Best Guide to Access your Inheritance Money in Switzerland

How to avoid hidden International Tax Traps?

- Are you the beneficiary of inheritance money in Switzerland?

- Did you inherit a Swiss bank account and you need help to deal with the Swiss bank?

- How to access the Swiss bank account of a deceased parent?

- How to find a deceased person bank account?

- Do you inherit real estate property in Switzerland?

- Are you involved with heritage distribution transactions in Switzerland?

- Did you inherit a Swiss bank account and you want to transfer the money in your name?

- How to become the access to the Swiss bank account of a deceased person?

- Do you have problems with your Certificate of Inheritance in Switzerland?

- No Swiss inheritance tax for non-residents?

- Can you withdraw money from a deceased person bank account?

- How to access estate money?

- Do you have questions in connection with inheritance law Switzerland?

Have we covered your issues here?

Even if we have not, please do not hesitate to call us to discuss your individual needs.

100% Free Case Evaluation

Table of Contents

- Who are the new Beneficial Owners of the Swiss bank account after Death?

- Who may dispose of the Estate with the Swiss bank accounts?

- Power of Attorney and Signatory Rights after Death

- How to access the Swiss bank account of a deceased Parent?

- Banking Secrecy for Inheritance Money after the Death of the Account Holder?

- Jurisdiction and applicable Law for international Bank Customers

- Offshore Companies, Trusts and Family Foundations

- The best way to transfer Money to your own Bank Account

Click on the Play Button  to start the Video

to start the Video

🎞️ ⬇️Content of the Video⬇️

00:00 👉 How to access the bank account of your deceased parent

01:20 👉 Swiss banks will not take the lead with distributing the assets to the heirs

01:32 👉 Do banks close accounts after death?

01:58 👉 Swiss banks want to keep the funds of the heirs as their new clients

02:21 👉 Mistake No 1: Telling the bank that you need the money urgently

02:41 👉 Tell the bank that you don’t need the money

03:00 👉 Mistake No 2: Not asking to see all account information kept on file with the bank

03:45 👉 Mistake No 3: Not checking the history of transactions

05:12 👉 All heirs must be in agreement otherwise the account remains frozen

05:24 👉 How do you access someone’s bank account after death?

05:39 👉 What is Certificate of Inheritance?

06:01 👉 How does inheritance work in Switzerland?

08:25 👉 How to make sure to not inherit black money?

09:02 👉 There are different ways to legalize inherited money from tax evasion

09:24 👉 The penalties for tax evasion are very high

The best way to transfer Money to your own Bank Account

- We will show you how you can quickly become access to your inherited estate transferring the inheritance money to your bank account with a Swiss bank

- We explain you the Swiss inheritance law and the Swiss bank rules applicable after the decease of the account holder

- We show you how to implement your rights in your capacity as a successor to the Swiss bank account inherited

- We point out dangers and give tips on how best to negotiate with the banks

- We’ll show you how to transfer the inheritance money to your own brand new bank account in Switzerland

- We will open it for you

- We will explain to you which documents you need to present to the Swiss bank so that the bank will accept you as the legitimate successor according to Swiss inheritance law

- We will show you which formal requirements have to be accomplished to access the estate money

Your inheritance money should be in your name for the next few decades. We show you how to invest with a long-term perspective according to Classic Swiss investment rules. As former CEO of the Swiss Association of Asset Managers

Abbreviation: SAAM, http://www.vsv-asg.ch

I show how to be a successful investor based on proven Classic Swiss Asset Management Rules.

1. Who are the new Beneficial Owners of the Swiss bank account after Death?

By virtue of death, all heirs enter directly into the rights and obligations of the deceased person. The heirs are taking over all assets, but also all debts. The transfer of all rights and all obligations takes place immediately – ipso facto – with the expiration of the deceased person.

The passage of property from ancestors to children is generally acknowledged and accepted since biblical times. This undivided succession and acquisition of all assets and liabilities of the estate money of the deceased to the heirs is known among lawyers as the Principle of Universal Succession. The universal right of succession is conferred by virtue of the law and not by the person who passed away, the deceased person. Universal succession means the passing of title to the decedent’s property and debts (assets and liabilities) instantly at the moment of expiration.

Alert!

If the account holder has agreed in writing with the bank before death that after death a particular person is to receive a particular asset (a specific legacy) from the estate, then that asset will not fall into the estate of the community of heirs. A life insurance policy is a typical asset that is not falling into the estate of the community of heir.

1.1. Which law determines the status as a legal heir?

In all contracts signed by Swiss banks with customers from all over the world, it is stated that the client’s contractual relationship with the bank is subject to Swiss law. On the other hand, the definition of the legal heirs of the account holder and the processing of the estate are governed by the law of where the account holder was the last resident. The estate will be distributed according to the law applicable in the place of the last residence of the account holder and not according to Swiss law.

The legal heirs of a bank client living in the Kingdom of Saudi Arabia are defined under current law in the Kingdom of Saudi Arabia, the Sharia Estate law. A bank customer from Saudi Arabia who leaves only female offspring is well advised to take other measures to ensure that his female successors do not end up in misery after the death of the father. According to Sharia Estate law, female successors are not legal heirs, but the male cousins of the female successors are considered as heirs.

If the distribution of the inheritance money (bank accounts in Switzerland) is not in accordance with our legal and moral concept in Europe, a Swiss court cannot recognize a foreign probate as valid and executable. From time to time, Swiss courts are declaring illegal some estate money distribution in compliance with Sharia inheritance law. I will explain to you why based on a verdict issued by the Swiss Federal Supreme Court.

1.1.1. Supreme Court stops estate distribution under Sharia inheritance law in Egypt

In a recent judgment of the Swiss Federal Supreme Court (BGE 143 III 51, verdict of 21 November 2016), the highest court in Switzerland rejected the recognition of a Certificate of Inheritance (acte d’hoirie) issued by an Egyptian court. The Federal Supreme Court considered the Certificate of Inheritance in Switzerland to be incompatible with the public policy of Switzerland (“Ordre Public”). The heirs in Switzerland must respect the basic principles of the Swiss legal system.

The Federal Supreme Court found that Egyptian Sharia Estate law does not recognize the passage of property (succession of inherited wealth) between a Muslim and a Non-Muslim. Moreover, according to Egyptian Sharia legislation, female offspring inherit only half of what male offspring inherit. Consequently, the recognition of the Egyptian certificate of inheritance in Switzerland would result in grave discrimination and disparity, on the one hand, the deceased’s Catholic widow because of her religion, and, on the other hand, the female heirs of the deceased account holder with regard to the female sex.

The inheritance discrimination as a result of the Catholic religion and the female sex violate the Swiss basic principle of non-discrimination from gender and religion. Gender equality and religious beliefs are protected by public policy in Switzerland. Such drastic discrimination is not acceptable from the Swiss point of view, even if the only connection to Switzerland is the location of movable assets in the form of bank accounts with Swiss banks. The Swiss Federal Supreme Court has rejected the acknowledgement and approval of a certificate of inheritance issued by virtue of Sharia Estate law.

Swiss banks have many clients from the Middle East. Middle East clients are coming to Switzerland for asset protection with Swiss banks. They are looking for estate planning solutions protecting their closely related female family members. The Federal Supreme Court judgement is the best evidence that Switzerland is offering what Middle East clients are looking for: a reliable legal system who works efficiently as a Swiss watch.

1.2. Succession with an individual account?

If several legal heirs succeed, all legal heirs together succeed the undivided property together. That is not a form of co-ownership by quotas. Rather, it is undivided total ownership, which only all legal heirs may dispose of together. The legal heirs must act in unison if they want to get money. This form of ownership still exists in the German-speaking territory only. It’s an old relict of old “Alamanni” or “Swabian” tribes (a confederation of Germanic tribes not colonized by the Romans) living beyond the Roman limes in antique times according to the history of law. Swiss banks like this conception of ownership because it offers the best protection. Swiss banks will not pay out unless the payment instruction is signed by all heirs together. The risk to pay twice is eliminated.

What exactly does this look like in practice?

“The bank pays only if all legal heirs agree. If only one person does not take part and cooperates with the distribution of the inheritance, the bank leaves the money in the bank account. Swiss banks will not pay out until all agree on how the bank account should be shared. The bank does not act as an executor supporting the division of the inheritance, as erroneously believed by many customers of Swiss banks and clients of our law firm. The bank does not care how the legal heirs share the inheritance with each other.”

The Swiss Bank pays only to all legal heirs together and simultaneously according to inheritance law Switzerland. It requires a signed instruction from all heirs closing the deceased’s account. At the same time, it needs an explicit payment instruction signed by all heirs and sends the assets precisely as instructed. Based on such rules, the Swiss banks eliminated the risk to pay twice.

1.3. Succession with joint accounts?

The joint account is also known as a “joint account”. In the case of a joint account, the legal heirs replace the deceased co-owner. You will continue the account with the surviving co-owner of the joint account. The sharing percentage depends on the old profit sharing agreement of the two joint account holders. If only one of the two Joint-Account holders has deposited the assets, it is generally assumed that the depositor alone is the beneficial owner of the joint account. But it does not always have to be like that. The following real case from our practice shows the contrary.

1.4. Real Case Study: The rich Widow from Sao Paulo, Brazil

We represented a rich widow from Sao Paulo. The widow and her recently deceased husband together held a USD 12 million Joint-Account. This Joint-Account (also known as “and/or account” or as a “Joint-Account”) was in the name of the recently deceased husband and in the name of the widow. The recently dead husband had 2 daughters from his first marriage. The two daughters are not related to the widow.

Both spouses of the two daughters claimed that the widow’s husband, who had recently passed away, was the sole Beneficial Owner of the joint-account (Ultimate Beneficial Owner). Although the widow is also a Joint-Account holder, she is not the beneficial owner of the joint account, our counterparty argued. The recently deceased Joint-Account Owner alone contributed the assets to the joint account. The widow was as poor as a church mouse. The USD 12 million was paid in by the recently deceased account holder alone. The case is crystal clear, they argued.

After we had requested the edition of the whole account file (access to the bank account records), we examined the entire dossier, page by page, all details. What a surprise: We found an old Form A from 2004. Form A was dated exactly 5 days after the date of deposit of the USD 12 million. In the famous Form A, there were two names in the “Establishment of the Beneficial Owner”: the name of the recently deceased husband and the name of the widow, and the remark: “50/50”. This old Form A was evidence that the husband passed over 50% of his assets to his wife as a donation. The two daughters and their husbands did not want to hear anything about the note on the old Form A.

She wanted to initiate legal action. I then pulled the counterparty’s lawyer by the sleeve, and I put him aside. Under 4 eyes, I explained to him that we are dealing with tax-neutral money (=black money) here – and not with regular funds. I pointed to the publicity risks of a court case over untaxed funds. He estimated his risks and we came to a conclusion. He exposed the dangers to his client so that the case could be successfully concluded by an out-of-court settlement. By settlement, each sister received USD 1.5 million. For our widow, we opened a separate account at the same bank and credited USD 9 million. Shortly after that, we legalized both: the widow’s USD 9 million and the USD 3 million of the two daughters via a Voluntary Disclosure with the Receita Federal (Tax Agency in Brazil).

Attention!

Tax Trap – for Swiss bank accounts inherited

Is Inheritance Money taxable?

Very frequently, international inheritance cases with Swiss bank accounts of our clients have a high-risk exposure in connection with criminal tax evasion. Is inheritance money taxable? The solution of a succession problem is not just a fair sharing of assets. A professional financial lawyer has to consider different types of laws applicable to various jurisdictions. The tax aspect, in this case, was much more critical to the customers than a seemingly fair division. It is the primary job of a financial lawyer to discover the latent needs of the client and to discover and identify tax traps. Often, the client is not aware having a tremendous tax issue with the tax agency at home.

“A good, experienced financial lawyer is able to recognize the latent needs of a client. The heirs were unaware that the funds had never been taxed. Here is where the savvy lawyer comes into play. He points out the enormous risks of untaxed funds. He offers unsolicited solutions that customers do not know, but all the more need. They were very happy that they could inherit less money but legal money.”

2. Who may dispose of the Estate with the Swiss bank accounts?

May the assets of the account holder be freely disposable?

Alert!

The instructions given by the account holder who passed away do not automatically expire upon his death. Rather, the bank must continue to carry out its dispositions. Only when the legal heirs revoke these, instructions are no longer executed. One heir alone can revoke a Power of Attorney post mortem. The bank will block the account immediately.

2.1. Certificate of inheritance, probate and legal status of the heir

Before the legal heirs can dispose of the inherited funds, the bank will clarify the status of inheritance. The bank identifies each heir with an official document (usually only passport allowed). The bank looks closely at the Certificate of Inheritance. In Switzerland, the Certificate of Inheritance is issued by the court. All found wills must be submitted to the court. In the Certificate of Inheritance, all heirs are listed with name and address. Only when all heirs are in agreement the bank starts executing transactions in the name of the heirs. Just uniform and crystal clear instructions that are jointly approved by all heirs are executed. The bank will be careful not to execute premature pay-outs. The bank wants to avoid the risk to pay twice. If only one heir does not cooperate with the common joint instruction, the funds remain blocked at the bank.

2.2. Joint-Account

In the case of a Joint-Account, the surviving co-owner may dispose of the funds only with the consent of the legal heirs. Here, however, the practice of banks is different. Each bank has different contracts. Due to the hidden risks of Joint-Accounts, many banks in Switzerland have almost given up promoting new Joint-Accounts. Many banks have completely abolished them. It, therefore, depends on the amount of money to be transferred, whether the bank permits payments.

In our day-to-day business, we had a few cases where the co-owner paid large sums to accounts at other banks abroad just before death or even after the death of the co-owner. As a rule, this leads to a later obligation to compensate statutory heirs. If multiple jurisdictions are involved, the recovery of funds in practice may take a long time to complete effectively. If an heir of the estate is handling with an evil intent, he can easily elude the other heirs by addressing payments into exotic jurisdictions. The best jurisdictions for such fraudulent money movements are foreign jurisdictions having no agreements in place with Switzerland ruling international requests for procedures for international legal assistance in criminal matters.

Click on the Play Button  to start the Video

to start the Video

🎞️ ⬇️Content of the Video⬇️

00:00 👉 The probability that inherited offshore money is in Switzerland is 30%

01:36 👉 Swiss banks are not becoming active in distributing the estate to the heirs

02:10 👉 What is the nightmare of a Swiss banker?

02:18 👉 Don’t tell the bank that you need the money urgently

02:54 👉 Every heir has the independent right of file inspection with the bank

03:19 👉 Check the history of transactions to trace other hidden assets

04:08 👉 The transfer instruction to your private account must be signed by all the heirs

04:25 👉 Documents requested from the bank to transfer the assets to you

05:04 👉 The physical presence of every heir before the Swiss bank is mandatory

06:04 👉 There is a high risk of inheriting black money if the Swiss bank account is very old

06:36 👉 Does banking secrecy still exist?

07:12 👉 Many heirs were convicted for tax evasion because of misinformation about tax evasion

07:27 👉 Legalize the inheritance with black money. It’s not worth cheating the taxman

3. Power of Attorney and Signatory Rights after Death?

Many account holders give trusted person authority over the account. For such account authorization, banks always keep forms prepared by bank lawyers. Bank lawyers limit the risks of banks. This represents their job. They shift the risks of banks over to the customer. If a customer comes with a power of attorney made by him, this is rejected categorically. In banking practice, only standardized subscription forms are admitted.

3.1. Signatory rights: individual signature, collective signature jointly by two

The banks offer two types of powers. In banking jargon, the subscription rights are reflected on signatory cards. Signatory cards are standard forms prepared by the bank lawyers. Very frequently, the account holder gives his wife a single signature. On the other hand, he gives his two sons a collective signature right to be executed jointly by two. This means that a transaction will only be executed if both sons sign their payment instructions. In the case of legal entity accounts, in practice, there is always the four-eye principle, which is implemented with a collective signature right. Entities are always represented by two individuals. If I see a legal bank document issued by a reputable company having one sole signature, I am very suspicious.

Alert!

“Anyone who makes a signature has to do it in the presence of the bank officer. The banker confirms that he has checked the authenticity of the signature. For security reasons, we recommend that you quickly make your signature in connection with payment instructions slightly different rather than in normal life.”

3.2. Special Tip: How to prevent the forgery of signatures for payment orders

Signatures used for payments should be different from the normal signatures of daily use. By doing so, you are making the falsification of your signature very difficult. My former boss at UBS told me this old and secret trick. I do not want to keep it secret. This trick will help you a lot if you deal with frequent payments.

Here is the old and secret trick! Read carefully.

Let’s say your name is “Maximilian Fröhlich”. Instead of making ö (in the name of Fröhlich) as always 2 points on top of the o, for bank transactions you use two dashes at the top of the o. If someone copies your signature, he will replicate the two common points. He does not know that your signature deposited with the bank looks slightly different and has two small dashes on the o. So you make life difficult to counterfeiters and fraudsters. You can protect yourself with this simple trick. This will prevent your signature from being counterfeited.

Alert!

“Banks are not liable for fake signatures. In the general terms and conditions of each Swiss bank, the risk of counterfeiting has been passed over to the customer. Following the above special tip can save you a lot of money. Anyone who has ever been the victim of bank fraud knows exactly what we are talking about here.”

3.3. Power of Attorney after Death (Lat. Procura Post Mortem, Mandatum Post Mortem)

According to the Swiss Code of Obligations (Art. 35 para. 1 OR), the power of attorney generally expires upon the death of the principal. However, a bank account holder may grant a power of attorney beyond death. Virtually all Swiss banks have a form for it. The power of attorney remains valid beyond death – as I said, with effect “post mortem”.

The Swiss bankers market this power of attorney beyond death (Procura, Mandatum Post Mortem) to the customer as an ingenious solution for its succession. In fact, this power of attorney beyond the death serves only to protect the banks. In many cases, banks are not informed about the death of the customer on time. That is especially true when it comes to the international clientele. If the authorized representative remits large sums abroad, immediately after death, without notifying the bank of the death of the account holder, the bank is insured with a power of attorney beyond death. If the heirs request their money from the bank, the bank can point out the authorization. The heirs are now allowed to argue for money with the sender of the funds, certainly not with the bank. The bank has secured itself.

3.4. Power of Attorney beyond Death as an Estate Planning Instrument – useless!

Some bankers are offering the joint account with a power of attorney beyond death as a cheap estate planning instrument. The argument of the banks is the cost.

“Banks claim to save the costs for a family foundation, trust, public will or inheritance contract. That’s not true, because banks immediately block all accounts as soon as they learn of the bank account holder’s death.”

The authority beyond death is in fact much less efficient than its formulation suggests. The banks block all accounts even if a power of attorney is valid beyond death. No chance with the banks if the arguments refer to the original sense of the law (the “Ratio Legis” or the “Spirit of the law”). The formulation is made ingenious. Banks are allowed to execute instructions after death, but they do not have to.

Alert!

Each legal heir may individually revoke the power of attorney. The bank refuses to enforce the power of attorney as soon as it learns of the customer’s death. There is a risk that certain heirs might be left out and the bank risks paying twice. As a rule, the bank allows payments in connection with funeral costs. On the other hand, the bank refuses payments to the heirs until a Certificate of Inheritance or a similar document is available. In the Anglo-Saxon legal area, a “Probate” is similar to the Certificate of Inheritance. For accounts of clients who live abroad, it often happens that the bank cannot identify all heirs. Under certain circumstances, the bank even has the obligation to conduct inquiries of its own accord.

4. How to access the Swiss bank account of a deceased parent?

The heirs have the right to receive all information on estate and inheritance in Switzerland. They have the same information rights as the account holder previously had before he passed away. This results from the Principle of the Universal Succession, as shown at the beginning. You have an extensive right to ask edition of the bank documents and inspect the file with the bank’s account documentation. The heirs need this information so they can find other accounts at other banks or in other countries. For foreign customers, we always check the history of all transactions in the account. The information also serves to safeguard the mandatory forced heirship rules in case one heir has been privileged by the account holder. The bank documents are the best evidence to be used in an estate reduction claim according to ZGB Art. 522 ff. (Swiss Civil Code, Zivilgesetzbuch, ZGB).

It always amazes us that banks refuse to release bank account information. They know for a fact that they cannot get away with it. However, if a lawyer is mandated, the bank quickly comes to its senses and is suddenly cooperative.

Alert: A mistake you should never do…

You are looking forward to collecting the money from a surprising Swiss inheritance. You want to use the funds immediately to invest in the property of your dreams. You inform in good faith your Swiss bank about your investment plan. If you tell the Swiss bank to transfer the money immediately to the account you have at home with your house bank, the Swiss bank will not be cooperative with you anymore. The Swiss bank does not want you to withdraw the money from Switzerland. The bank wants to continue working with your money. Never tell your Swiss bank that you need the money urgently.

At the Swiss bank, you have to give the impression that you do not need the money. Let your Swiss bank believe that the money will remain here – for the next 50 years. You will see that this simple behaviour will work wonders. Immediately, the bank will ensure that everything is done quickly and smoothly when transferring the money to your Swiss account. Only after you have finished the inheritance procedure, only then, you can inform the Swiss bank that you want to withdraw everything immediately, because the money is needed for a real estate investment.

Alert!

If the bank refuses to give you information about the bank account, you should call us.

“We will not only request the immediate inspection of all documents, but we will analyse all the old transactions of the deceased account holder. We look for additional offshore accounts that could be in other offshore locations. In many cases, we have discovered secret accounts that were unknown.”

There are still many accounts with undiscovered funds. Above all, older people are not aware of the undeclared black money problem with the Swiss banks and the consequences of the Automatic Exchange of Information (AEI) and the Common Reporting Standard (CRS). The mentality of hiding money from the government is still widespread, especially among the older generation who survived the WWII. The old generation grows up after WWII with the mentality to hide assets and to keep it secret for rainy days, sometimes even towards family members.

An 82 years old Turkish client who became extremely wealthy with his textile factories in Bursa, Turkey, had a secret bank account with 8 Million USD with a Swiss bank in Zurich. He had 2 sons and a wife. Nobody of his family has been informed about the father’s bank account in Zurich. His Swiss banker with Turkish origins seduced him with investments with currency futures and options. At the beginning, the investments have been very successful.

Suddenly, in the month of January 2015, the Swiss National Bank (=the Swiss Central Bank) stopped hedging the EUR at CHF 1.20. The EUR came down from CHF 1.20 to CHF 0.80 losing a third of its value within minutes. The Turkish client lost a fortune. The value of his account came down to 0.5 Million USD. The Swiss banker misinformed his Turkish client. He told him that he hedged the positions. 2 months later, a “margin call” destroyed the entire value of the account. In finance, a “margin call” is a collateral guarantee that the holder of a financial instrument has to deposit with the bank to cover the credit risks.

The banker leveraged the bank account with a credit facility to increase the amounts for more speculative investments. The Turkish client signed the leverage agreement without being aware what he signed. He trusted his banker without limits. He signed and entered into an agreement he did not understand. The client was in a very uncomfortable situation. He disclosed the Swiss bank accounts to both sons and his wife. The banker has been arrested because he defrauded other clients of the bank.

The Swiss bank closed a series of out-of-court-settlements with all the clients who lost money. It was imperative to the bank to keep this case very secret. The bank has been prudent dealing with the journalists. The bank successfully avoided negative publicity. The Turkish client does not speak English. He appointed his 2 English speaking sons to manage the settlement negotiations with the bank and our law firm. Just because of particular circumstances the 82 years old client disclosed the bank account to his family. Under normal circumstances, the account would have remained kept secret.

Because of this mentality of secrecy among the older generation, it is always worth, if you analyse the old account movements exactly. Often, payments to offshore banks whose existence the heirs knew nothing about are coming to the surface as a surprise.

The most frequent (wrong) arguments of the banks, by which they refuse to provide information, are:

- A single heir should not ask for information alone

- Clauses in the last will are imposing to the bank not to disclose information

- It has already passed too much time

- The only limited storage obligation of the banks is the 10-year retention obligation according to OR Art. 962 (Swiss Code of Obligations, Article 962). That’s not true because all documents under the custody of the bank must be imperatively disclosed.

For you as a legal heir, it is very interesting to know who has received money from the inherited account in the last 10 years. If your statutory inheritance rights were reduced by payments to third parties in the last 10 years, you could find valuable evidence in the bank account documentation. You could be entitled to more money than you think today. Call us and we will verify it immediately. Because of our professional experience, we are very quick when we check old transactions. Usually, it takes us a couple of hours to analyse the history of transactions. You can engage us for just a few hours with the specific goal to check the account history of your ancestors and to identify promising transactions.

How to find out if someone has a Secret Bank Account in Switzerland?

This video can be interesting to potential heirs, spouses, children of spouses, victims of scam artists, fraudsters and private detectives.

The probabilities of finding money are higher than expected. Approx. 30% of all offshore money in private hands on the planet is stashed with Swiss banks.

Switzerland should be the main target for treasure hunting. Mainly older clients of Swiss banks carried the secret of having an offshore bank account to the grave without sharing the secret with their own family members. That’s the main reason why 50 million CHF are still booked on so-called dormant accounts.

Click on the Play Button  to start the Video

to start the Video

🎞️ ⬇️Content of the Video⬇️

00:00 👉 This video is for the heirs of secret bank account holders

02:37 👉 Victims of scam artists should hire international offshore banking lawyers

03:47 👉 Does Switzerland still have bank secrecy?

04:24 👉 Swiss banks will not respond to letters of foreign lawyers

05:00 👉 How to find out if someone has a Swiss bank account?

05:19 👉 Swiss banks will not act as the executor of assets inherited

06:26 👉 As an heir, you are entitled to access the file kept by the bank

07:25 👉 How can I access my Swiss bank account? Which documents do I need?

09:06 👉 Never tell the bank that you need your money urgently

09:32 👉 Make the bank believe that the funds will remain with the bank for the next 50 years

10:09 👉 Can only one heir access bank account information?

10:26 👉 The transaction history of the account can disclose unknown assets

12:18 👉 How to avoid inheriting contaminated funds because of tax evasion

12:54 👉 Does bank secrecy still exist?

13:11 👉 How to avoid the black money trap?

13:50 👉 How do I get out of tax evasion?

5. Banking Secrecy for Inheritance Money after the Death of the Account Holder

Neither the banking secrecy nor the privacy protection can reduce the extensive right to information of each heir. Exactly the same information that the account holder could demand from the bank can now demand the heirs.

In many cases, we serve overseas clients who have inherited undeclared assets (black money). It is precisely these heirs who unexpectedly have to deal with questions about the Automatic Exchange of Information (AEI) and the Common Reporting Standard (CRS). Often, these heirs have no experience with the tax situation of offshore accounts. The trap with the inheritance of black money is very dangerous.

Alert!

Foreign clients should always hire a specialized lawyer when inheriting offshore accounts. The stumbling blocks are enormous. Depending on the homeland of the account holder, the consequences for criminal tax evasion can be unexpectedly severe. Many countries, such as the US and Canada for example, have tremendous penalties in place. Multiple years of imprisonment for criminal tax evasion is a high price for an offshore bank account inherited. You need to dedicate adequate attention to this explosive matter.

6. Jurisdiction and applicable Law of international Bank Customers

The legal relationship with the bank is also subject to Swiss law for foreign bank customers. On the other hand, the foreign law always applies to property law and inheritance law issues. Often, legal systems of several countries come parallel to the train. We maintain a long-established and proven network of relationships with specialized lawyers throughout the world. As a former employee of the legal departments of UBS and other Swiss banks, I was able to build a priceless network of relationships with the best experts in the world. When you become our client, you benefit from this international network of contacts from day one. We are used to co-operating internationally with experts we fully trust.

“We think and we work internationally – across borders, time zones and cultures.”

Furthermore, Caputo & Partners is a member of the largest legal network in the world.

AEA – International Lawyers Network: http://www.aeuropea.com/

We meet personally with lawyers from all over the world, who, like us, are internationally oriented. We exchange our experiences and maintain personal relationships. In order to serve international clients successfully, personal relationships of trust with foreign lawyers and tax experts are essential, We are reliable, professional and result-oriented.

Our advantages at a glance:

- Multilingual skills

- Internationally experienced for over 30 years

- Multicultural know-how on foreign legal systems

- Internationally well connected

- Insider connections to the banking directors

- We work with different legal systems – every day

7. Offshore Companies, Trusts and Family Foundations

If the account holder is an offshore company, a family foundation or a trust, then the question arises as to whether the heirs can take action against the bank directly. The account holder is the offshore company, a legal entity and not a natural person. The Swiss courts have developed an extensive practice. Under certain circumstances, the heirs may proceed directly against the bank in connection with the bank account of such a structure.

How does it look if a reduction claim abroad is to be enforced?

There are different answers. Legal systems of the former British Empire usually do not have the protection of legal heirs or direct descendants. Other countries, which are influenced by continental European law, are well aware of the imperative protection of the legal heirs being direct successors.

7.1. The Black Money Trap

There is no Swiss inheritance tax for non-residents. Inheritance tax of your country may apply. Is inherited money taxable in Switzerland? No, this is impossible for non-resident heirs. If you inherit a bank account that is in the name of an offshore corporation, a family foundation, or a trust and such accounts were opened many years ago, you must be careful and vigilant. It could be a black money trap. In the past, family foundations and trusts were often used to govern the succession of black money. Black money could be transferred to the next generation with the help of a family foundation or trust, without involving the courts or other authorities. It was a private and tax-neutral estate settlement.

With the help of offshore structures, the liquidation of black money was a purely private matter, which could be handled entirely in Switzerland. Nobody got wind of it: no judge, no tax authority, no notary. The banking secrecy was strong and protected privacy immensely. With the help of the bank, the clientele was able to process the proceeds of black money – without disclosing to the authorities and courts – without any complications. The bank inspects the certificate of inheritance so that it can find and safely identify the legal heirs. The bank wants to pay out to the legitimate heirs only.

Today, the estate is no longer a private matter. An Automatic Exchange of Information (AIA) is a fact today. The OECD has obliged banks to disclose all account information via the Common Reporting Standard (CRS). The inherited account will also be disclosed due to the AIA and the CRS. Since 1 January 2017, all Swiss banks started collecting the bank account information of their clients. In September 2018, the first Automatic Exchange of Information takes place in Switzerland.

If you inherited a bank account in the name of an offshore vehicle, you are most likely inheriting black money. To get out of the black money trap, all heirs must be united and act in a coordinated manner. All heirs must legalize the inherited black money before the bank forwards the account information. All heirs must disclose the inherited black money to the tax agency at their place of residence. Many cases of estates with black money have been discovered by the authorities because several heirs had not cooperated. If one heir declares and the other does not, the tax agency will become wind.

“If you have inherited bank accounts from Offshore Companies, you can be pretty sure that you inherited black money. Call us for help. We help you to find the best way to legalize your black money tax-efficient.“

Depending on the legal system, there are different ways to do it. For example, the timing of self-reporting must be coordinated and optimized. If every heir does what he wants, you’re bound to have tax issues. In the last 5 years we have legalized nearly 1000 bank accounts with the help of the tax self-reporting option, commonly known as Voluntary Disclosure, Offshore Voluntary Disclosure Program, RERCT etc.. We seek the best way for you and accompany you in the process of legalisation of your Swiss bank account. Give us a call before it will be too late.

8. The best way to transfer money to your own bank account

If you have inherited a bank account, you should act fast. It is worthwhile for you to inform the bank immediately in writing about the death of the account holder as a first step. It is best to send a registered letter. At the same time anticipate a copy of the registered letter via fax to the bank. This will destroy the good faith (Lat. bona fide) of the bank.

The bank may no longer make a payment at the expense of the inherited account. The bank can no longer argue that she knew nothing about the bank account holder’s death and therefore made a big payment. A designated representative having a power of attorney is no longer able to plunder the account. All banks protect themselves and lock the deceased’s account as soon as they know about the death.

“Make sure the bank also locks the account you inherited. Do not let an authorized representative of the account, whom you may not even know, loot your inherited account at the last moment by virtue of his power of attorney beyond death.”

8.1. What documents do you need for the bank?

- Death Certificate (original or certified copy, depending on the bank and the country)

- Certificate of Inheritance, Probate or equivalent, listing all heirs (In most jurisdictions, the court at the last residence of the account holder issues a Certificate of Inheritance)

- Copy of Will or Contract of Inheritance (certified copy is sufficient)

- Passports in original of all heirs (Passport is a must! Identity Card is not enough)

- For Anglo-Saxon legal systems, you need a “Probate” (this corresponds to a Certificate of Inheritance, different according to the legal system)

8.2. Formal requirements: what form must the documents fulfil?

Countries that are signatories to the Hague Convention of 1961:

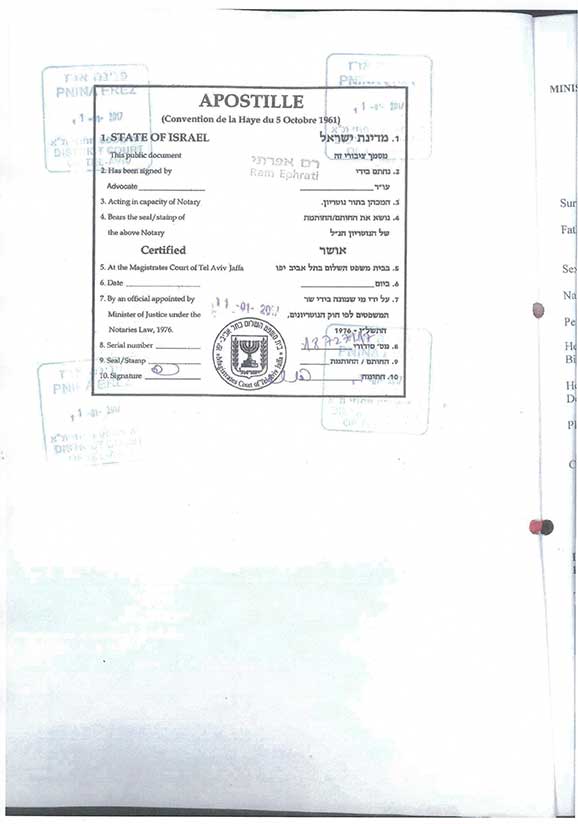

Documents that have not been issued in Switzerland must be certified or legalized by a notary public (certified means legalized by a notary public). Often, you need an over-certification or better known as Super-legalization with Apostille according to the 1961 Hague Convention (“super-legalized with Apostille”).

“Caputo & Partners helps you to collect all the documents needed to transfer your money to your own bank account opened in your own name.”

Countries that have not signed the Hague Convention of 1961:

If it is a country that has not signed the Hague Convention, you need an over-certification or super-legalization by the Swiss Embassy of that country.

The certification of a notary public determines the authenticity of the document. An over-certification confirms that the notary really exists, is known and capable of exercising his office.

8.3. What do I have to do if my papers are not complete?

If you are unable – for whatever reason – to get all the documents in the form you want, that’s not your fault. We’ll help you. We always find a solution with your bank to accept you as an heir.

We even found a solution for an elderly heir from Baghdad. She could not travel. So we asked an American general to certify certain replacement documents from Iraq for us. He did that. The bank has accepted all documents. There is always a solution for you. That’s my personal guarantee to you.

If you have a positive sentiment that a parent must have an account in Switzerland, then you must contact us. We help many international families with our investigation services in connection with their estate.

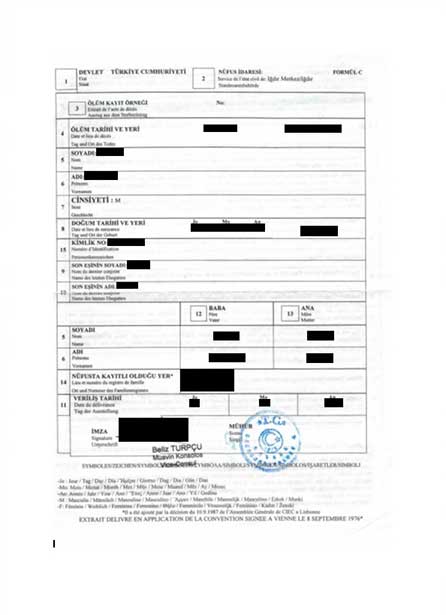

Certificate of Death Example

Certificate of Inheritance Example

Super Legalization with Apostille Example

If you are the heir of a Swiss bank account as a non-resident, do not deal alone with your Swiss bank. Rocky is the way and full of pitfalls. Fatal mistakes are made quickly, especially when it comes to black money or multiple heirs living in different jurisdictions are involved.

Never go to the bank alone. You will lose. The knowledge advantage of the bank is enormous. The bank can tell you everything. You are not dealing with the bank at the same eye-level. You have no chance when the going gets tough. When the bank can keep your money, the bank quickly becomes your friend and helper.

If you can assert your claims against the bank alone, then get into the ring alone and fight against a heavyweight boxing champion. You will lose. A few seconds later you go to the ground – by KO victory of the bank.

We like to climb with you in the ring. Together, we can dispute with the bank with same weapons. We help you to get your money safely and quickly transferred into your own bank account.

It is never too early, but often too late. Solve your problem now. The solution to your problem starts by calling us. Book an appointment for a call.

If it is urgent, write an email to Mr Enzo Caputo. Explain your situation. Write few sentences. Do not forget to attach useful documents. If you do that, I have a first input on your issue. The first consultation on the phone will deliver much better results.

Be rich and remain rich. Have a wonderful day.