lawyers without grey hairs”. At the time, he was not conscious of his statement. 30 years later, he has to admit that he was right. You need practical experience and a portable know-how in order to judge and successfully close sophisticated cases within a reasonable period of time.

As a student, he helped emigrants from Italy to solve legal problems. In cooperation with the “Missione Cattolica” in Zurich, he looked after the Italian community in Zurich. He speaks and write in German, English, Italian and French. He has conversation skills in Spanish and Portuguese.

After completing his practical stage as a court clerk at the District Court of Zurich, he successfully absolved the bar-examination with the Zurich Supreme Court. He is registered as a practising attorney/barrister in Switzerland in the Bar of the Canton of Zurich.

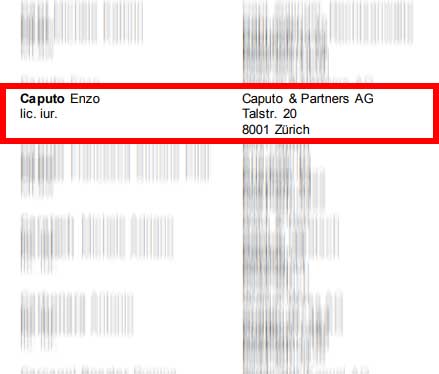

5.1. Attorney/Barrister Registry of the Canton of Zurich, Page 41:

http://www.gerichte-zh.ch/fileadmin/user_upload/Dokumente/obergericht/Aufsichtskommission/Anwaltsregister.pdf

He is allowed to conduct civil and criminal proceedings in court and he is admitted to practice for all instances as a lawyer in Switzerland.

He will advise you to resolve disputes – where possible – always with an out-of-court settlement with the bank. A bad settlement is much better than a good litigation before the court. Believe us. We are always looking for elegant solutions with the management of the bank – without involving the legal department of the bank and without court. Litigation before the court should be avoided if individuals of a certain age are involved. The health consequences of a hard-knit process should not be underestimated.

If for once, there is no way out but to start a lawsuit with the bank, I will select the best litigators for you. Let us manage the best hand-picked team of litigators for you.

6. Professional Career

He was engaged as Head Legal & Compliance of a company being part of the UBS Group. They managed thousands of offshore companies, trusts and family foundations for HNWI being clients of UBS.

As a Compliance Officer he has been responsible for:

- Special Client Due Diligence (PEP-Accounts for Politically Exposed Persons)

- Admission of new bank accounts

- Monitoring international and complex transactions

- Analysis and approval of unusual transactions

- Advising private bankers and bank clients on complex transactions

- Advising on off-shore and on-shore structures, trusts and family foundations

- Negotiations with the US Department of Justice (FATCA, embargos, sanctions)

- Requests for International Legal Assistance and Administrative Assistance

- Negotiations as a tax lawyer with authorities, courts and lawyers abroad

- In-house training for combating money-laundering

6.1. Credit Agricole (Suisse)

Credit Agricole (Suisse) made him an offer he could not refuse and he left UBS. As the Head Legal & Compliance, he approved the customer’s account opening applications after a successful background investigation. In addition, he looked after private clients from Southern Europe and South America. He perfected his portable know-how as an international tax attorney in Switzerland and expanded his network of relationships with regulators, auditors, other banks and authorities, in particular with the Swiss authorities for international legal assistance. His practical advice as a banking and tax attorney to account managers and end customers has been greatly appreciated.

6.2. Compliance Management and Anti-Money Laundering

During the years 2000 and 2001, he attended the postgraduate studies in Compliance Management and Anti-Money-Laundering offered by Prof. Dr. iur. Monika Roth, HWS Lucerne, Business and Banking School, Institute of Financial Services. He followed the origins and evolution of anti-money-laundering legislation step by step, and he has seen all stages of practical implementation in practice.

6.3. Chief Executive Officer of the Association of Swiss Asset Managers (VSV)

The President of the Arbitration Court of the Swiss Association of Asset Managers VSV-SAAM (www.vsv-asg.ch) hired him in 2003. Shortly after that, he was appointed CEO of the VSV. As CEO, he supervised all asset managers affiliated to the VSV-SAAM. He granted new asset managers the financial intermediation license to act as an asset manager. He was able to quickly expand his network of relationships with banks, regulators and non-governmental organizations (NGOs), such as:

FINMA https://www.finma.ch/de

Swiss Bankers Association http://www.swissbanking.org/de

Transparency International https://www.transparency.org/

Financial Action Task Force on ML http://www.fatf-gafi.org/

USA Department of Justice https://www.justice.gov/

Here, he gained valuable experience in dealing with the financial market supervisory authority FINMA and other bodies and regulators in Bern, the banks and external asset managers.

7. Caputo & Partners AG

In 2006, he founded the boutique Law Firm, Caputo & Partners. Immediately, he started with the interpretation of the federal court decision on the retrocessions. Together with Professor Daniel Fischer, he was the first to publish a study on retrocessions in private banking in the business paper “Finanz & Wirtschaft”: “Tickende Zeitbombe Retrozessionen”. With Professor Daniel Fischer, he defended the interests of many investors towards banks, funds and asset managers for the purpose of reimbursing hidden retrocessions.

Whenever possible, he avoids costly and nerve-wracking litigation in court. Rather, he seeks the immediate personal conversation with the directors of the bank. A quick and fair comparison is the goal. The customer should get his money quickly. A payment rendered promptly is worth twice as much. The high value of an immediate payment was well-known to the old Roman lawyers. Here the Latin phrase: “Bis Dat Qui Cito Dat.” (Publilius Syrus, sententiae 64)

Swiss banks fear reputational damage as a result of the adverse press. They avoid the media like the plague. In press inquiries, they wrap themselves up in silence. They cleverly avoid exposing themselves to the media. Nevertheless, the banks are mentioned almost daily in the media. Therefore, the banks want to do everything quickly and discreetly – if possible without media coverage.

Many Swiss banks know that Enzo Caputo, as an international lawyer in Switzerland, maintains good contacts with the media. If the value in dispute does not amount to tens of millions, good results can be achieved relatively quickly in a personal conversation with the bank. Results that other lawyers who go to court can only dream of.

Arguments attacking the reputation of the Swiss bank can produce better results for the client in the negotiations with the bank at the end of the day than just legal arguments.

“If you have a problem with your Swiss bank, you must know that from now on the bank no longer acts as a friend and helper. Rather, the bank (and the banker) now tries to get away without harm. Every mistake is categorically denied. The customer is sent to the desert or otherwise dropped. Sometimes the bank even says goodbye to its own employees. The customer often notices the bank’s adverse behaviour very late – too late.”

Traditional character values such as loyalty, friendship, or even a word of honour have no place in the hard-hitting banking business. When Oswald Grübel, former CEO of UBS, was asked what he thought about career and loyalty in banking, he said, “If you’re looking for loyalty, buy yourself a dog.” He wanted to say that anyone who wants to succeed in banking and make a career is acting without consideration for others and has to put on a thick coat.

Only what is immortalized in writing and legally binding counts in a dispute with the bank. You can’t build on verbal assurances and agreements. In banking, the old legal maxim from the inquisition processes in the Middle Ages applies: “Quod non est in actis non est in mundo” (What does not stand in the files, does not exist). When it comes to money, hard-fought bandages (the term “hard bandages” is characteristically derived from the boxing match) are fought for regardless of casualties.

It is bargained hard. The bank has an easy game if the customer wants to solve his problem alone. An accomplished banker or even a banking lawyer effortlessly pushs the customer into the corner, as his knowledge advantage over the customer is enormous. In such a situation, how can the customer assert himself efficiently on equal terms with equal weapons? No chance, if he wants to solve his problem alone. It’s a mission impossible.

Frequently, the unlimited trust of the foreign client in the Swiss bank is exploited. Many foreigners are of the opinion that all Swiss people in Switzerland behave correctly. Many private bankers calmed their customers by saying that bank secrecy will never die out. They feared to lose their customers. Nevertheless, many bankers have lied to their clients until the last moment of bank secrecy in order to delay account balancing as much as possible. They exactly knew that banking secrecy could not be defended for much longer. When the customer wanted to close his account after the abolition of banking secrecy and insisted on a cash payment, he was denied this. Some of these customers were even insulted as “scoundrels”. There are also black sheep in Switzerland, as everywhere. Not infrequently, bank customers sign contract documents or important statements (for example, risk information on the risks in securities trading) without reading or understanding them. That can take bitter revenge.

8. Jordanian gets compensation for risky investments

(We will now show some real case studies that illustrate how important the role of an expert can be.)

An elderly man from Amman, Jordan, has lost much money with too risky investments. In order to increase his bonus, the banker has convinced the client undertaking risky investments. He has not disclosed the risks in connection with securities trading activities to our client. In any case, there was no trace of risk education in the file. Bank customers are not allowed to buy risky investment products without first being informed about the risks. Adequate risk education of the investor is a duty of the bank. The risk education efforts must be evidenced in writing.

The account manager collected the missing signature of the client shortly after the gigantic losses occurred. He had pre-dated the document showing risk disclosure efforts. Without realizing what he was signing, the client signed having received the standard booklet on risks in securities trading. At the time of signing, he did not know about his losses of USD 2.5 million. It is the duty of every bank to fully inform the client about the risks before the investment and not after the damage has occurred.

He confirmed with his signature in good faith that he had understood the risks. Had our client recognized the legal consequences of his signature, he would never have blindly signed. With his signature, the client has discharged the bank, saved the banker’s job and deteriorated his own situation. Had we been present in the bank at the signing, we would have forbidden our client to sign. The client’s trust in the banker was limitless. Not today. Fortunately, the quality of graph logic expertise in Switzerland has progressed so far today that they are able to pinpoint the date of the signed signature. Thanks to the latest technology, we were able to get at least part of the damage out of the bank.

The example with the client from Jordan clearly shows how important the assistance of an expert is. Without the assistance of an experienced financial lawyer, the bank has a slight game of evil intentions. Too big is the knowledge advantage of the bank. Do not face an unfair game, which is not played on equal footing with the same weapons.

The consequences are crystal clear:

You are going to lose if you will go to the bank alone, without the support of a financial lawyer. The amount of money for the consulting fee is an outperforming investment if compared with the losses.

“If you have a problem with your bank, you should never go there alone. When it comes to large sums, an expert beside you is mandatory. It always pays to engage a financial lawyer for a few thousand euros and negotiate with the bank with same weapons. Successful people are getting advice. A call is enough. We’ll be in the bank with you right away.”

We help internationally linked families solving international inheritance and tax issues. Solving them alone can be a risky undertaking. Often, inherited accounts turn out to be black money accounts. Solving cross-border problems with black money requires experience with the relevant laws applicable to the affected heirs. We have them.

In our offices at Paradeplatz, we advise international wealthy private clients, family offices, asset managers, foreign lawyers and tax consultants in all cross-border matters relating to international business and private banking.

9. Help-Videos on YouTube

We are the first international law firm in Switzerland with a strong social media presence on the internet. Our video channel on YouTube collected more than 1’000 subscribers. We don’t produce cost-intensive image-videos using them as a tool for advertisement of our international boutique law firm. We deliver Help-Videos offering tips, tricks and solutions to the viewers who are immediately applicable.

The goal of our videos is to help the international investment community with solutions to solve their private banking issues. Most of our YouTube viewers have a Swiss bank account. Our Help-Videos are designed to explain possible solutions to problems in connection with a private bank, asset manager, banker, tax, tax evasion, asset protection etc. We help our followers, subscribers and visitors with practical tips and tricks. We prevent them from making costly mistakes with their hard earned money.

As the first law firm in Switzerland, we have been publishing YouTube videos on the internet for 4 years. The practical insider knowledge accumulated over the last 30 years is summarized in simple words with the help of over 200 educational Help-Videos. In the videos, I speak English, German, Italian, French, Spanish and Portuguese. We have engaged professional radio speakers translating some of our Help-Videos in Russian, Arabic and Chinese using the voice-over technology. The ultimate goal of our videos is to convey complicated facts in simple terms.

10. Voluntary Disclosure Program to legalize black money

Mr Caputo was the first tax lawyer in Switzerland reaching directly – thanks to our YouTube videos – the holders of secret accounts with black money with Swiss banks in the USA, Italy, Belgium, Brazil, Canada and Argentina. Based on his capacity as an international tax attorney he convinced nearly 200 international tax evaders through over 40 YouTube videos to legalize their assets by joining the Offshore Voluntary Disclosure Program (OVDP) of those countries.

All tax evaders we helped with solving their tax problems were normal and honest business people. They have been convinced by their bankers that the Swiss banking secrecy will remain in force forever. Most bankers were in a conflict of interest situation. They were scared to lose the clients with their assets. When it was already crystal clear that the Swiss banking secrecy would not survive, they ensured their clients to not be afraid of. They had a predominant interest to retain the clients within the bank. The clients who trusted in the banker’s advice have been criminalized overnight. Suddenly, it was too late to escape. The Swiss banks have forbidden to close the account and to invest the money out of the banking system. The best solution for such tax problems is to qualify for the voluntary disclosure program legalizing the assets. Many clients with secret bank accounts suffered severe health problems as a consequence of their tax problems. The voluntary disclosure program solved both: the health problems and the tax problems.

In cooperation with our international partners abroad such as US-tax lawyer Jeffrey Neiman, from Fort Lauderdale, Florida, USA, Dr. Paride Zanardelli, tax attorney in Italy, Dr. Tobia Colavero and Dr. Salvatore Scrascia, tax attorney in Italy, Prof. Dr. Simoes Bata, tax attorney in Sao Paulo, Brazil, bank and tax attorney Valeriy Volkov in Kiev, Ukraine, private banker Ahmad Jalanbo in Dubai, UAE, private banker Alexander Timofiev, Moscow, Russian Federation, private banker Jan Andrzejewski, Warsaw, Poland, Belgium, Argentina, Canada etc. we successfully solved hundreds of tax problems. We have legalized ca. 200 bank accounts of international non-tax-compliant investors as an International Tax & Law Office in Zurich, Switzerland.

As an international tax lawyer in Zurich he helped clients listed on various stolen Tax-CDs. Let us give you an example: the HSBC-List, stolen by Hervé Falciani from HSBC Private Bank in Geneva and illegally sold and distributed to 28 tax agencies of European countries. Stolen Tax CDs have been illegally obtained. In some of our cases, it was very critical to use illegally obtained evidence against our clients. We have been very successful in solving their implications of being accused of criminal tax evasion if the primary evidence against our clients was limited to the fact of the listing of his name in the illegal Tax CD. The competent tax agency itself was implicated in the offence of receiving stolen information. Under normal circumstances, the acquisition of illegally obtained information is an offence. As a tax attorney, he has seen that the interpretation of law can be very flexible if taxable money is involved.

11. TV-Interviews with Swiss banking expert Enzo Caputo

TV Station Italy: La Sette

Media Giant Brazil: O Globo

Middle East: Al Jazeera

International Business Media

Bloomberg Business, Valor Economico, Il Sole24Ore, Die Welt, Finanz & Wirtschaft, Frankfurter Allgemeine, Milano Finanza, RIA Novosti, Insideparadeplatz, Private, PBWM Russia, Kommersant, Radio Televisione della Svizzera Italiana, La Sette, O Globo, Spear’s Russia, Al Jazeera, Evening Standard, etc. published many articles, reports and interviews due to our know-how with Swiss banks and tax evasion.

11.1. Frozen bank accounts based on Requests for international legal assistance in criminal/tax matters

He is known as a specialist for blocked bank accounts of international bank customers. Frequently, these are accounts of politically exposed persons (PEP-accounts) such as related parties of Hosni Mubarak and Ben Ali or accounts related to the “Lavajado” corruption scandal in Brazil. This is where the principles of international legal assistance apply.

11.2. Frozen bank accounts based on Requests for international administrative assistance

We look after clients with accounts that are blocked in the context of international administrative assistance. It is often the Securities and Exchange Commission (SEC) https://www.sec.gov/

in the USA, which submits a request to the Swiss financial regulator (FINMA) to become the access to bank account records. The SEC often investigates in a pump and dump procedure for illegal price manipulation practices.

The representation of holders of such accounts is about thwarting the edition as much as possible. It’s not easy anymore. Our delay strategy gives US lawyers the time to file a statute of limitations or negotiate a deal with the SEC. Sometimes, just enough time is needed for our client to negotiate a good deal with the SEC. Usually; the account holder agrees to pay a certain amount of money for the termination of the procedure.

The reasons for such procedures can be manifold. Lately, many applications have come from foreign tax authorities submitting applications to the Swiss Federal Tax Administration. All want only one thing: insight into bank account documentation. This information from the bank records is subsequently used in the home country of the client to prove the alleged facts and to hold him accountable in court. Due to the time-consuming procedures, many facts become statute-barred. Thanks to the statute of limitations, many of our clients have been able to conclude advantageous deals with the authorities. In such international cases, cooperation with lawyers abroad must work. We have accumulated experience with the cooperation with our foreign colleagues.

11.3. Account opening with wrong identity (purchased passport)

Two very young Russian clients had each bought a real passport from Ireland for half a million dollars each. Although the two passports were not forged, they were unlawfully obtained by bribing the Irish authorities. The two Russians faked participation in a witness protection program. These witness protection programs protect witnesses from reprisals in connection with trials against the terrorist organization, the Irish Republican Army (IRA). With these two genuine but illegally obtained Irish passports, the Russians have successfully opened several accounts on behalf of offshore companies through a trustee at a Swiss bank. Fabricated real estate transactions have been presented as economic background to justify the false origin of funds.

In the account opening formalities in the bank, the young Russians were identified as beneficial owners with Irish names and Irish passport in the Form A. The trustee unfortunately also sold these genuine Irish passports to criminal narcotics traders in Bulgaria, Turkey and Lebanon. The federal prosecutor got wind of it. He blew up the international ring. In total, the investigation authorities closed more than 500 bank accounts opened with irregular passports from Ireland. In our case, several accounts of offshore companies in the amount of approximately USD 80 million were frozen. These accounts were opened and maintained with counterfeiting of Form A and the purchased illegally obtained Irish passports. The two Russian clients were suspected of money laundering in the millions. The appearance is deceptive. In fact, the clients’ 80 million was legally generated by trading textiles from Hong Kong to St. Petersburg. As a due diligence documentation on the economic background, 15 kg of documents were submitted twice and various multi-day interrogations were organized in Bern until the funds were finally released. Our young clients were punished with a minor penalty. They got away well. The treatment was fair.

The two Russians opened the accounts under the false identity with unlawful passports. They wanted to protect themselves from an illegal request for international legal assistance from the Russian Federation. Their competitors were looking for a flourishing business. Therefore, our clients wanted to protect their funds with accounts with false Form A. This asset protection strategy is completely illegal. Opening bank accounts with a false Form A constitutes the crime of money-laundering. Their competitors in the textile business had worked together with the authorities in Russia. In a night and fog action, our clients had to flee and leave Russia immediately. The funds were legally obtained with textile import from Hong Kong. The young age and the substantial amounts involved made our job difficult. That’s why it was no easy task to clear the suspicion on money laundering and to convince the prosecutor.

There exist much better methods for asset protection that are completely legal. Illegal asset protection methods are like lies. They have short legs and cannot run for too long. The Russian clients could legally buy a passport through a Citizenship by Investment Program. The legal passport is always cheaper. It is possible to receive a name change completely legally in Dominica, for example. There are legal systems where name change procedures are straightforward and quick. Under certain conditions, name change procedures are available even in Switzerland.

12. Services offered by Caputo & Partners

Overview

12.1 Help with Bank Account

- Introduction to the best Swiss bank and top senior banker

- Account opening for Trade-Finance / commodities trading activities

- Account Opening for Politically Exposed Persons

- Account Opening under the radar (under the radar of the Automatic Exchange of Information, AEOI)

- Asset recovery for victims of fraud

- Dormant Bank Account and Account/Bank Investigation

- Blocked Bank Accounts

- Problems with the Automatic Exchange of Information (AEOI)

- Problems with the Common Reporting Standard (CRS)

- Help with Secret Bank Account Problem

- Track down hidden and hard-to-access account information

- Clarifications with World-Check Database, Cancellation Procedure at World-Check

12.2 Due Diligence, Economic Background Investigation, Special Investigation/Clarifications

- Search for the best external asset manager

- Wealth Planning & Private Wealth Management with “Absolute Return” Strategy

- Due Diligence, Background Investigation/Clarification on future Business Partners

- Due Diligence/Second Opinion on Financial Investments

- Due Diligence on Investments abroad

- Background Investigation abroad to ensure future business

12.3 International Relocation for Tax

- Golden Visa Italy, Spain, Portugal, Switzerland, Bulgaria, Slovenia

- Relocation, Flat Tax Italy, Lump-sum Tax Regime in Switzerland, Malta, Cyprus

- Immigration, Citizenship-by-Investment Program, Relocation

- Fast residence in Switzerland or UK: via Cyprus Passport Program

- Second Passport via Ancestors (Italian-Americans, German-USA, CH-USA)

- EU Passport: Cyprus, Bulgaria, Malta, Slovenia, Montenegro

- Diplomatic Passports

12.4 Real Estate Off-Market, M & A, Trophy Assets, Club Deals

- Buying and Selling Off-Market Commercial Properties

- Commercial / Private Properties with Trophy Assets

- Transaction with Art

12.5 International Tax Optimization and Tax Help

- Oases outside the Automatic Exchange of Information (AEOI, CRS)

- International Tax Law opinion of a tax attorney in Zurich

- FATCA, FBAR Filing, OVDP, Troubleshooting, US Tax Law, IRS, US Dept. of Justice

- Relinquishment of US Citizenship and US Exit Tax

- Procedure for returning US passport

- OVDP, Offshore Voluntary Disclosure Program

- Whistle-blower Advice for USA/Impact of Swiss Law

- Tax Planning, Tax Optimization, Estate Planning as your international tax lawyer in Zurich

12.6 Request for International Legal/Administrative Assistance in Criminal & Tax Matters

- Representation for Intern. Corruption, Intern. Fraud & complex Offshore Structures

- Help with Proof of Exculpation – suspected for money-laundering activities

- Avoidance / Delay for Edition of Bank Account Documents

- Representation White-Collar Crimes – Board of Appeal with Federal Criminal Court in Bellinzona

Defence:

- Former disgraced Politicians/Foreign Officials

- International Corruption (Politically Exposed Person, PEP)

- International Financial Market Crimes, Price Manipulation, international Fraud Schemes

- International Money-laundering/International Fraud, Bribery

- Requests for International Legal/Admin. assistance in criminal/tax matters/fin. Regulators

- Help with the Torpedoing of Fishing Expeditions

- Offshore Voluntary Disclosure Program

- Voluntary Disclosure with black money

- Offshore Bank Account Problem

12.7 International Inheritance & Succession Cases

- International Successions with Bank Accounts & Real Estate

- Joint Accounts, Trusts and Family Foundations

- Powers beyond death (Procura post-mortem)

- Account analysis for dormant assets

- Residence Switzerland with lump-sum taxation

12.8 Asset Protection

- Asset Protection

- Asset Tracing

- Asset Recovery

- Banking Secrecy & Automatic Exchange of Information

- Search for the best External Asset Manager with evidence on track-record

- Background Investigation with the help of Foreign Intelligence Services

12.9 Formation/Acquisition & Management of Swiss Companies AG

- Set-up of Swiss Company & Shell Purchase

- Purchase of old AG

- Complex International Transactions and Banks to execute

12.10 White-Collar Crime

- Market Manipulation, Pump & Dump, Front Running, Scalping

- Email Fraud

- Identity Fraud / Theft

- Money-laundering

- Investment Fraud

- Securities Fraud

- Criminal Tax Evasion

- International Tax Avoidance

- Email Payment Fraud

12.11 FINMA Licenses

- Financial Intermediation, Asset Management

- Asset Management for Crypto Currencies

- Introduction to the Market Leaders of the Crypto Finance Industry