“Problems with your Swiss Bank Account?

Lost Money? Frozen Assets?

We will solve your Problems immediately – At the Bank!”

Caputo & Partners is a Boutique Law Firm specialising in international business and banking. We have specific know-how in Swiss banking in conjunction with international tax law. We successfully help international business men with their problems within Switzerland, Europe and other specific countries like Brazil, where are helping wealthy families with their international tax issues.

On the following pages, we give you an overview of the most common problems faced with a Swiss bank account, offshore banking, international tax & business. These problems mean that you can lose all your money, that your money remains frozen for years, or you even risk going to jail.

We are specifically versed with solving such problems mentioned above. Here I provide you with a battle-proven survival guide on how to better identify your problems and find the best solution for them, based on real life case studies.

Table of Contents – Help with Swiss Bank Account

- Never go to the bank alone when it is burning – Don’t be Blind!

- Conflict of Interest facing Private Bankers

- Your Money is Lost –It’s not your Fault!

- Open a bank account with a Swiss private bank

- Politically Exposed Person – PEP Account

- Retrocessions and maintenance commissions belong to the customer

- Legal litigations can be harmful to your health

- Identity Theft with Email-Fraud can wipe out your Bank Account

- Victims of International Fraudsters

- Russian lovers plunder rich business men’s bank accounts

- Bank account was frozen because of a “Fishing Expedition”

- Suspicious Activity Report (SAR) on money laundering according to Art. 9 AMLA

- Request for International Legal and Administrative Assistance

- International corruption of foreign officials

- Victims of Pump & Dump market manipulation

- Did you inherit a numbered account? The contents may not be tax-compliant

- Are you the heir or a Swiss bank account holder?

- Power of attorney beyond death on a bank account (Procura post-mortem)

- Dormant Bank Account including the Safety Box

- Damage limitation in connection with black money

- FATCA-letter and FBAR-reporting requirements

Are you the owner of a Swiss bank account?

Then you might find the following topics very interesting:

- Independent asset management with a Swiss bank cheaper than a direct relationship

- How was Switzerland blackmailed

- New Swiss company in Zug’s Crypto-Valley, including account opening and start-up coaching

- International relocation as the supreme discipline for tax avoidance

- Buy a Second Passport with the “Citizenship by Investment” Program

- Golden Visa for Non-EU Citizens

- Off-Market Real Estate and Club Deals

1. Never go to the bank alone when it is burning – Don’t be Blind!

If you go to the bank on your own attempting to solve your problem, it can backfire. You do not have the knowledge a banker has with his day to day negotiations. Successful people seek advice. You risk shooting yourself in your foot. Don’t forget, every little thing you say to your banker will be written down and recorded during the interview. You will obstruct and make our arguments impossible for later negotiations. You will create a scenario against yourself. Even worse, through your misconduct the bank will file a Suspicious Activity Report for money laundering and block your Swiss bank account for an unforeseen period of time, without telling you.

The gap between your knowhow and the knowledge possessed by an experienced banker is enormous. He can use his knowledge against you and lead you blindly through the negotiations to his favour. When we go to the bank together, we negotiate on your behalf and at the same knowledge-level. We steer the negotiations for your advantage and not that of the bank. The bank cannot lead you blindly anymore. Now, we will negotiate with both eyes open until we reach success.

2. Conflict of Interest facing Private Bankers

Reporting Obligations:

In case of any suspicious utterings from you, the private bankers today are obliged by law to report you to the authorities.

Art. 9 Money Laundering Act – Bank’s Duty to Report the Client to the MROS (Money Laundering Reporting Office Switzerland)

Click here and read the original Reporting Document.

Unlike the private bankers, we have no conflicts of interest with anybody. We are fully independent and as a lawyer defending your rights. We are familiar with all facets of the private banking business. Ideally, the private banker should protect your interests and at the same time those of the bank, which are often in a conflict together and hence the conflict of interest. We are not on the bank’s payroll and by law do not receive any retrocessions from them. We are fully behind your back and will be representing your interests only. Exactly for this reason, we deliberately do not accept mandates from banks, as are all major large business law firms in Zurich. We act solely in your interests – exclusively for you as a private person.

3. Your Money is Lost – It’s not your Fault

Your private bank has promised you an “Absolute Return” Portfolio and now your money is gone? We will get your money back. Often we find irregularities in the account documentation, which we use as a door opener for settlement talks.

Most of the Bankers are driven by their yearly Bonus

Do you want to make sure that you are not being ripped off by a greedy banker? There are excellent prophylactic measures that can be implemented with a few simple tricks, e. g. state in your asset management contract exactly what the banker promises you, i.e. the Absolute Return. We give you the background information you need, in order to help you to make the right decisions when it comes to your hard-earned money.

Are you looking for the best private bank with a dedicated senior banker? In a personal interview, we analyse your needs and situation carefully and challenge your goals. We create a profile that we compare with the best Swiss private banks. Based on these results, we will than be looking for the optimal private bank for you. We will introduce you to a top banker or an external asset manager who will constantly increases your wealth. We will help you to make the right decisions for your assets and guide you all the way as your independent partner during this process.

Are you looking for a top banker who constantly increases your wealth? Top bankers are often busy and out of the way. They prefer to receive customers who have been recommended and introduced by a trusted professional. If you go to the bank on your own, you are likely to be received by a junior banker. Do you want to leave it to chance who is caring about your hard-earned fortune? Or would you prefer to have all the top benefits that a Swiss bank account can offer?

We will protect and increase your assets against the evil eyes of the third parties (including that of the government’s)? We provide you with internationally proven asset protection strategies, that exploits each countries legislation. We will show you how to put asset protection into practice efficiently. We show you the immeasurable values of such strategies in an emergency can be. Our strategies are battle-proven. They work. They are unassailable. If the disaster strikes, it’s already too late for such strategies. Prior to the disaster it is important to implement the asset protection strategies.

4. Open a bank account with a Swiss private bank

Do you quickly want to open a Swiss account because you are expecting an important inflow of cash? We are well connected. We compile the KYC documents (Know Your Customer) quickly and immediately go to the bank. On special request, we can introduce you to the top Swiss banker, namely the owner of the private bank. Do not accept the prices listed on the major bank charges. We always negotiate special conditions for our customers. As you can see, we always have the interests of our clients at heart negotiating the best rates and conditions for our customrers.

5. Politically Exposed Person – PEP Account

How to get a Swiss bank account if you are a PEP?

In Switzerland bank account opening for a Politically Exposed Person (PEP) has become very difficult. Opening Swiss bank accounts online for PEP’s is practically impossible. All PEP accounts are subject to personal identification. Are you a PEP and you want to open a Swiss bank account as a non resident? It’s not a problem for us but a big problem for everyone else.

We help you to put together the documentation showing the history of your funds. We know the best Swiss banks for foreigners who are PEPs. We can introduce you to the top 10 Swiss banks specialized with PEPs. There are banks and asset managers who specialize in specific PEP compliance for PEP accounts. The Swiss bank account minimum deposit for PEP accounts is at least 3 million.

The due diligence requirements are far above average for PEP accounts and here we can be useful. It is extremely sensitive to provide the right data and not more. Due to the tailor-made PEP compliance know-how, the Swiss bank account opening minimum balance for PEP accounts is higher (at least 3 million) compared to a normal private bank account (which is only 500’000 EUR).

Swiss banks need to earn more money with PEP accounts because they are subject to more rigorous legal and compliance requirements. The risks connected to PEP-accounts are also higher, e.g. Swiss banks had to freeze all assets related to Mubarak (previous president of Egypt). We also open a Swiss bank account for non residents who are not politically exposed.

6. Retrocessions and maintenance commissions belong to the customer

In the first verdict of October 30, 2012, the Federal Supreme Court ruled that the customer also has the right to collect the maintenance fees.

Do you have questions about the above statement? Do you want to retrieve retrocessions that were made on your account? However, were never accredited to your account. Then you are at the right address with me. Retrocessions are hidden fees paid by the bank by external product providers. Together with Professor Dr Daniel Fischer, we extensively explained the first leading case of the Swiss Federal Supreme Court in the financial newspaper “Finanz & Wirtschaft”.

There are two fundamental decisions of the Swiss Federal Supreme Court (“Leading Cases”) which are of interest to the investor.

In the second verdict of 17 June 2017, the Federal Supreme Court pronounced the highly controversial issue on the duration of the state of limitation period. The longer the state of limitation period is, the greater the period to claim back the retrocessions. Since last year, it has been precisely defined how long retrocessions can be reclaimed. Asset managers and banks have always asserted a plea of limitation against customers and thus categorically rejected claims letters.

7. Legal procedures with banks are harmful to your health

Has your bank allowed a fraudster to steal your money? We analyse the bank records and look for due diligence violations of the bank. We aim for a quick settlement. A less favourable settlement can in certain circumstances be better than a more favourable outcome resulting from a good litigation before the court. It all depends upon the time horizon you can wait for your money and the urgency with which you are chasing that money. Above all, older investors should refrain from legal disputes that can drag on for years. My experience shows that litigation before court harm the health and are often associated with very high external costs.

8. Identity Theft with Email-Fraud can wipe out your Bank Account

Someone stole your identity and transferred your money from your Swiss bank account to a Wild West bank in Nigeria or China or any non-regulated jurisdiction? The number of email scams increases from year to year. Each case is different and needs to be looked at very carefully. At the end of the day, the truth is not decisive, but what can be proved on record. On the same day, we know whether we have good cards to close a settlement.

9. Victims of International Fraudsters

You are a victim of international fraudsters. You suspect your money is hidden in Switzerland? We know all tricks and structures with offshore companies who have been used for “tax optimization” with secret accounts. The same tricks and structures are used by scammers to mask your money. Thanks to our extensive network of relationships, we often find what we are searching for. Without local network, without our expertise and insider connections you can search for years without a successfully outcome.

10. Russian lover plunders rich businessman’s bank accounts

This is a well-known phenomenon. A rich businessman woke up one day realizing that his Swiss bank account was plundered and his family robbed of their inheritance. We can analyse such situations carefully and with our extensive knowhow of Swiss banking laws and regulations recover your lost assets.

11. Bank account was frozen because of a “Fishing Expedition”

Your account has been frozen by your bank, as a result of an order given to them by the Federal Tax Administration (FTA) or the public prosecutor’s office. We will find it out for you the same day and contact the bank, the tax office or the prosecutor immediately. We are looking for a personal conversation with the decision makers of the bank. With a few phone calls, we find out if an international legal assistance request has been filed with Switzerland by an authority abroad. After that, we work with you to determine a goal-oriented strategy, in order to get the contents of your account back. Our statistics show that about 70% of all blocked bank accounts can be de-blocked again.

In retrospect, requests for international legal (or administrative) assistance often turn out to be illegal fishing expeditions. Fishing expeditions are malicious international requests that are inadequate, inaccurate and/or too generalized as well as not well founded. In many cases, the request of a foreign authority for legal assistance has no solid ground against you in hand, but only vague assumptions based on general phrases. Therefore, the foreign authority constructs imaginative facts with the wildest assumptions.

She wants to make the Swiss authorities believe that certain criminally relevant facts were met. According to international legal assistance legislation, facts do not have to be proved, but merely credibly portrayed. This flexible regime is often abused by foreign authorities to obtain bank records through a letter of request addressed to Switzerland for innocent clients without any information to the account holder. These bank records are used as evidence abroad to sue the account holder in his country of residence. It is important that your Swiss bank account and its documentation are accompanied by us for you not to face an investigation against you at home.

These unfair attempts to gain inappropriately useable evidence are referred to in the jargon as fishing expeditions. Our goal is to convince the judge in Switzerland that the request for legal assistance from abroad is to be qualified as an inadmissible fishing expedition and therefore no bank documents with bank account information may be delivered abroad. The delivery of bank documents with bank account information abroad is referred to in the jargon as an edition of bank information.

12. Suspicious Activity Report (SAR) on money laundering according to Art. 9 AMLA

Is your Swiss bank account frozen due to a suspicious activity? You realize that something is wrong with your Swiss bank account as they are refusing to illicit facts on your account? Do you know that the bank has a legal obligation to lie to you when it makes a Suspicious Activity Report (SAR) on money laundering pursuant to Art. 9 of the Anti-Money-Laundering Act (AMLA)? The bank is obliged by law not to inform you on the Suspicious Activity Report (SAR) filed with the Money-Laundering Reporting Office Switzerland (MROS).

Money Laundering Reporting Office Switzerland (MROS) – Link:

https://www.fedpol.admin.ch/fedpol/en/home/kriminalitaet/geldwaescherei.html

We often notice from the first day and after the first call, whether the bank is telling the truth or lying on your affairs. We have already released hundreds of accounts by collecting, sorting and presenting the exonerating evidence.

Are you worried that your bank may file for suspected money laundering activities? You must not lose time now. Now you have to act immediately. It’s a very serious issue. You must proactively communicate with the bank and eliminate the suspicion. Do not get involved on your one. You are going to lose. Too big is the danger that you will get involved in contradictions confirming the suspicion. We collect all documents necessary combating the suspicion. If the bank has filed the Suspicious Activity Report (SAR), it may take a long time to get access to your account again. It is much better to intervene and stop such a filing beforehand. Time is of the essence.

13. Requests for International Legal and Administrative Assistance

Are you suspected to be the target and at the same time the victim of a request for international mutual legal assistance or an administrative tax proceedings? What does the existence of such an activity mean for you?

It means that an authority in your home country is actively investigating you and seeking to obtain bank account information from Swiss banks to put you in jail. This bank account information will be used as evidence against you in a criminal lawsuit. The fact that such bank account information does not leave Switzerland may be decisive for your condemnation. It can make the difference between whether you are found guilty or acquitted free of charge. Often such a case is directed against you.

The prosecutor prohibits the bank informing you. The prosecutor does not want to jeopardize the course of the investigation. Are you worried that your bank details will be delivered to your home country?

We represent your interests in coordination with your lawyers at home. We will find out for you if there is something hidden from you. We will call the bank and inquire on your behalf. Depending on the response of the bank, we quickly notice whether a request for international legal assistance is pending against you. In the meantime, thanks to our delaying tactics, your attorney can often conclude a tax deal with your authorities at home, because the foreign authority fears that the bank records will not be delivered due to our actions and proceedings in Switzerland.

14. International Corruption of Foreign Officials

Are you afraid of a procedure for international corruption or fraud in your home country and you are fully innocent? We represent you in close cooperation with your lawyers at home. Please be informed that we are far away from judging you based on your previous activities committed in your home country of residence. Our mission is very simple: we defend you based on the most effective tools and strategies. Private bribery of foreign civil servants has only recently been punishable in Switzerland. You have a good chance that no legal assistance will be granted if this offence was not punishable at the time as the commission in Switzerland.

The Financial Task Force on Money Laundering (FATF) has put massive pressure on Switzerland to classify certain offences as crimes by virtue of the criminal code. These were previously classified as minor offences in Switzerland but not any longer. Only serious crimes are included in the catalogue with predicate criminal offences needed to accomplish the heavy crime of money laundering. In recent years, a number of new offences are also classified as crimes under Swiss law, so that the crime of money laundering is fulfilled. Although according to the Swiss sense of justice certain crimes are not heavy enough, Switzerland had to bow to the horrendous pressure of the FATF and criminalize behaviours that previously have not been perceived as criminal by the sense of justice of the Swiss population.

During my time at UBS, I have been involved in a case with a Swiss company who could legally pay a premium to a foreign official in Brazil so that the approval process for a power plant could be completed more quickly. Such practices 20 years ago were common practice. Not only was this private payment considered perfectly legal, it could even be deducted as a business expense on the tax return. Thanks to the payment of the premium, a Swiss company could even save taxes in the past. Such activities will be punished heavily today.

15. Pump & Dump Price Manipulation

The Securities and Exchange Commission (SEC) is targeting your secret bank account and your offshore accounts opened in the name of multiple offshore companies in Switzerland? Is the SEC accusing you of price manipulation i.e., Pump & Dump? We cooperate with your lawyers at home. We try to prevent or at least delay the process of delivering such bank account information to the SEC. In doing this, your attorneys at home will gain enough time to make a convenient settlement or compromise in your favour in your country.

16. Did you inherit a Numbered Account? The contents are most probably Black Money

Have you inherited a Swiss numbered account with non-taxed funds? Do you want to open a numbered account because you are looking for the best available level of discretion?

Numbered accounts, as they used to be, are no longer available today. Even today, we are unable to legally open a completely anonymous account. However, we have solutions for investors who are dependent upon high confidentiality, not for tax reasons, but for other reasons (e.g., a high risk of being kidnapped in Latin America because of their wealth, if it is known to the public). We have discrete tailor-made solutions outside the banking system that we can discuss with you, as the case may demand. We have multiple options and combinations available for you.

17. Are you the Heir or the Beneficiary of an Account?

You are the heir or beneficiary of a personal bank account, a joint account, or Offshore Company accounts, a family foundation or a trust account?

You have inherited a Swiss bank account and need help transferring and rewriting the bank account under your own name? We help you efficiently with complex international succession cases with foreign legal systems. We not only help you with your Swiss bank account but also with the international tax treatment of your new wealth. We will assist you to disclose your newly inherited wealth within your residential country and all that tax-compliant and beneficial to your wealth.

Our Deferral Strategy & your Taxes

We would like to point out that there are legal strategies in order to postpone the pay-outs of the benefits and all this in connection with your trust and family foundation. Thus we also legally shift the occurrence of the tax-causing facts, namely the pay-out of the benefit. If you plan to move your residence to a tax-friendly jurisdiction in the future, you can use this deferral strategy combined with a tax avoidance strategy to save a fortune on taxes.

18. Power of Attorney beyond death in connection with your bank account (Procura post-mortem)

Do you fear your inherited Swiss bank account could be plundered as a result of “authority beyond death”?

Do not worry; we will assist you with words and deeds. We know exactly how to intervene here and block all assets immediately for the benefit of your heirs.

19. Dormant Bank Account

Do you have strong evidence that your grandfather had a Swiss bank account or even a safety box with physical gold bars? Would you like to negotiate with a Swiss bank if there are unclaimed assets? We are the experts for “Dormant Bank Accounts”.

Let me enlighten you with some of my experience and here is my advice:

Only begin to investigate if there are un-doubtful indications for the existence of Dormant Bank Account. Do not fish in the dark. If, on the other hand, you are in possession of any kind of a document, we can proceed.

Look for an old agenda, old business cards from Swiss banks, travel reservations and bookings of trips to Switzerland, old correspondence, old brochures, old travel documents. Talk to old friends of the account holder before they pass away. Often, such indications come from such old sources. The ground-breaking indicators can bring up the treasure to the surface.

Even if there are no discovered assets in the first account, you can use the same documentation to search for another dormant account connected with this one. Make an appointment with us. Let us search and examine your case together. Often it’s simple detail which opens the door to big fortunes.

20. Damage Reductions in connection with Black Money

Do you need help because of the Automatic Exchange of Information (AEIO) and CRS between the OECD countries?

We have already helped many clients to limit their damage. There is no template set in stone. Every case is unique. Make an appointment with us, so that we can examine your individual case with your documents and determine the next steps with you.

21. FATCA Letter and FBAR reporting requirements

As a US person, you are taxed throughout the world, irrespective of where you live. Even if you do not reside in the USA.

The possession of a “Green Card” makes you liable to be taxed in the USA. You can be subject to the FBAR reporting requirements (FBAR: Foreign Bank and Financial Accounts).

https://bsaefiling.fincen.treas.gov/NoRegFilePDFIndividualFBAR.html

We help you with FBAR-filing. Make an appointment with us, so that we can examine your case with your documents and determine together with you the further procedure.

If you are a private client you should be able to afford our reasonable consultation fees. If you believe it is expensive be tax-compliant, try to find out what it will cost you to be non-compliant. It will wipe out your wealth and put you in prison. You can lose your job, your reputation and even your family.

Our specialists at Caputo & Partners give you the background information you need to make the right decisions.

Please be advised: successful people always seek professional advice.

The real value of preventive measures only comes to the surface when the disaster is already there. Those who save on consulting fees are saving in the wrong place. A wrong decision has fatal consequences that are not easy to repair. I speak from experience. Take the first step to solve your problem. You will feel much better afterword’s. I can guarantee it because I have seen so many happy clients after our first meeting.

Other interesting topics for Swiss bank account holders:

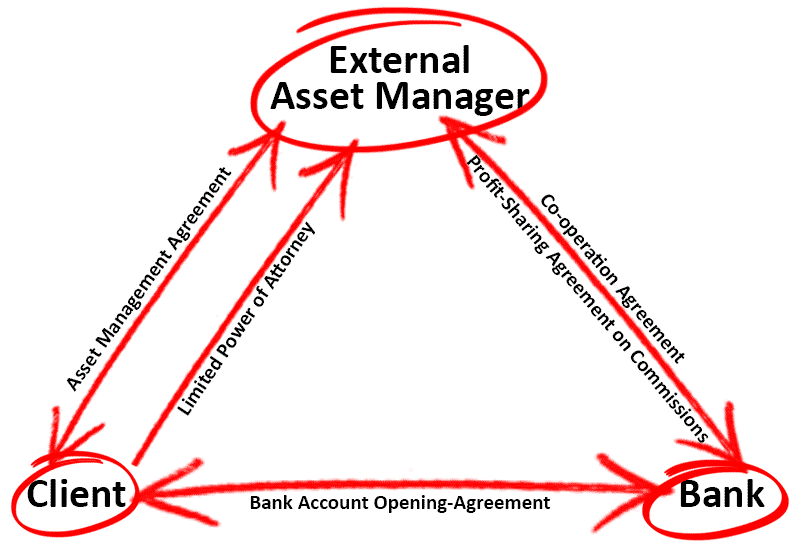

A. Are Independent External Asset Managers more attractive?

Are you looking for an independent external asset manager who is free to make his own choice of the suitable products for you. You do not want to relay on the bank’s recommendation list of products available to all their customers. Do all banks choose the best financial product available in the market? As a former CEO of the Association of Swiss Asset Managers (VSV), I know almost all independent and successful asset managers in Switzerland. I recommend only the best in the industry (“Best in Class”).

You will be amazed to discover that, with the help of an outside asset manager whom we recommend, you’ll pay less fees to your bank rather than going there on your one and opening your own bank account with them. Certain asset managers manage very large assets (assets under management). They use their assets to put economic pressure on the bank’s pricing. You pay less bank fees to the external asset manager than if you went directly to the private bank without an asset manager.

B. How Switzerland is being blackmailed

Today, if you pay a foreign representative of a company to speed up a procedure, a completely legitimate behaviour in ancient times – thanks to the FATF – has been drastically criminalized and qualified as a predicate crime for money laundering, namely as international corruption.

http://www.fatf-gafi.org/

Such a payment of a premium today qualifies as money laundering because the predicate offence of international corruption had to be included as a crime in the catalogue for predicate crime offences. The FATF has put Switzerland under tremendous pressure to criminalize simple gift payments. The funds for this premium payment are to qualify according to the current understanding of law as contaminated funds. Whoever pays such premiums, is now a criminal and can face at least three years in prison.

According to my judgement here they shot with cannons on sparrows. Here, I deliberately refrain from further personal comments. Otherwise, I risk being attacked in social media by certain circles with the allegation that I am representing the interests of criminals and money launderers.

C. Swiss Company Formation in Switzerland’s Crypto-Valley, account opening and start-up coaching

Would you like to build up your crypto business in Switzerland, in Canton Zug (Crypto Valley)? You want to start a Swiss AG, open accounts and launch a start-up? We know the market leaders in the crypto business. We accompany you in your ICO process as a legal advisor.

D. International residence transfer is the supreme discipline in tax avoidance

Would you like to Relocate to Switzerland? We deliver tailor-made “One Stop Shop” solutions not only for Switzerland but also for Italy, Cyprus, Bulgaria, Malta, Monaco, Ireland, Portugal, Spain, Andorra, United Kingdom, Dubai.

E. Second passport with Citizenship by Investment Program

As an HNWI (High Net Worth Individual) are you economically or politically exposed in an unstable country? Do you need a second passport to ensure you and your family in order not to become stateless overnight, like former Thai Prime Minister Thaksin Shinawatra. If you are out of favour at home, you must expect your passport to be taken away or invalidated on the same day. This is exactly what happened to the former Prime Minister of Thailand. He left Thailand with his passport but at arrival his Thai Passport was taken away from him and he was made stateless.

F. Golden Visa for Non-EU Citizens

You are not an EU citizen and want to establish your residence in Switzerland or in London? We have the solution for you. We will legally get you a passport in Cyprus – without ever living in Cyprus. You can then come to Switzerland or go to London, completely legitimate. The procedure has already been criticised but it is fully legitimate – at this very moment.

G. Off-Market Real Estate and Club Deals

Are you looking for investment properties, commercial real estate or trophy assets that you would like to buy or sell off-market? Thanks to our excellent relationships with top bankers at Paradeplatz, we have access to exclusive “Club Deals”. Club Deals are offered exclusively within the clientele of certain private banks. These deal are not available outside. The wealthy and already audited customers value maximum discretion. Before the information on the deal is exchanged, a written confidentiality agreement must be signed. We always have unique opportunities to buy or sell commercial off-market properties with attractive returns (5% or more in CHF).

Our Performance Balance

Call your international lawyer in Zurich, Switzerland, to solve your international issue in connection with:

- International Offshore & Swiss Private Banking

- International Tax Problem

- International Business

You are at the right place! 100% Free Case Evaluation!

YOU RECEIVE REAL ANSWERS BY EXPERIENCED PROFESSIONAL LAWYERS.

We help successful international business people to solve their international issues and problems, fast and efficient.