Banking in Switzerland: How To Open a Swiss Bank Account in 2023

As a former compliance officer and banking lawyer of the UBS Group and former CEO of the Swiss Association of Asset Managers, I have opened thousands of Swiss bank accounts in the last 30 years.

Today, as an independent Swiss banking lawyer, I advise my clients on opening accounts. It has become difficult to open a Swiss bank account despite online banking. Smart clients take professional advice.

Here, you will discover the most exhaustive list on the internet with all types of documents facilitating the account opening procedure. There is also a list of countries black-listed to open accounts, and much more useful information. It will be much easier for you if you are prepared.

Banking in Switzerland means dealing with 284 Swiss banks and ca. 2,500 independent asset managers. That’s too much to handle, especially for a non-resident investor.

The Swiss banking industry is known for being intransparent. I will show you how to recognize the safest Swiss banks and honest wealth managers who deliver results. You will discover fair pricing.

Your

Autor: Enzo Caputo

Banking Lawyer since: 1986

Position: Founder & CEO of the

Boutique Law Firm Caputo & Partners

Updated on: 12.06.2023

Click on the Google Button and read our Google Reviews.

Important information for 2023 about Swiss Bank Account

Only very few investors can judge the safety of a bank.

I saw investors losing all their savings because of dishonest, greedy, and bonus-driven wild-west bankers. The wrong choice of a banker will cost you money.

Making the right choice is difficult (if not impossible) without professional advice. Don’t leave it to coincidence or the advice of a friend. Relay on the following facts and figures instead.

Based on my advice, you will unmask wild-west bankers before investing, avoid mistakes and become a successful investor (like all my happy clients before you).

Let me give you some numbers about banking in Switzerland

Switzerland is the largest offshore financial center in the world. According to the Swiss Bankers Association (SBA, www.swissbanking.ch), banks in Switzerland managed bankable assets totaling 7,878.7 bn Swiss francs at the end of 2020.

“Never before have Swiss banks collected so much money from abroad as they have since the outbreak of the Covid-19 crisis and the war in Ukraine.”

Investors from Hong Kong, Singapore, the Baltic States, the USA, the European Union, and other countries call me every day. They ask me first for a Swiss bank account but also for a second passport, a golden visa, and a private Swiss vault to keep physical gold in Switzerland.

Some of them fear an invasion from Russia or China, others fear:

- unpredictable inflation

- rapacious tax authorities

- capital export restrictions

The world has become more insecure. Banking in Switzerland offers the best asset protection worldwide. There is not a better place for asset protection.

Actually, ca. 30% of all account holders with offshore assets are banking in Switzerland.

Of the 284 banks, 104 offer private banking services. However, not all 104 banks offer accounts for non-residents.

Safe banks and performing asset managers can’t be found around the corner. Good advice is worth its weight in gold.

What are the benefits of banking in Switzerland?

- the highest level of privacy

- economic and political stability

- the safest destination for asset protection

- an efficient banking system

- low financial risk because of the highly regulated market

[1.] Why Are Swiss Banks Famous?

They are famous for their strong bank secrecy and for having stashed black money for dictators, warlords, and tax dodgers. Swiss bank accounts offer safety. The major Swiss banks are members of the Swiss Bankers Association (SBA). Investors from all over the world love banking in Switzerland.

Good Swiss banks have no leveraged balance sheet. They are the strongest capitalized banks in the world. It’s common knowledge among international investors that Switzerland has the best banks for wealth protection.

[2.] Swiss banks secrecy

Since 1934, disclosing client information has been, and still is today, a criminal offense in Switzerland. Swiss banking secrecy does not mean protecting the secrets of the bank but the sensitive information of the clients.

In the past, many clients abused the Swiss banking secrecy laws offering full client anonymity. They have stashed big amounts of untaxed money. Tax evasion was omnipresent. It has remained unpunished until the introduction of the Common Reporting Standard (CRS).

[3.] How Privacy Works for Banking in Switzerland

Today, banks in Switzerland are rejecting account opening requests with untaxed money or without impeccable documentation on the history of funds. As a standard procedure, they ask for the TIN Number (Tax Identification Number) of their clients before accepting money.

The introduction of the Automatic Exchange of Information (AEOI) and Common Reporting Standard (CRS) by the OECD and the Foreign Account Tax Compliance Act (FATCA) signed between the US and the Swiss banks are preventing tax crimes.

Opening a Swiss bank account with untaxed money has become impossible in Switzerland. Tax evasion has become a crime according to Swiss law.

The days with top-secret bank accounts are definitely gone, except in James Bond movies.

“Today, approx. 30% of all offshore assets on the planet are invested in Switzerland.“

🖱️Move your mouse over the bars to find out more.

The most important offshore financial centres

AuM = Assets under Management in bn USD

[4.] Swiss bank account advantages

Today, the Swiss banking system has become attractive because of wealth protection with the safest banks on the planet and high levels of privacy. The Swiss banking system has attracted record numbers of new money.

There are no Swiss bank account tax advantages anymore. The following Swiss bank account advantages are attracting astronomic amounts of new assets to Switzerland.

The best returns of your portfolio have no value if your wealth is not protected. Transfer a substantial part of your assets to the best banks. Be assured that they will protect your wealth for generations to come.

The constant change of governments, social unrest, demonstrations leading to violent riots, social upheaval, political, health, or religious problems (Arab Spring, 2012 and 2013, Covid-19, Lebanese crisis, war in Ukraine) could endanger your wealth at home. Therefore, you should move quickly a part of your wealth to Switzerland before it will be too late.

Open a private bank account today and transfer your assets to Switzerland. Do it – as long it is still allowed. Remember, money transfer restrictions are coming overnight. Do not waste time. It can be too late.

Let me open the best Swiss bank account for foreigners with the best Swiss private banks in Switzerland.

Due to the Crisis in Cyprus in 2013 where the government in Cyprus confiscated the bankable assets, the European Union, through the ECB (European Central Bank), introduced the Bail-in laws in 2017. Bail-In means that the client of a bank must pay the bank’s debts.

“You will be forced by law to save your bank with your private savings.” Enzo Caputo

114 banks in Italy have bad loans of EUR 318 billion in total. The systemic risk in Italy is contaminating the rest of Europe. Bail-In means that instead of receiving your money back you will receive shares of the bad bank. You will mandatorily become a shareholder of the insolvent bank by virtue of Bail-In Legislation.

- Bloomberg: „Betrayed by Banks, 40,000 Businesses Are in Limbo (Italy)”

- Forbes: “Italy’s Latest Bank Bailout Has Created A Two-Speed Eurozone”

Expropriation based on Bail-In legislation can hit you overnight in European countries. Why are Swiss bank accounts safe? Because there is no such Bail-in legislation in Switzerland, as Switzerland is not a member of the European Union. Your assets are much better protected in Switzerland.

[5.] Bank Accounts in Switzerland

Banking in Switzerland offers different types of bank accounts depending on specific purposes.

Current accounts

Current accounts are also known as checking accounts. They are a good choice for your salary and daily payments.

Foreign residents can only open current accounts if they have an investment account with a minimum deposit of one million CHF with the same bank.

Joint accounts

Joint accounts are held in the name of 2 individuals in their capacity as account holders. They are typically held 50:50 by a couple or between close family members. Both joint account holders can have independent access to the full balance of the joint account, regardless of who earned the money. They are often used and misused as a succession planning instrument.

Savings accounts

A savings account offers a very low-interest rate for liquidity. In Switzerland, there are negative interest rates applicable for substantial amounts in Euro or Swiss francs. They are safe and reliable if you need the funds within a short period.

Investment accounts

If you do not need the funds for the next couple of years, you should opt for an investment account. Under the same bank account number, Swiss banks offer a multi-currency account and a deposit for your investments. As a prudent investor, you should take care of your money investing in high-value and direct investments.

Private banking accounts

A private banking account is an investment account with a minimum deposit of one million CHF. They should be invested in diversified investments. Do not put all of your eggs in one basket. Wide portfolio diversification is key to mitigating financial risk.

Therefore, a substantial amount of money is imperative for a well-diversified portfolio. Avoid cluster risks.

Premium accounts

Major Swiss banks offer premium accounts to non-resident investors (off-course Swiss investors) with substantial amounts (assets under management).

There are 2 categories of wealthy clients:

Clients with bankable assets from 1 million up to 30 million USD are considered High Net-Worth Individuals (HNWI, wealthy clients).

Clients with bankable assets exceeding 30 million USD are considered Ultra High Net-Worth Individuals (UHNWI, super-wealthy clients).

Swiss private banks offer a dedicated banker for HNWI. The bank takes care of their personal finance needs. For UHNWI, there is a dedicated key-clients team in the bank offering sophisticated family office services, including concierge service, etc.

PEP accounts

A PEP account is an account in the name of a politically exposed person. These accounts are subject to continuous monitoring because of a much higher money laundering risk with contaminated money deriving from corruption.

Safe deposit boxes

Under the same bank account number, you can rent a safe deposit box with the bank. That’s a safe place for important documents, gold bars and coins, jewelry, and cash bills. However, gold storage should be done out of the banking system with a private vault.

With a private vault, you will preserve direct ownership of the content. Valuable content in a safe deposit box is always connected to your bank account without direct ownership of the content. It’s only an obligation against the bank. You have to ask the bank to give you access to the content.

Numbered Swiss bank accounts

Non-resident clients misused numbered accounts for hiding undeclared assets and money laundering in the past. The strong Swiss banking secrecy protected tax doggers from being prosecuted for tax crimes.

Numbered accounts were 100% anonymous in the past. Swiss accounts were opened in the name of a number, a code, or a fantasy name but not in the name of the client. Those days are definitely over except in James Bond movies.

Today, there are very few Swiss private banks offering numbered Swiss bank accounts. Only clients with above 20 million CHF assets under management can request numbered accounts. The number of the bank account is replacing the name of the client.

The account holder has an extra layer of privacy. Only a few private bankers inside the bank know the client’s identity. The account opening procedure is exactly the same as for other accounts.

Multi-currency account

Banks in Switzerland offer accounts with multiple currencies under the same account number. A multi-currency account can be held with up to 20 different currencies. There is an IBAN number for each currency (IBAN International Bank Account Number). Swiss accounts are perfect for international payments. However, in order to protect the purchasing power of your wealth, you should invest your money with a best-in-class asset manager.

Corporate account

Corporate accounts are accounts in the name of a company. The Swiss bank account opening procedure for corporate accounts is more difficult compared to that of private accounts.

Caputo & Partners offers corporate accounts mainly for commodity trading and trade finance, for example, for companies involved in commodity trading. Important turnovers must be shown to the banks.

For a small non-resident company, it is close to impossible to open a bank account. The compliance requirements are sophisticated.

[6.] How to Open a Swiss Bank Account for Non-Resident or Foreigners?

Open the account with your Swiss bank online

- We check your information submitted on the online-form

- Video-Call No. 1 with Enzo Caputo – Preselection with the safest Swiss banks and asset managers delivering results

- Video–Call No. 2 with the asset manager

- Providing the account opening forms and the asset management agreement via FedEx/DHL to the Investor

- Video-Call No. 3 with Enzo Caputo All questions on the forms are answered and problems clarified

- The investor sends the forms back

- The Swiss bank will open the account online and send the IBAN number

Open your account with a face to face meeting in Zurich

- We check your information submitted on the online-form

- The first discussion on the safest banks and outperforming asset managers in the chambers of the law firm Caputo & Partners

- Preselection of the best banks

- Meeting with the Swiss bank and signing the account opening forms inside the bank’s building

- Discussion on suitable investments with the asset manager and signing the asset management agreement with the asset management company

- The Swiss bank will open the account and send the IBAN number

Caputo & Partners discussing a Swiss bank account opening

Opening an offshore bank account in Switzerland has become more difficult despite online banking. Swiss banks have become very strict, stricter than ever before. Their client onboarding procedure has become very selective. They verify and document the economic background and the identity of their clients very carefully.

Since the Covid-19 crisis, record sums of new money have been coming to Switzerland. Since the Ukraine war even more. The number of assets managed by the banks is skyrocketing. They are reluctant to take risky clients. Due to the high demand, they prefer rejecting clients in case of doubts.

You have to be at least 18 years old to be accepted as a client. Since the covid crisis, opening a Swiss bank account online is possible with many Swiss banks. However, not all of the 104 Swiss banks that offer private banking accept non-resident clients. Many Swiss banks ask for a bank account minimum deposit of 1,000,000 USD from foreigners.

[7.] How to open a Swiss bank account from the US?

There are only 6 banks in Switzerland accepting foreign clients from the US. They need a US license issued by the Securities and Exchange Commission (SEC). A discretionary asset management agreement is mandatory for US clients. US clients are not allowed to give direct investment instructions to the Swiss bank.

US citizens like to diversify and protect their assets with banks in Switzerland and invest in Swiss francs.

Non-resident investors from Hong Kong, Latvia, Lithuania, Estonia, and Poland, are calling me for a bank account in Switzerland. Because of the Ukraine war, some fear an invasion from China or Russia, others fear unpredictable governments, high inflation, and rapacious tax agencies.

After the best Swiss bank account for foreigners, they ask for a second passport with a citizenship by investment program and a golden visa. Today, the Swiss offshore banking industry is connected with second citizenship and golden visa services. The world has become less safe.

“Bring your money out of your country before your country will take it out of you.”

Remember, it’s never too early, but often too late. Having a bank account in Switzerland is like owning an insurance policy in case of an emergency.

It is a very wise move that makes sense – no matter what.

There are wild rumors circulating since the Panama Papers that secret bank accounts are illegal or at least immoral. Offshore banking in Switzerland is completely legal. However, you must comply with the tax reporting obligations. US account holders are subject to the so-called FBAR filing.

What is FBAR filing?

A US person that has a financial interest in or a signature authority on a foreign bank account must file an FBAR form with the Internal Revenue Service (IRS). The IRS is the tax agency in the United States of America.

Please consult the following official website of the IRS for further details:

https://www.irs.gov/businesses/small-businesses-self-employed/report-of-foreign-bank-and-financial-accounts-fbar

A Swiss bank account for non-residents is not about avoiding taxation and hiding money with a secret bank account.

It’s all about diversifying your political risks in a perfectly legal and legitimate way by investing your hard-earned savings in solid, well-capitalized institutions and countries. Your savings should be in a country with a well-functioning legal system, such as Switzerland.

Now that you know the advantages of an offshore bank account in Switzerland, the next question is “How to get a Swiss bank account?” As I said, it is not as easy as it was before. We are the experts. We will show you the best private banks in Switzerland for foreigners. We do it every day. We tell you exactly which private bank suits you.

We bring you to a top wealth manager who can document his proof of performance. Do not leave it to chance who will look after your account. Swiss account interest rates are very low in CHF.

There are well-capitalized bond portfolios in CHF with Swiss issuing companies offering an attractive interest rate. We can recommend such bond portfolios upon request.

We cooperate with people we trust for decades. We have an internal Swiss bank list with the top 10 Swiss banks. Start today with the opening of a bank account, as long as it is still possible in your country of residence to move assets abroad.

[8.] How to open a Swiss bank account from the UK?

Bank accounts for UK clients can be opened without any problem. Today, we are in a position to open accounts without traveling to Switzerland. The laws for video identification are working well. However, I always advise my clients to visit the bank and the asset manager in Switzerland.

Having a bank account in Switzerland is an important step for you and for the next generation to come. A personal meeting is not necessary but it will consolidate the relationship.

No problems with UK clients. As long the assets are disclosed to Her Majesty’s Revenue & Customs (HMRC) bank account opening will not be a problem.

[9.] Can an EU citizen open a bank account in Switzerland?

Due to the turbulence in some EU countries, for example, Italy, hundreds of investment accounts are activated at this very moment. EU citizens are investing in Switzerland for wealth protection, diversification, a strong currency, and other reasons. However, as a non-resident account holder, the minimum deposit should be at least 1 million CHF.

[10.] How to open a Swiss Bank Account from South Africa?

Similar to Australia, Canada, and the USA also South Africa has a highly regulated financial market. Any bank or asset manager dealing with a client from South Africa must have an FSP license (FSP, Financial Service Provider).

Swiss banks like Bank Vontobel, Pictet, Safra-Sarasin, UBS, and other banks have an FSP license to open investment accounts for South African clients starting with at least 1 million CHF.

We at Caputo & Partners know all banks and asset managers authorized to onboard clients from South Africa. Our asset managers are authorized. They have the FSP license to visit the clients in South Africa for opening an account in Switzerland.

How can I send money from South Africa to Switzerland?

South Africa has capital export restrictions for substantial amounts. Money can exclusively be sent using the clearing services of the Reserve Bank of South Africa. They check, for example, if tax payments are outstanding.

You can transfer a maximal amount of 10 million Rand (644,000 USD) per person and per year out of South Africa. Sending out more money is illegal without a special permit.

To better serve clients from South Africa, we are working with specialized asset managers. They are licensed and very familiar with the sophisticated financial regulation in South Africa. They know how to move money out of South Africa.

Remember, there is always a solution, even in seemingly hopeless situations.

[11.] How to open a Swiss Bank Account from Australia?

Australia has a highly regulated financial market. The government in Australia does not like if Australian investors are moving their money offshore. Therefore, recently Australia introduced a new restriction making offshore investments more difficult.

You have to prove to the Swiss bank that you are a high net-worth individual. The minimum wealth is 10 million Aussi dollars. Australia has imposed such restrictions on Swiss banks.

More and more such kinds of restrictions are coming.

However, not all Swiss banks are taking the 10 million Aussi dollar requirement seriously.

[12.] Opening a Swiss Bank Account from Canada?

Account opening for residents in Canada can be done with Swiss banks that are licensed by the regulators in Canada. Only several banks and asset managers having an appropriate Financial Service Provider license can onboard clients from Canada.

If you are a Canadian resident just give me a call. I will introduce you to the best bank authorized to serve clients from Canada.

Don’t blindly follow the advice of the big bank’s advisors.

I have seen significant losses in the millions of dollars and hidden fees that have destroyed many assets of wealthy entrepreneurs.

Be smart and learn from other millionaires’ mistakes.

Speak to Mr. Enzo Caputo today and let us analyze your situation.

[13.] Requirements for opening a Swiss bank account

There are some basic standard requirements that you have to satisfy. Depending on the economic background of the origin and history of funds and the identity of the client, including place of residence and nationality, the requirements can be very different.

Documentation

Similar to all banks in the world, banks in Switzerland have some basic mandatory requirements. They have to establish the identity of the ultimate beneficial owner (passport copy) and document the economic background of the funds (agreements, invoices, certificates of origin, etc.).

Definition of Beneficial Owner

The beneficial owner is defined as a natural person who ultimately, directly or indirectly (by interposed persons or entities), controls and owns the assets deposited in the bank.

A simpler definition of Beneficial Owner (invented by Enzo Caputo)

The beneficial owner is the one who yells the loudest when the money disappears.

The bank establishes the identity of the ultimate beneficial owner using the famous Form A. Form A is the most important document of the bank account opening documents.

Declaring incorrect bank account details and false personal information on Form A is a serious criminal offense. It’s a forgery. For forgery, there is a high penalty of up to 10 years imprisonment in Switzerland.

Documentation required to open a bank account in Switzerland

- passport copy of a valid passport (for at least the next six months)

- short CV or resume showing the professional career of the applicant

- utility bill showing the residential address of the applicant

- TIN number, the Tax Identification Number

- origin of funds with conclusive documents, for example:

- bank statements showing the money, the bank, and the client’s name,

- Sale of real estate, copy of the deed of sell, extract of the land registry, inheritance documents

- copy of divorce settlement

- dividend distribution

- donation agreement

- royalties and intellectual properties

- domains and chart of companies owned

- IPO, contracts showing the sale of companies

- contracts showing the business, invoices

- delivery and shipping papers

- receipts and much more

- detailed description of how the assets were acquired (previous jobs, careers, investments)

- specific description of how you earned the first million

Today, the bank account opening documentation has a volume of 50 up to 100 pages.

Warning!

Many people just sign bank account opening agreements without reading and understanding the content. That’s a big mistake. Most clients are not aware of having signed a global pledge agreement in favor of the bank. This can backfire. Let me tell you why.

Many greedy bankers are selling a Lombard loan to their clients. More assets under management mean more bonuses for the greedy banker. They offer a super attractive interest rate below 1%. The portfolio is pledged. It’s the collateral in favor of the bank.

Let me give you an example:

Let’s assume your portfolio has a value of 10 million CHF. The bank gives you a Lombard Loan of 5 million CHF. Instead of investing 10 million, you will buy investments for 15 million. A Lombard Loan means high risk. It’s leverage.

You are speculating with money you do not own.

If the markets go down, you risk a margin call. If you are not in a position within 24 hours to bring new money to the bank, the bank will automatically sell your investments at market conditions. I saw investors losing all of their savings because of margin calls based on Lombard Loans.

I will answer all of your questions before signing the account opening documents. I will explain the agreements you may need and alert you on the agreements you should not sign.

Eligibility for Swiss bank account

Banks have blacklisted some countries, activities, and individuals. It’s impossible to open bank accounts for clients living in black-listed countries (see the list in the next chapter).

It is very difficult if not impossible to open an account in Switzerland for individuals living in a country with a high Corruption Perception Index (CPI).

It’s very difficult to open bank accounts for Individuals involved in sensitive industries like gaming, gambling, precious metals, diamonds, commodities, adult entertainment, nightclubs, discotheques, etc.

People listed on the terrorist lists and in world-check, including convicted criminals, scam artists, impostors, etc.

Individuals who can potentially harm the reputation of the bank are not eligible for a bank account, including innocent people involved in scandals or legal proceedings, names of individuals listed in certain databases like World-Check, Factiva, LexisNexis, etc.

Applicants that have problems demonstrating their tax compliance will be rejected based on minimal doubts. Swiss banks paid billions of penalties for tax crimes. They are scared of doing business with potential tax evaders. In case of minimal doubt, they will reject you.

If you are a Politically Exposed Person, you can open a so-called PEP account. Swiss banks are reluctant to open PEP accounts unless the assets under management are a few dozens of million CHF.

[14.] Countries that are blacklisted for opening a Swiss Bank Account

There are clients living in countries that are rejected by Swiss banks. Every bank decides for itself which clients from which country can open a bank account in Switzerland.

However, there are certain countries with a high CPI Index.

(CPI, Corruption Perception Index, a list of all countries issued by Transparency International, an NGO, a non-governmental organization)

Countries with a high level of corruption risk are blacklisted from the bank because of money laundering purposes.

If your residence is located in one of the following countries with a high CPI Index, you have no chance to open a swiss bank account.

Countries, individuals, and activities listed in the embargo acts and sanction lists of several countries, for example, the OFAC-sanctions of the USA, EU sanctions, and Swiss embargo and sanction lists, have no chance of opening a bank account.

Banks in Switzerland must guarantee impeccable business activities.

FINMA is the Swiss banking regulator, the financial watchdog (www.finma.ch, Swiss Financial Market Supervisory Authority). FINMA will penalize banks that are not in a position to ensure impeccable business activities.

Swiss bank minimum balance requirements

There are no minimum balance requirements for Swiss residents, including expats. A Swiss resident can open an account without sending money after having opened it.

For non-resident account holders, the balance requirements are substantial. Foreigners are accepted for wealth management purposes only. They can’t open a basic account for the execution of daily payments.

Most Swiss private banks expect at least 1,000,000 CHF. I heard that Citibank (Switzerland) AG expects a minimum of 10 million CHF. I am pretty sure that Citibank will open a bank account for 3 million CHF if the compliance requirements are satisfied.

However, if you bring at least 1 million CHF to start, many Swiss banks will accept you. Below 1 million, you are rejected by most banks or, if you are lucky, charged with a 5,000 CHF deposit fee per year.

We at Caputo & Partners expect at least 500,000 CHF, otherwise, it will be difficult to diversify your portfolio with direct investments diminishing the financial risks.

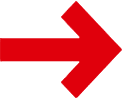

If you deposit 1 million CHF with one of the safest Swiss banks for non-resident investors and with one of our best-in-class wealth managers, the total all-inclusive pricing will be 13,000 CHF per year.

13,000 CHF = 1,3% from the assets under management per year.

0,4% depository fee (to be paid to the bank) and

0,9% asset management fee (to be paid to the assets manager).

1,3% all-inclusive fee per year for 1 million CHF

[15.] How to Open a Swiss Bank Account for Your Children?

They offer savings bank accounts for children. The parents can make deposits and invest money for the benefit of their children.

The bank account is in the name of the children. The parents will manage the account until the children reach 18 years of age.

They offer gift savings accounts. Grandparents can invest money in investment funds for children.

Write me an email to find out the best banks offering tailor-made services for children.

[16.] Transferring Money from & to Switzerland

Before making a transfer to Switzerland or outside Switzerland, check out the different options you may have.

If you have good investments in your portfolio in Germany you can transfer directly your investments to your bank account in Switzerland. There is no need to sell your investment and send the liquidity to the bank.

There are other payment service providers like Transferwise and PayPal. If the transfer expenses are exaggerated you can transfer money with the above service providers. The pricing will be more competitive compared to banks in Switzerland.

They are members of the SWIFT payment system. You can send large amounts of money with a SWIFT payment from bank to bank.

[17.] Choosing a Swiss Bank and a Swiss Credit Card

I will introduce you to the best private wealth management bank in Switzerland. We only propose banks that do not have a leveraged balance sheet. They should have a minimum Tier-One Capital Ratio of 20%.

As the safety of a Swiss bank is very important to non-resident investors, we avoid banks involved in risky lending activities. We only work with the safest Swiss banks among 284 banks. Only the safest Swiss banks are good enough for our clients. The big Swiss banks are not always the best choice.

The safest banks according to the above criteria are not the two big banks. The Swiss private banks we suggest are, for example, Bank Vontobel, Lombard Odier, Pictet, UBP, and other very safe banks that have core business wealth management.

One or two weeks after the bank account opening, you will get the AMEX Black Card, also known as the Black Centurion Card, or any other of the most prestigious credit cards.

There is no need for an invitation letter. The Swiss private bank will issue a bank guarantee to AMEX. You will pledge your portfolio to the bank as collateral.

Swiss Banks have become more attractive than ever before

Today, the Swiss offshore banking industry is connected with second citizenship and golden visa services. The world has become more insecure and Swiss banks have become more attractive for wealth protection.

Often, the main shareholders of Swiss private banks are families involved in banking for centuries. Among the 104 banks offering private banking services, there are the two big banks. The two big banks are universal banks providing the full range of banking services.

As a non-resident investor, you have no chance of opening an account with one of the Swiss Cantonal banks, for example, the Zurich cantonal bank. Such banks operate in the Swiss cantons. They are oriented to the Canton where they have their head office.

They accepted non-resident investors in the old days but not anymore. Most of them do not have the compliance measures in place to serve non-resident clients. They are focused on the region where they operate. There is no bank branch located in a different canton outside the canton of the cantonal bank.

Many non-resident investors ask me if they can open a bank account with the Swiss National Bank (SNB). For an individual, it is not possible to open a bank account with the SNB.

The SNB conducts Switzerland’s monetary policy as an independent central bank of Switzerland. It is obliged by the Swiss Constitution to act in accordance with the national interests.

National Swiss retail banks

National Swiss retail banks are present in all the regions of the country. Their opening hours are from Monday to Friday from 9 a.m. to 5 p.m. As a Swiss resident, including an Expat, you can walk into the bank and open a bank account without depositing money immediately.

You can deposit and withdraw cash, ask questions and make an appointment with the retail banker in case of a specific business with the National Swiss retail bank. Swiss bank employees speak English.

The most famous National Swiss retail banks are:

- Credit Suisse

- UBS

- Migros Bank

- PostFinance

- Raiffeisen Bank

However, since the Covid crisis, National Swiss retail banks started offering online and call-center services avoiding physical contact.

Swiss cantonal banks

Swiss Cantonal banks are typically owned by the Canton. The head office is located in Canton’s capital. They are specialized in providing mortgages and savings accounts to the inhabitants of the specific Canton.

List of Cantonal Banks

- Aargauische Kantonalbank (AKB)

- Appenzeller Kantonalbank (APPKB)

- Banca dello Stato del Canton Ticino (Banca Stato)

- Banque Cantonal de Genève (BCGE)

- Banque Cantonale de Neuchâtel (BCN)

- Banque Cantonale du Jura (BCJ)

- Banque Cantonale Vaudoise (BCV)

- Basellandschaftliche Kantonalbank (BLKB)

- Basler Kantonalbank (BKB)

- Berner Kantonalbank (BEKB)

- Freiburger Kantonalbank (FKB)

- Glarner Kantonalbank (GKB)

- Graubündner Kantonalbank (GKB)

- Luzerner Kantonalbank (LUKB)

- Nidwaldner Kantonalbank (NKB)

- Obwaldner Kantonalbank (OKB)

- Schaffhauser Kantonalbank (SHKB)

- Schwyzer Kantonalbank (SZKB)

- St. Galler Kantonalbank (SGKB)

- Thurgauer Kantonalbank (TKB)

- Urner Kantonalbank (URKB)

- Walliser Kantonalbank (WKB)

- Zuger Kantonalbank (ZugerKB)

- Zürcher Kantonalbank (ZKB)

Regional savings banks

Regional savings banks are delivering savings and mortgage services in the specific region they are located in. The services are limited to their skills as they are not internationally oriented. You can have a standard bank account with a debit card. They do not accept non-resident clients. These traditional banks are good for expats and for the locals living not far away from the bank.

The best terms and conditions for a mortgage are most probably offered by one of the regional savings banks as they know the region very well.

Swiss investment banks

Swiss investment banks are banks offering investment banking services, for example, mergers and acquisitions, IPO, etc.

For our private clients, we avoid Swiss investment banks or Swiss banks offering investment banking activities as they are considered high-risk business activities.

Many people think that Swiss investment banks exclusively allow super-wealthy people to invest astronomic amounts of money. This is a misconception.

You can start opening an investment account with Caputo & Partners with a minimum balance of 500,000 CHF only (or counter-value). You don’t have to be super-wealthy to open an account in Switzerland.

The largest private banks in Switzerland

- UBS 2,260 billion USD assets under management

- Credit Suisse 770 billion USD assets under management

- Bank Julius Bär 379,1 billion USD assets under management

- Pictet 213,6 billion USD assets under management

- J. Safra-Sarasin 151,7 billion USD assets under management

The largest private banks in Switzerland are defined by the number of assets under management. From the client’s perspective, the largest private banks are not always the best. There are many other important criteria to consider. That’s where I come into play.

International banks

International banks have their physical presence in the two big Swiss cities, Zurich and Geneva. They all have English-speaking staff.

The 10 most known international banks in Switzerland are:

- Banco Santander

- HSBC

- Deutsche Bank

- Barclays Bank

- Citibank

- BNP Paribas

- J. Safra-Sarasin

- UBS

- Credit Suisse

- Bank Julius Bär

Best Swiss Credit Cards

All Swiss private banks offer credit cards connected to bank accounts. Non-resident investors like to connect their credit cards to their offshore bank accounts for confidentiality reasons.

Caputo & Partners offers the most reputable credit card in the market, the AMEX Black Card, also known as the Centurion Card in conjunction with a bank account in Switzerland with one million CHF.

After the account is open, the assets deposited with the Swiss private bank are pledged in favor of the bank. The bank will issue a bank guarantee to Amex Switzerland enabling the client to use his credit card. A debit card has a monthly credit limit.

For the most prestigious Centurion Card issued by AMEX Switzerland, a deposit of a minimum amount of one million Swiss francs is needed. If you have one million invested with your Swiss bank, you will receive your Centurion Card within one or two weeks only after the termination of the successful bank account opening procedure.

[18.] Largest Bank in Switzerland

UBS is the largest bank in Switzerland. UBS is a so-called universal bank offering all banking services. There are 71,304 employees working for UBS (2021).

UBS is the world’s biggest asset manager.

The assets under management are 4,5 trillion USD including the 3,2 trillion USD with Global Wealth Management. UBS shares are traded in Zurich and New York with a market capitalization of 55 billion USD, as of September 20, 2021.

[19.] Cost of Opening a Swiss Account

For a personal account of a resident account holder, most Swiss banks take a monthly fee between 10 CHF and 50 CHF or annual fees up to 600 CHF. They do not charge for the account opening services. Additional fees must be paid for credit and debit cards. Consulting services for personal finance are not included for account holders with little money.

Non-resident clients are rejected if they ask for a basic account for day-to-day payments. They can open an investment account if they are capable and ready to invest at least 1 million CHF.

Non-resident clients from the European Union must pay deposit fees for depositing their securities of a minimum of ca. 4,000 CHF per year. This corresponds to 0,4% if you deposit 1 million CHF. Clients residing outside of the European Union are overcharged if they are not ready to negotiate. The most charged clients are the Russian clients. The pricing is not transparent.

Everything is negotiable, including the banking fees. You should reject standard pricing lists as a non-resident investor. There are also hidden fees. You must negotiate if you want fair pricing.

Therefore, never go alone visiting a Swiss bank. Take professional advice. Good advice is worth its weight in gold.

How to negotiate if you have no idea about the different pricing models and industry standards?

Here I come into play. You tell me exactly the types of services you need and I will accompany you to the bank. I will negotiate the best possible price for you.

You should always negotiate a transparent all-inclusive fee structure. If you engage my boutique law firm Caputo & Partners for bank account opening I will make sure that you will receive fair pricing and impeccable wealth management services. We do open accounts based on an all-inclusive pricing model.

We will support you. You will save a lot of money if you are prepared to negotiate. You will be surprised.

Clients told me that Credit Suisse charges an account opening fee of 20,000 CHF for corporate accounts.

Some banks in Liechtenstein are charging due diligence fees of a couple of thousand Swiss francs (CHF) for the account opening procedure.

If I open a bank account for substantial amounts of money I will not charge anything for the account opening services. Difficult accounts with an unclear source of funds or history of funds, PEP accounts, and sophisticated corporate accounts can cost 100,000 CHF, or even more. The account opening fee is subject to the difficulties of the particular account opening situation.

More important than the costs are the returns. My non-resident clients have generated returns per year from 8% up to 11% on average during the last 13 years. I never lost a client because of low returns. My preferred hand-picked asset managers have outperformed the benchmark for the last 13 years.

Outperforming wealth managers can’t be found around the corner. If you would like to have a chat with one of my asset managers, just write me an email or give me a call.

Switzerland’s interest rate

The Swiss National Bank (Schweizerische Nationalbank) decides on the interest rate. Actually, the interest rate for Swiss francs is a negative interest rate at – 0.75%.

Swiss banks offer accounts with multiple currencies under the same account number. A multi-currency account can be held with up to 20 different currencies. There is an IBAN number for each currency. Swiss accounts are perfect for international payments. However, in order to protect the purchasing power of your wealth, you should invest your money with a best-in-class asset manager.

[20.] Swiss Bank Account – Frequently Asked Questions (FAQ)

Every day, our international investment community is asking questions about banking in Switzerland. We collected the Frequently Asked Questions (FAQ) from all over the world.

Please find subsequently the answers to the most Frequently Asked Questions (FAQ).

Are Swiss bank accounts legal?

As long as you fulfill the tax reporting obligations, Swiss bank accounts are 100% legal. Tax evasion made Swiss bank accounts illegal. Meanwhile, close to all bank accounts in Switzerland have been disclosed to the tax agencies at the place of residence of the client.

Are Swiss bank accounts insured?

Swiss bank accounts are insured until 100’000 Swiss francs. Zurich Cantonal Bank (ZKB) guarantees 100% of your savings. If your money is invested, for example in shares and bonds, your investments are anyway fully protected.

In case of bankruptcy, you have the benefit of excussion. Swiss law allows you to take your investments out of the bankruptcy procedure. Liquid money is insured until 100,000 Swiss francs.

Are Swiss bank accounts taxed?

Swiss tax agencies do not tax the assets on your account. The income and the capital gain collected are subject to ordinary taxation only in your country of residence but not in Switzerland. Certain investments are subject to the Swiss withholding tax.

Why are Swiss bank accounts untraceable?

Swiss accounts are difficult to trace because of the very high levels of privacy. A banker will not disclose the bank information of his clients. Disclosing sensitive client information is a criminal offense.

Privacy and financial affairs are connected. The Swiss mentality keeps financial affairs secret. It’s based on a very long tradition of secrecy. For centuries, Swiss banks in Geneva acted as the safety box for the French kings financing the wars in the French colonies.

How secure are Swiss bank accounts?

Non-resident investors from Hong Kong, Latvia, Lithuania, Estonia, and Poland, are calling me every day asking for a bank account in Switzerland. Because of the Ukraine war, some fear an invasion from China or Russia, others fear unpredictable governments, high inflation, and rapacious tax agencies.

After the best Swiss bank account for foreigners, they ask for other wealth protection instruments like a second passport with a citizenship by investment program or a golden visa. Today, the Swiss offshore banking industry is more famous than ever before for protecting wealth.

The Swiss banks are the safest bank accounts on the planet. Swiss bank secrecy keeps the assets secret. Switzerland is definitely one of the safest jurisdictions on the planet to do business. International business people have a bank account in Switzerland to facilitate international transactions.

The probability that your business partner has also an account in Switzerland is very high. This makes an international transaction with big volumes very safe and secure. Sometimes, it’s just an internal transfer within UBS. This is a very important comfort factor for international big business. Business people know exactly that Swiss banks have very strict Due Diligence and Know Your Customer rules. Having a bank account in Switzerland is the entry ticket to the international business community.

Can Swiss bank accounts be frozen?

Yes, the Swiss banking secrecy is protecting the privacy of investors. However, there is no protection for criminals and their activities. The Swiss Bankers Association is very concerned about the reputation of its members. Switzerland is the worst place for criminals to hide black money of criminal origin.

Do Swiss bank accounts have credit cards?

Yes, Swiss banks are very familiar with dealing with all types of credit cards. During the old days of Swiss banking secrecy protecting untaxed money, it was very common to keep the Swiss account indirectly in the name of an interposed offshore company instead directly in the name of the investor.

British Virgin Islands (BVI) companies were frequently used for hiding the identity of the ultimate beneficial owner. The BVI company had a credit card. The owner spent his untaxed money with the credit card in the name of the BVI company without being detected by the tax authorities. However, BVI companies are still used for confidentiality reasons.

Why do criminals use Swiss banks?

Between 20 and 40 fraudsters from all over the world are always sitting in the luxury hotels in Zurich’s financial center waiting for the next financial victim. Based on the Swiss criminal legislation, fraudulent activities are very difficult to prove. 5 conditions must be accomplished before fraudulent activities are considered a criminal offense.

In Switzerland, it will be very difficult to bring a fraudster to justice for fraud and white-collar crimes. They take specific advice from a financial lawyer on how to place fraudulent private equity investment products. Give me a call before you invest money with an investment product you do not fully understand. I will check it for you within a few minutes.