Ultimate Guide in Private Banking to Secure Your Wealth (2018)

“In a financially unpredictable world with today’s geopolitical turmoil and rapacious tax authorities, who can take away your wealth, the decision to put your money in your home-bank or saving it in an exclusive private bank in Switzerland will make the difference between losing your money overnight or protecting for the future generations.”

Discover what Swiss Private Banking can offer you with their exclusive services you will never find elsewhere.

Find out how we can help you to protect your wealth, your business and your family from destruction.

The following text contains the most detailed and comprehensive information that you can find on the internet about Private Banking. We recommend you to take your time reading this text carefully, in order to avoid the most common mistakes:

- ▶ Choosing the wrong bank

- ▶ Engaging greedy bankers

- ▶ Buying risky products

These can wipe out your savings overnight. Be careful, look after your money.

Table of Contents

- The Day of Truth in Swiss Private Banking: January 15, 2015

- Characteristics of a Senior Top Banker

- How can we make you a successful Investor

- Relationship Management vs. Portfolio Management

- A Relationship for Life

- Best Private Banking Services

- Business Model Private Banking

- Difference between Private Banking and Wealth Management

- Swiss Private Banking Services typically offered

- External Asset Manager

- How can Caputo & Partners help you?

- Financial Times: Swiss Private Banking – an out-dated business model?

- Which financial centre can seriously compete with Switzerland?

- What is the real Unique Selling Proposition (USP) of Private Banking – Made in Switzerland?

- How does a Swiss private bank make money?

- Swiss Bank fees too high?

- Bloodletting due to Repatriation after the Legalization of the Bank Accounts?

- Number of Billionaires more than doubled

- Where are the Emerging Markets located?

- Little sympathy for former Colonial States

- Switzerland is Booming: An Exclusive Private Club and not an International Ghetto

- How much do you make in private banking?

- How a Millionaire from Cairo lost his Fortune with Forex

- Share-investment in Russian banks went wrong

- 80 year old Turkish Forex Options investor

What is meant by private banking?

Private Banking Definition

Private Banking Definition

What are the key success factors of Swiss private banking? What is meant by Swiss private banking? Swiss Private Banking is a combination of high quality and high diversity of investment services on a global level. The sophisticated global advice services are tailored to the needs and requirements of High Net Worth Individuals (HNWI). The client of a private bank has the privilege of being permanently in a professional dialogue with an assigned private banker taking care of his assets. In order for the Swiss private bank to be able to assure high-quality tailor-made global wealth management advice, the private banker must know and understand the private situation and goals of the client and his family.

What distinguishes a Swiss private banker from others – delivery of good results.

How to find the top 10 private banks ranked on the private banks’ list?

- He must have a valuable international network of adequate specialist’s supporting you in preserving and growing your assets. A good banker is an excellent networker. He has the ability to introduce new business contacts and grow your business.

- He is your perfect sparring partner for all of your personal wealth management, including non-bankable activities. He answers all your questions and protects you from doing wrong. He should prevent you from making unreasonable investments. It protects you from emotional investments. But above all, he must look after your assets also in turbulent and challenging market situations.

- He may give you access to the most exclusive club deals that are handled discreetly with other clients of the bank (privileged off-market deals).

- He should have at least 5 years of professional experience as a consultant. Ask for his CV and track record. If you don’t have access to this information come to us. We know all senior private bankers that make the difference.

- Such senior bankers serve customers with at least 50 million assets under management. Sometimes, banks are reluctant to disclose the number of assets under management (AUM). We’ll find out if he is senior and has a considerable number of AUM.

- Due to his client base, he has the necessary power position within the bank, so that he can implement your special requests.

The customer’s reference person is always his private banker. This person should, therefore, be a senior private banker, also referred to as a “Relationship Manager”. He should be responsible for your strategic asset management and wealth placement.

A good senior banker is always reachable. He should assist you when the markets go crazy.

1. The Day of Truth in Swiss Private Banking: 15 January 2015

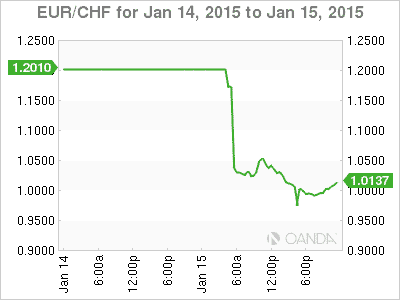

After the financial crisis in 2008, the Swiss Franc, because of its safe-haven status, skyrocketed. There was only one direction for the Swiss Franc (CHF) and that was up. In order to protect the Swiss export economy, the Swiss National Bank (SNB) (https://www.snb.ch/en/) decided to stop the appreciation of the Swiss Franc at 1.20 and capped it against the EUR. When the value of the EUR fell below CHF 1.20, the Swiss National Bank intervened and supported the exchange by buying more EUR.

Speculators from around the world had an easy game until January 15, 2015. They made easy money, knowing well that the Swiss National Bank stopped appreciating the CHF at 1.20 by massively intervening. Many bankers simply stopped picking up the phones of concerned customers on 15 January 2015.

I successfully represented two clients against their bank, having lost 8.5 million EUR on January 15, 2015, because they invested in EUR with leverage. Leverage investments up to a factor of 200 are common in the foreign exchange market (leveraged investments). The banks have compensated some of the damage suffered by my clients with an out-of-court settlement. It was their contractual obligation to respond to the phone calls in a period of turbulence in order to execute the customer orders according to the “best execution” principle.

Whether a banker is well versed comes out on such days of truth as January 15, 2015. When we introduce you to a bank, we make sure that only a savvy and experienced senior banker manages your hard-earned assets. One who is always there for you, even during turbulent times and does not answer your calls during such essential times.

Nice weather pilots and bonus-obsessed beginners are easy to find everywhere. No one needs help during sunny periods. Only turbulent weather distinguishes the good from the bad and the juniors from the seniors.

2. Characteristics of a Senior Top Banker

On the other hand, good senior bankers with a track record, who also provide professional support in case of bad weather and turbulence, are often occupied or busy with their Ultra HNWI. They are rarely available without our specific recommendation. Best private banking services are not around the corner. We, on the other hand, know these Top Bankers personally. They like to work with us because they know that the customers introduced by us have already successfully passed the Know Your Customer (KYC) clarifications and we have analysed their needs and requirements.

New customers without appropriate introduction have no chance to land with the successful Top Bankers. Top Bankers do not want to waste their precious time on customers who have a dubious reputation or whose source of money is not 100% clear. And for any other reason unfit for private banking.

The Top Bankers have a substantial amount of assets under management (AUM). They no longer need to accept latent risks with unknown offshore banking customers. However, you as an investor and as HNWI are dependent on the skills of a senior banker, because only a Top Banker introduced by us guarantees, that your assets will be professionally invested according to your defined goals.

Investors want to be sure, that their assets are safe and growing. If you want to be sure that you are not losing money, then you must make sure that the words “absolute return” are written down in your written investment profile and specified correctly. When we accompany you to the Swiss private bank, we ensure that important notes are also correctly noted in the documents, we might check. Such a written note is worth gold. It’s the atomic bomb for every lawyer, who has to negotiate compensation with the bank for you in case of a controversy.

3. How can we make you a Successful Investor

The relationship with your private banker should be established on a long-term basis based on trust. You have the right to be looked after by the same Private Banker for the entire duration of your business relationship with the Swiss Private Bank. Ideally, even a private friendship will develop. Only if he has all the relevant information about you and your family, he can advise you in a tailor-made and efficient way. I know Swiss private bankers, who even release their private phone number for important calls at any time, including during the vacation with the family.

When I was CEO of the Swiss Association of Asset Managers, SAAM (www.vsv-asg.ch), almost 15 years ago, we engaged an agency with a survey on the duration of banking relationships with Swiss private banks. At that time, the duration of Swiss banking relationships in connection with dormant bank accounts and Holocaust money was much discussed. The survey showed, that on average, the duration of a personal relationship with a Swiss private bank far exceeds the duration of a marriage. I want to show how important the choice of the right Swiss bank and the right Swiss private banker are for you. The best choice of the best in class Swiss private bank and best Swiss private banker has a permanent impact. The right choice will affect your life more than what you think.

We will guide you through the Swiss banking world and we will help you in choosing the bank that suits your business in the best way. We introduce you to a Top Banker, who takes time for you thanks to our recommendation and is there for you for the rest of your life. Only based on our analysis and advice, you will be sure to have access to the most efficient Swiss private banking services. They will make you a successful Investor.

Upon your special request, we make sure that your dedicated Relationship Manager will be the owner of a Swiss private bank in person.

As the former CEO of the Association of Swiss Asset Managers (VSV)

http://www.vsv-asg.ch/en/home

I know almost all independent asset managers in Switzerland. If you want to have your assets managed by a successful external asset manager with a track record, call us now for advice.

4. Relationship Management vs Portfolio Management

The Relationship Manager is always supported by a team of specialists. This gives the customer access to global market information, first-class financial products, solutions and opportunities. He benefits from the bank’s global asset management network. The Relationship Manager shows the client in simple terms exclusive wealth management options on how to manage and preserve his assets for himself and his family, and for future generations. It also provides access to exclusive club deals and other exclusive off-market deals.

The discretionary asset management (private asset management) activities for the customer are no longer executed by the Relationship Manager. A portfolio manager takes care of the portfolio management activities based on the defined investment plan. The Relationship Manager maintains the relationship with the customer alone. He is the official representative of the bank and hence the business card. If he makes a specific buy or a sell order for securities at the client’s request, this is usually not its main activity. The goal of the Relationship Manager is that the customer signs a Discretionary Asset Management Agreement. After signing the agreement the investment decisions are transferred to the bank and taken away from the relationship manager and the customer. The bank takes the investment decisions and not the customer. The Relationship Manager discusses the investment profile, but the investments themselves are in the bank’s portfolio management department. In modern private banking, relationship management and portfolio management are separated. The Private Banker (the Relationship Manager) can be the prima donna of the private bank, if he works successfully and if he is able to attract and control large fortunes.

Private banking services are based on an intensive, long-term relationship of trust between the parties.

5. A Relationship for Life

A Banker who put taxpayers’ money at risk should be jailed

A good Relationship Manager binds his clients for the whole lifetime. A Relationship Manager, who controls several hundred million francs of assets under management, has a certain position of power within the bank. He has something to say in his bank. A client should be proud that his Relationship Manager has something to say within the bank. In many cases, the power position depends on the amount of “assets under management” (AUM) and his expertise. Therefore you have to investigate his position inside the bank. We will investigate for you, in case of doubts. We only introduce our clients to the best senior bankers and to the top 10 private banks. The Relationship Manager can enforce the interests of his client more efficiently within the bank. Special requests, enforcing certain complex transactions, club deals, exemptions, quick settlement of transactions, preferential treatment, special terms and conditions are all part of his duties.

6. Best Private Banking Services

Highly qualified and experienced Swiss bankers have built up a far-reaching network and practicable private banking know-how for decades. The Swiss culture of strict confidentiality combined with the best-personalized services is passed on from generation to generation. The personalized intensive service culture is still the basis for the successful business model.

7. Business Model Private Banking

Most of the approximately 132 Swiss private banks offer the following business model, which is based on three types of written mandates:

7.1 Discretionary Asset Management Mandate

The bank manages the assets on the basis of a previously agreed investment profile. The bank makes and is responsible for the investment decisions, not the customer. The client mandates the Swiss private bank with the asset management activities of his portfolio. The Swiss private banks charge an average of 0.80% of the assets under management as a management fee per year.

7.2 Advisory Asset Management Mandate

The bank presents you all investment ideas and advises you on their choice. At the end of the day, you have the right and the duty to make the final investment decisions for the successful management of your portfolio. The bank gives you non-binding comments and advice, but you make the final investment decision by yourself. The bank charges you an advisory fee, which depends on the intensity of the consultation.

7.3 Execution-Only Mandate

The bank executes your investment execution orders without giving any comments or advice. As a rule, only independent asset managers and professional investors are interested in such an “Execution-Only” Mandate.

8. Difference between Private Banking and Wealth Management

What is Swiss private banking and wealth management?

Swiss Private banking vs wealth management: the services overlap but are not identical.

Read about the difference here.

8.1 Private Wealth Management

Wealth management services are focused on optimizing the client’s portfolio of securities. Depending on the financial investment profile of the customer, the appropriate investments are selected. Financial risk factors, goals and plans of the customer play a major role here. Today, each bank has the obligation to create a written investment profile of the customer. Not every customer is risk-tolerant, able or willing to take risks.

8.2 Swiss Private Banking Minimum Requirements

Swiss Private banking services also geared up to optimize your assets, but they are only available exclusively to wealthy clients. All Swiss banks have private banking minimum requirements in place. Most Swiss private banks require an investment of at least CHF 1 million assets under management (AUM). Certain banks, such as UBP or Banque Pictet, require assets under management of at least CHF 5 million. Swiss Private banking services are designed exclusively for High Net-Worth Individuals (HNWIs) that bring at least CHF 1 million or equivalent to the bank. For this, the customer gets an assigned supervisor (Relationship Manager or Private Banker). The professionality of whom he should investigate with us.

It is very difficult to find banks that open accounts under CHF 1 million. Thanks to our network of contacts, we are able to open accounts from CHF 500,000 onwards. For accounts inferior 500’000 CHF we do not manage to open an account. Under one million, it will be difficult to offer well-diversified Classic Swiss Asset Management Services. Under one million, there is simply not enough money to build up a sufficiently risk-diversified portfolio. For small portfolios, investment funds are selected.

Many Swiss banks, including UBS, have special departments that only serve key clients. Key clients are Ultra High Net Worth Individuals (UHNWI) with assets of at least CHF 30 million or their equivalent.

Private banking services are not just focussed on optimizing assets. Rather, the Swiss private banks, we know, offer a much wider range of private banking services oriented towards a more sophisticated international clientele.

9. Swiss Private Banking Services typically offered

9.1 Club Deals

The term Club Deal comes from the private equity industry. Several private equity firms have joined forces to form a consortium to take over a company. Swiss Private Banking clients have the unique opportunity to participate in very large investments through Club Deals, such as corporate takeovers or rare investment properties. With access to exclusive investment opportunities, you can often achieve above-average returns that you would never achieve on your own without such Club Deals.

9.2 Co-Investments

For co-investments, the private banking client joins a major investor. Again, these are off-market deals that are not publicly available. It is always the Relationship Manager, who prepares access to such exclusive deals. Most of these are investments in projects such as marinas, real estate, hedge funds and private equity. The Private Banking client benefits from the expertise of the main investor.

As most of the participants usually have an account at the same bank, such deals can easily be processed within the bank. Due to the strict anti-money laundering regulations, every investor has already passed a strict KYC (Know Your Customer) exam. The likelihood of getting involved in cheating with such deals is very low. Often the participants do not know each other well because investors live on different continents. Nevertheless, such deals enjoy increased popularity. Such activities are profoundly offered in Switzerland due to the density of wealth.

9.3 Hedge-Funds

Hedge funds are alternative investment vehicles with maximum flexibility since they can invest in various asset classes, such as bonds, equities, commodities, derivatives, real estate, art collections and classic car collections. Long and short positions, derivatives and leverage instruments are often used. Despite their performance in the past few years, hedge funds are to generate returns, that are not dependent on the stock markets (they have no direct correlation to the market). As a result, they are excellently suited for the diversification of portfolios and their risk reduction. Hedge-Funds investments are usually only accessible to professional, highly qualified investors.

9.4 Impact Investments

Impact Investments does not focus on returns but on the environment. Thus, for example, social goals, medical research goals or concerns of environmental protection can be pursued. In contrast to philanthropy, a positive return should look out.

9.5 Passion Investments & Trophy Assets

- paintings and sculptures

- luxury hotels

- football clubs

- watch, big gems and jewellery

- vineyards with top quality premium wine

- unique real estate, skyscrapers and landmarks

- coins and stamps collection

These assets are also referred to as Trophy Assets because they are not just bought as investments but because of the passion, and but above all, the prestige.

9.6 Private Equity

Private equity investments are long-term investments aimed at bringing the company public and to make a substantial gain.

9.7 Venture Capital Investments

Often a privately-run start-up company is financed, which is active on the Internet or in biotechnology. The goal is the IPO.

The examples are well-known: Facebook, Uber, Twitter etc.

The top Swiss private banks are able to offer investment banking services in such areas.

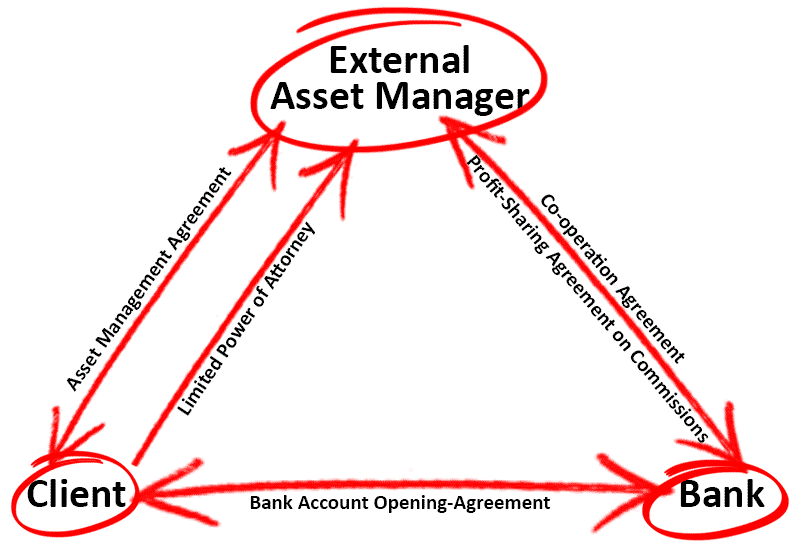

10. External Asset Manager

An external asset manager typically worked in a bank as a Relationship Manager, before he started his private asset management services. The Swiss private asset management companies I know have a tremendous placing power with the depositary banks they work with. Such asset management companies are controlling substantial assets with the same bank. They are in a position to negotiate very attractive banking fees. For the client, it can be cheaper to work with an external asset manager instead of the bank. It’s cheaper for the client in terms of fees at the end of the day. He can be sure that his asset manager will choose the best private banking products available in the market. If he works directly with the bank and without external asset manager the risk that his bank will promote his own bank products is very high.

Good asset managers are effectively independent of the selection of products and it’s more convenient for you because you can benefit from a better pricing. As former CEO of the Swiss Association of Asset Managers (SAAM), I know the most performing and the fairest working asset management companies. Give me a call now and pay less private banking fees in the future by choosing a professional and independent asset manager.

11. How can Caputo & Partners help you?

We monitor, coordinate and consolidate all Private Banking services shown in the following infographic.

As boutique law firm focusing on Swiss Private Banking for international entrepreneurs, we act exclusively in your interest. We are independent. We are not on the payroll of big banks, like other big law firms in Switzerland. We look towards an adequate solution – for you and your family.

You only have one single point of contact – Caputo & Partners as One-Stop-Shop Solution provider.

We monitor, select, and introduce you to a proper Swiss bank and a Top Senior Banker who has gained our trust.

We select the best professionals for your issue: the “Best of Class” Provider

We know the industry-standards and the pricing. Let us negotiate for you all services in the private banking industry. We will negotiate for you – at the same level with your counter-party.

12. Financial Times: Swiss Private Banking – an out-dated business model?

The article draws on the reports made by key audit firms such as KPMG, Deloitte and PWC. The audit firms argued with the diminishing number of banks in Switzerland.

Off-course with increasing compliance costs, small banks are no longer able to compete with the large Swiss private banks. Therefore, we have a diminishing number of banks in Switzerland. This, however, does not indicate an out-dated business model. On the contrary, never in the history, Swiss banking has had such an attractive position of private banking and all this due to the volatile political and financial situation from east to west. This has also been resonated by the key audit firms. Off-course they say that. Due to the fact that the banks are the best clients of the audit firms because the big audit firms are protecting their own business.

The Financial Times (FT) criticizes Swiss Private Banking without providing the background information. This could be a reaction to the fact that a number of financial institutions are now leaving the UK because of their out-dated business model.

So the Financial Times affirms:

- the number of banks in Switzerland is shrinking

My comment: This has nothing to do with the business model but the compliance issues which has made the cost of banking more expensive for smaller banks. - jobs are being dismantled

My comment: Banking Industry is shrinking worldwide. In the past 2 years, however, Swiss private banking has recovered enormously and has even increased their assets under management by Billions of USD! - high banking fees

My comment: Banking Fees and that especially for HNWI and UHNWI are all negotiable. Hence, there is no fixed cost for such wealthy clients. - the customer portfolios are performing poorly

My comment: The above statement cannot be more inaccurate than ever. It is not without reason that 30% of all global bankable assets are being managed in Switzerland.

The noble “Financial Times” has strongly criticized the Swiss private banks with its one-sided “Health Check”. The negative comments did not stop. Stereotypical criticisms of the Swiss financial centre, such as the metropolis for criminal tax evasion, the money of corrupt politicians, the world’s money laundering machine, followed an avalanche. Only a few bankers have opposed the shit-storm. This one-sided presentation has to be massively corrected.

All such rhetoric is due to the fact that the financial industry in the UK is under pressure. Financial Times with such rhetoric is trying to divert the attention to the real problem somewhere else.

The business model “Private Banking – Made in Switzerland” has recovered surprisingly quick from the financial crisis of 2008 and eliminated the tax evasion problem with black money. How did Switzerland achieve this within this short time period?

“There is no credible alternative to Switzerland, as a financial centre for asset protection in times of Geopolitical and Financial Turmoil.”

13. Which financial centre can seriously compete with Switzerland?

Let us together examine a few of the well-known financial centres.

13.1 Singapore

Do you really believe that the wealth of an Ultra High Net Worth Individual (UHNWI, investors with a portfolio of more than USD 30 million equivalent) is safe in Singapore? Should such an investor deposit his hard earned cash in Singapore? A small country in the South China Sea, surrounded by hostile neighbours is a safe place for your hard-earned money?

With the breakout of a political unrest between the East and the West, your money is lost forever overnight. Who will be foolish enough to travel to Singapore to recover the assets? Which European or an American lawyer will be courageous enough to risk his life in order to go to Singapore and fight for lost assets of a client who will also have problems communicating with the Chinese language?

Where can political unrest break out in the region at any time? A country that does not has its own portable water? This is all true for Singapore. Don’t forget, Singapore despite its international fame is only a small rock in turbulent South China waters where pirates are lavishing.

13.2 Dubai

What is Dubai? An overnight grown government and prosperity in a region, where oyster collectors were nothing but poor fishermen compared to their oil-rich neighbours. The unforeseen and lucky development which has been going on in the past 30 years in Dubai is nothing but a miracle combined with phantasy investments. Who is stupid enough to invest in a small desert location like Dubai, where the Sheikh dynasties can introduce Sharia law overnight and take away your money because you do not have a macho male as your first born?

I would not trust my money in a country with such draconian measures. Just remember what happened to King Salman’s corruption purge victims, where rich Saudi citizens were held in a golden cage “Riyadh Ritz Carlton Hotel” by the ruler his Excellency Prince Mohammad bin-Salman bin-Abdulaziz Al Saud. Do you think you are more powerful than prominent Billionaire Alwaleed bin-Talal, who used to consult the political elite on Saudi wealth and the US-government?

Even Internet, the medium for free speech is subject to strict censorship.

You would really trust your hard earned money in a small desert land surrounded by hostile neighbours who again does not have own portable water?

13.3 Hong Kong

In 1 July 1997 when the last British Governor said goodbye to this beautiful Island of Hong Kong it officially turned out to be a Chinese territory. Would you put all your money in China?

13.4 European Union

According to some of the member states, the European Union is considered to be a disastrous union of non-unified indebted countries. EU is desperately seeking money, wherever they can and in doing so punishing some of its wealthiest and successful entrepreneurs. Would you, therefore, trust the unelected European Government whose members are getting poorer every day, with your hard earned cash? Most states within the European Union are seeking measures to expropriate each account holder with more than EUR 100’000. Read the comments from Christine Lagarde, IMF.

Christine Lagarde, Director of the International Monetary Fund and Minister of Finance in the office of the French Prime Minister François Fillon,

“The IMF has advocated for a general “debt tax” in the amount of 10 percent for each household in the Eurozone, which also has only modest saving.”

Or maybe a bank in a heavily indebted state who is the member of the European Union, where you are no longer sure whether the bank account will be confiscated or disappear overnight, as in Cyprus in 2013?

13.5 The United States of America

“How much does it look out for me today? The short-term mentality of the American People criticized by their own people, such as Warren Buffet and Jamie Diamond is not appreciated by the rich investors. These people are looking for wealth preservation and constant growth. They are often engaged in industrial, internet and other entrepreneurial activities. When they have earned their money, they do not want to gamble with it. The primary purpose is to not lose their hard earned money and to secure and place it in the most stable political, social and economic environment.

The selection of the most secure jurisdiction for asset protection is of paramount importance.

The American wealth management industry has little know-how in internationally oriented asset protection and geographical diversification. The asset management in the USA is mainly concentrated in the US and mainly investing the US Blue Chips. Lack of global diversification skills of the American asset managers will result in a cluster risk. This is the reason why so many UHNW investors from the US are seeking Asset Management Services in Switzerland.

What are US-Investors looking for – BUT cannot find in the USA?

- Geographical and physical diversification of assets

- Internationally diversified portfolio in various currencies with international investments

- Asset Protection with Swiss Francs and Offshore Trusts

All above skills are not found in America. US-Investors are self-centred on US-equities and that with short-term horizons.

Due to the recent scandals about the American black money in Switzerland and the subsequent astronomical fines imposed on Swiss banks, they have been scared in accepting US clients. The situation has changed dramatically in the past year. More and more Swiss asset managers have acquired an SEC license in order to be able to serve US clients.

Alert!

Be careful where you put your money and whom you trust. When it disappears, it’s gone forever.

🖱️Move your mouse over the bars to find out more.

The most important offshore financial centres

AuM = Assets under Management in bn USD

14. What is the real Unique Selling Proposition (USP) of Private Banking – Made in Switzerland?

Here, we have listed our USPs

- The neutrality

- Political, social and economic stability of Switzerland

- our prosperous economic

- our high-quality education and universities

- our competence to innovate

- our strong currency

- our expertise in global asset allocation

- our competence to understand foreign cultures

- our multi-lingual and peaceful multi-cultural society

- our long-lasting experience and tradition in wealth management (since 200 years)

- high-quality services and discipline are unbeatable security and success factors, with which Switzerland wins the favour of international investors.

14.1 How does a Swiss private bank make money?

A Swiss private bank makes money using simple to realise and unleveraged Investment Instruments for long-term asset management.

It is not without reason that 30% of all 500 world-wide companies, listed in global Fortune 500 List have established a company in Switzerland. Since Brexit started, Switzerland has definitively become the number one Hub for commodity trading, worldwide. Many UK companies have transferred their headquarters in Zug (Swiss TAX Heaven).

Since 2017, the Swiss banks again manage the same number of “assets under management” (AUM) as before the financial crisis of 2008.

In 2018 they have even superseded their previous AUM by Billions. Assets under management in the United Kingdom of Great Britain do not even reach 50% of that managed in Switzerland.

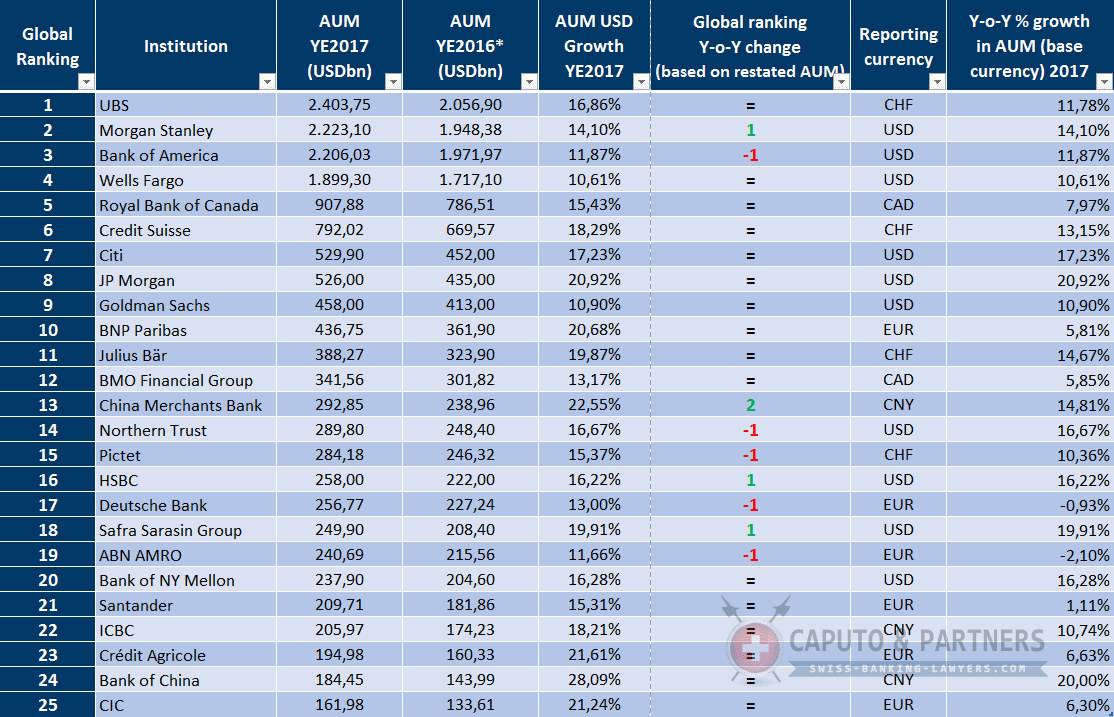

Here is the “Scorpio Partnership 2018 Private Banking Benchmark” list of the 25 largest banks.

(Click on the Graphic for Full View)

Source: http://www.scorpiopartnership.com/press/2018-benchmark/

In the Private Banking industry, 5 Swiss banks are ranked in the top 20, on a worldwide scale.

The Swiss banks are ranked in positions 1, 6, 11, 15 and 18, while the United Kingdom has only one bank and that in 16th place.

14.2 Swiss Bank fees too high?

For large assets, the fees of Swiss private banks are negotiable. We will always negotiate the fees charged to our customers Private Banking Account. There is no fixed charge for private banking clients.

Therefore, as you can realise the argument for the high fees is not justified and irrelevant for Swiss Private Banking.

14.3 Bloodletting due to Repatriation after the Legalization of the Bank Accounts?

The exodus illustrated by the media i.e. outflow after tax self-disclosure of the holders of black money accounts is not true. Many small and very small customers have withdrawn their money, but not the big ones. Swiss banks, such as UBS and Credit Suisse, have deliberately distanced themselves from accounts below CHF 1 million. The compliance effort has become too expensive. It is estimated that around 70% of legalized funds have remained with Swiss banks. Some of my Italian clients, who deposited their money with banks in Italy following the Italian “Voluntary Disclosure”, returned to Switzerland. Too sloppy was the Private Banking Service in Italy. In addition, the political uncertainties in Italy have not shrunk.

14.4 Number of Billionaires more than doubled

Since the financial crisis in 2008, the number of billionaires has more than doubled. The number of millionaires has increased tenfold over the same period. Such growth rates are usually only known from Silicon Valley. The increase in wealth takes place above all in countries, where sympathy with Switzerland is particularly pronounced, such as in Asia, India and Africa. Due to the colonial past of these countries, Switzerland is favoured over other financial centres that had colonies. Many of my older clients, who come from these emerging markets and former colonies, have confirmed to me time after time.

14.5 Where are the Emerging Markets located?

What’s in for me today? – This reflects the American mentality.

UHNWI from Asia, India and Africa are reluctant to accept the American style of banking The more solid and long-term orientation of Swiss bankers and the Swiss mentality of confidentiality is highly appreciated among people from Asia. The USP of Swiss Private Banking has narrowed as a result of the tax transparency (OECD, Common Reporting Standard), but it still intact and offers the world’s best asset protection against political uncertainty and turbulence.

Investors living in these “emerging markets” are well versed with the risks of the economic and political turmoil. They know exactly what can occur if government change overnight. All the more, they appreciate the political and economic stability of the Swiss financial centre. With the visit to the bank, HNWI and its numerous family members are happy to combine a ski vacation in the mountains, a stay in a Swiss luxury clinic or a private hospital or investigate the possibilities of sending their children to one of the best private schools in the world.

For the reasons outlined above, it is no surprise that UBS manages – by far – the assets for the largest number of billionaires and ranks at the top. The smaller Swiss private banks, however, are constantly expanding their share of the wallet. The complicated and more demanding customers are no longer specifically advertised by the banks. Rather, Swiss banks are investing the marketing budget in the emerging markets.

14.6 Little sympathy for the former Colonial States

The world is not getting more stable and secure. Due to the current geopolitical turmoil, the future is rather bleak. The high number of new millionaires and new billionaires from China, the USA, the Gulf States, India, Africa and Southeast Asia are springing up like mushrooms. They will continue to avoid the financial centres in London and the US because they have little affinity and trust towards these countries. Many know Switzerland because they have had a positive experience with the private schools or the private clinics. There are private hospitals in Switzerland and renowned specialist clinics that are more well-known abroad than in Switzerland among the local population.

14.7 Switzerland is Booming: An Exclusive Private Club and not an International Ghetto

For all reasons mentioned above, Switzerland is becoming even more attractive amongst the rich. The authorities have recognized the trends and are playing along. In the past four years, many new companies have been established by foreigners. In the canton of Zug, international business is currently booming in commodity trading, biotechnology and bitcoin business. The Canton of Zug is famous abroad as Crypto Valley. This not only means a golden future for “Private Banking – Made in Switzerland”, but also for Switzerland not only as an exclusive club for the rich and famous but also an attractive and efficient location for innovative business models in general.

Alert!

Do not risk your entire fortune by choosing the wrong banker. Not all Swiss bankers are qualified to professionally manage the assets of international clients. There are many bonus-centric bankers who are ready to do irregular transactions with risky private banking products just to increase the bonus.

Our offices are at Paradeplatz, at the heart of Zurich’s financial centre, very close to the most important banks. We are here to visit your bank with you. Just give us a call.

You should not leave the choice of your private banker to chance. A junior banker could only have one thing in mind with your hard-earned fortune: increasing the bonus rather than recommending the best product for you. Investment advice, influenced by a conflict of interest situation is very common.

Junior bankers have small assets. Therefore, they tend to increase their bonus by recommending risky investments. Bonus-centric bankers are often in a conflict of interest with the assets of their clients. The riskier the investment product that the client buys, the higher the bonus for the banker will be. Let us review the professional capabilities of your private banker. Last year, I had three customers who lost 14 million to those greedy bonus-focused junior bankers.

14.8 How much do you make in private banking?

The following example shows a client from Cairo who started with a half Million in 1995 doing private banking in Switzerland based on funds received from his sister living in the USA. My client made USD 14.5 Million with Swiss private banking services delivered by a professional Swiss Top banker during the last 20 years. Money grows over time. The famous lucky punch coming out of the blue is not permanent. It can disappear just as fast as it appeared. If you have a strong relationship with your Swiss banker you will have excellent opportunities to participate in special Club Deals and unique investment opportunities common clients have not access.

14.9 How a Millionaire from Cairo lost his Fortune with Forex

A typical Swiss senior banker has built up the Egyptian’s portfolio starting from a half a million dollar. This portfolio has grown – over the last 20 years step by step – and has reached USD 15 million. I know this Top banker personally. Unfortunately, he retired unexpectedly and these hard-earned were handed over to a junior Arab-speaking banker. The junior banker destroyed nearly USD 10 million in just two months by persuading him to invest in a risky Forex product. He had no idea about Classic Swiss Asset Management. He was an ex-trader. The Egyptian’s trust in the Swiss bank was limitless, as his former banker had successfully built up a huge fortune. Due to the blind trust, my customer was persuaded to high-risk investments. The disaster has taken its course. The private banker tried therefore to mask the damage to the customer. This increased the damage even more. Today, we are conducting tough negotiations with the bank to mitigate the damage and find an amicable settlement for the old Egyptian client.

14.10 Share-investment in Russian banks went wrong

Another customer from Novosibirsk was looked after by a Russian-speaking lady, a junior banker who worked as a kindergarten teacher before she started her banking career. Many Swiss banks were looking for Russian-speaking bankers. Since they did not find enough Russian-speaking staff, sometimes non-qualified bankers from all kinds of jobs were hired. Our client lost USD 1.5 million. On the advice of the kindergarten lady, he invested nearly all of his assets in shares of ailing Russian banks, which had to deposit their books shortly after the investment with the bankruptcy judge. The financial disaster was perfect.

14.11 80-year-old Turkish Forex Options Investor

An 80-year-old Turkish customer was persuaded by his young Turkish Relationship Manager to invest in foreign exchange options. Today, the bank seriously claims that the 80-year-old client from Istanbul took the initiative to invest in currency options. The bank often says that they wanted to keep the client away from this risky investment, but the client insisted. Would you believe that he forced the bank buy currency options for him? Please be aware, in case of any dispute, it is only the written and signed documents that are considered before the court. Fortunately, the young Turkish banker damaged many clients. If more clients are victims the negotiation power on the victim’s side is much bigger. It’s easier to make a settlement with the bank. The bank’s reputation is at risk if many victims are involved. The banks are afraid of negative journalism.

It is better to prevent damages in the first place rather than fighting with the bankers. Not all Swiss bankers are qualified to professionally manage the assets of international clients.

We are happy to investigate the performance of your private banker and give you a second opinion. We will even accompany you during your next visit to the bank.

If you have a bad feeling, you should follow your sentiment. Take the first step before it becomes to be too late.

We would introduce you to:

- Senior Top Private Bankers that grow your assets continuously

- the Best Private Bank guaranteeing you asset security

- External and Independent Asset Manager who do not follow the recommendation lists of the big banks

- A typical Swiss Private Banker owning the bank (upon specific request, reserved for UHNWI only)

- or we give you a “second opinion” on your current situation

- We protect you from unlawful confiscation and fishing expeditions

- We will check your future business partners with a background check

- We help you to diversify your assets with the selected Swiss banks

- We introduce you to a Top private banker

- We are looking for the bank that suits your business

- We are independent and we deliver an independent second opinion

- We help you to save taxes legally

- We will accompany you to the bank on the same day of your call

- We negotiate with you and the bank at the same level of financial and legal knowledge

- We provide an investment profile that protects your assets and not that of the bank

- We structure and anonymise your assets so that it will not be possible for third parties to discover it

- We help you with private bank online banking services

You will realize that many problems do not arise based on our support. Take action before it’s too late.

If you remain passive until the problem becomes acute, damage can already occur.

It is never too early, but often too late. Do the first step now and preserve your wealth. Do not wait until it is too late. Remember, successful and rich people always look for advice. Damage prevention is cheaper compared to a damage claim in the courts.

Take the first step to protect your wealth. Be rich and stay rich.

Don’t blindly follow the advice of the big bank’s advisors.

I have seen significant losses in the millions of dollars and hidden fees that have destroyed many assets of wealthy entrepreneurs.

Be smart and learn from other millionaires’ mistakes.

Speak to Mr. Enzo Caputo today and let us analyze your situation.