Tax Evasion: Best Tips & Tricks to legalize your Offshore Money fast

Do you have a secret offshore bank account? You risk losing all of your money. Frozen bank account, severe penalties and prison are the consequences. Tax Evasion is a serious crime with heavy penalties.

You will be treated like a criminal if you do nothing!

“In case of Tax Evasion, the bankers are no longer your friend and helper anymore. While the same banker may have accompanied you to a nightclub as a friend before, it may now turn away from you overnight acting as a police officer. The bank will spy on you – by virtue of law!”

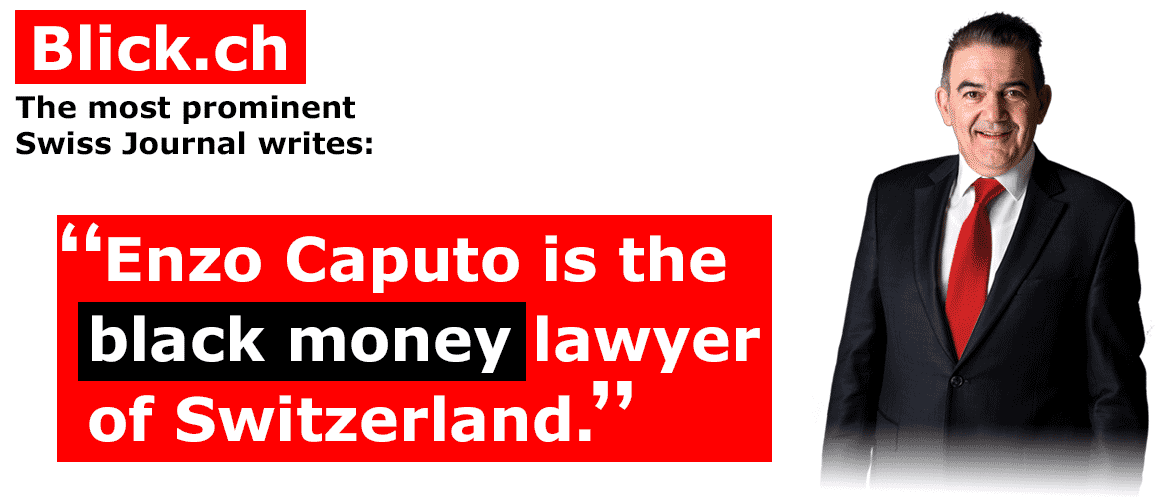

We successfully closed more than 220 Offshore Voluntary Disclosure Programs in Brazil, Italy, USA, Canada, Argentina, Germany etc. Ex-UBS Lawyer reveals best Tips & Tricks to legalize your offshore money fast.

Table of Contents

- Tax Evasion

- Switzerland: New Law on Tax Evasion

- Qualified Tax Evasion is Tax Fraud

- Qualified tax evasion is a crime

- Qualified Tax Evasion is reportable

- Suspicious Activity Report (SAR) for money-laundering

- What does this mean for a customer having black money in Switzerland?

- Lex mitior

- Black money makes you sick

- What is a legal loophole in tax law?

- Why will the Common Reporting Standard (CRS) and the AEOI not only hit Tax Evaders and Tax Fraudsters?

- Tax Avoidance Strategy à la Tina Turner

- Non-Dom Status: move abroad and save taxes

- Legalized Black Money – thanks to Golden Visa Switzerland

Foreword to Tax Evasion

Never try to solve your offshore bank account problem on your own. The bankers are much better informed than you are. You are not informed of the background information and on what recently happened. The knowledge-level of the bank is far higher than that of your own.

“Don’t go to the bank on your own.“

Perhaps you have a pending request for international administrative assistance in tax matters against you? Maybe there is a pending investigation at home for tax evasion? You risk losing all of your money, having problems with the tax agency at your place of residence, or even going to jail. Tax evasion penalties are increasing everywhere. Tax evasion cases have been considered as a Cavalier offence in the past – but not anymore. Today, tax evasion is a serious crime with heavy penalties. You must realize that in case of a legal or tax problem the bank is no longer your friend and helper. The bank turns away completely from you overnight. The bank tries to be more protective of their own interests. The banks may try to collect declarations of discharge. Do not sign declarations and letters you do not understand. The bank is not your friend anymore!

“While the same bank may have accompanied you to a nightclub as a friend in the past, it may now act as a police station, spying on you – by virtue of law! Let us accompany you t the bank and defend your interests in front of the bank!“

Never go to the bank alone. You cause irreparable damage. Everything you say is recorded ending up in the bank account documentation. The bank documentation can be used later against you (even in your home country in criminal proceedings!). You lose all your money or your account remains frozen for many years. You risk going to jail. The knowledge-level of the bank is higher. I guarantee you: Alone – you are going to lose against the bank. New laws force the bank to lie to you and spy on you (on behalf of the OECD). Come on and sit down with us. Let us prepare your papers before presenting them to the bank. In this way, you will not be making any mistakes which can subsequently create damage.

“Do not sign any paper beforehand. You will regret it bitterly.”

But when we go to the bank together, we quickly know what’s up. I will talk directly to the management of the bank. As your business law firm in Zurich, we negotiate on an equal level with the bank. We notice what’s in the air after the first five minutes. The bank cannot lie to us. We solve your problem case professionally. We fight illegal group requests, legal assistance and administrative assistance procedures from abroad (“Fishing Expeditions”) asking the transmission of your bank account information out of Swiss territory. The prosecutor or the state attorney has to prove beyond any reasonable doubt every element of the crime. Without having the bank account information provided by the Swiss authorities on his table, it will be a nightmare for the prosecutor at home to prove all the elements of the criminal tax evasion. We will protect you. We always have a solution, even in apparently hopeless cases.

We accompany you to the bank today and sit at the table with the director of the bank. Together, we discuss your problem case on an equal and fair level. We will take all measures not only to legalize your account in Switzerland but also in your country of residence.

1. Tax Evasion

Nobody likes to pay taxes. Nevertheless, taxes have to be paid. This is the law. Everyone understands that the state needs money for the infrastructure it provides. But if the taxation in a country is so high that it amounts to a seizure, tax evasion is justified as a means of self-defence of the constitutionally guaranteed right to property. Tax evasion is not fair to the community. If everyone pays the taxes correctly the tax burden would not be that high.

1.1. Tax Evasion vs Tax Avoidance

It is not my job to spread moral ideas. Rather, I want to demonstrate battle-proven solutions for solving tax evasion issues and legally saving taxes. The law describes precisely the facts which trigger a tax liability. The terms “tax avoidance” and “tax evasion” are often used synonymously. That’s a common mistake. Tax avoidance is legal. Tax evasion is illegal.

What is the difference between tax avoidance and tax evasion? You are subject to prosecution if you purposely avoid taxation by keeping secret taxable facts and taxable events. If you keep secret a reportable bank account you are committing tax evasion. You hide the fact of having a reportable and taxable bank account.

Let me explain you. You live in Switzerland and you form a company in Dubai with a bank account in Dubai. You don’t collect dividends from your company in Dubai. You increase the value of the company in Dubai because there are no dividend payments. After a couple of years, you sell all the shares of your company in Dubai. The capital gain realized with the selling of your company is not taxable in Switzerland. Capital gains realized by a private individual are not taxable in Switzerland. This is a typical tax avoidance scheme. Tax avoidance is legal. Instead of taking out the profit in the form of dividend distribution from the company in Dubai (taxable in Switzerland) you accumulate the profit. Subsequently, you sell the company including the accumulated profit. This is considered as a tax-free capital gain in Switzerland. What may be considered as a legal tax avoidance strategy in Switzerland can be an illegal act of tax evasion in another jurisdiction? And hence, international tax issues are complex and therefore, you have to understand where to present what.

1.2. Tax Evasion Examples

You open an account in Montenegro and do not declare the income with this account to the tax authority. The Automatic Exchange of Information (AEOI) is not planned for Montenegro. Most probably you will not be discovered as Montenegro does not exchange bank data. If you are discovered anyway, then you have to face a penalty for tax evasion.

But you can quite legally avoid paying taxes by not creating the taxable facts and circumstances.

You form a company in Dubai. You collect the dividends from the company in Dubai with an account in Montenegro in the name of another company. As long as you do not receive dividends from the company in Dubai with a personal bank account in your name, you are not taxable as a private individual.

1.3. My Solutions for you

- I’ll show you tax evasion examples with international tax avoidance schemes

- I’ll show you how my international clients are solving their tax evasion issues

- We help you in all international tax issues

- I’ll show you how you legally avoid paying taxes and protect your assets with battle-proven international tax avoidance strategies

- I’ll also show you how to limit the damage in connection with existing international tax evasion cases

1.4. Tax Avoidance Definition

To successfully implement a tax avoidance strategy, one must first know the tax-creating facts and the tax law attached to it. If the tax-triggering facts are known, we think about a situation that does not trigger taxes. Which prerequisites and circumstances must be fulfilled so that the taxable facts and events are not accomplished? Tax burdens can be reduced by transferring payments to another legal entity domiciled in a tax-efficient jurisdiction. Tax avoidance can be achieved by creating conditions and circumstances that are not taxable.

Some examples of tax avoidance:

- Establish facts and conditions that make tax deductions possible.

- Booking business expenses with a company located in a high-tax country.

- Move and realize profits with a company in a low-tax country.

- Transfer of personal residence to a tax haven.

- Passport relinquishment from a high tax country

- Purchase a new Citizenship legally (Malta, Cyprus etc.)

1.5 Tax Evasion Definition

1.5.1. Tax Evasion meaning

The tax-creating conditions and the tax-triggering facts are already accomplished. Tax evasion means hiding these conditions and facts so well preventing the tax authorities from discovering it. Tax evasion is an illegal hiding practice with the result to pay no taxes.

1.5.2. Methods of Tax Evasion

Many bank accounts were opened in Switzerland because they could keep cash receipts secret from the tax authorities thanks to bank secrecy. The tax-creating facts exist but they are kept secret by illegal measures. The facts are not disclosed to the tax agency. Tax evasion definition: Illegal measures to keep tax-triggering facts and events secret.

All business receipts must be declared. This also includes income from barter transactions and cash transactions. In many cases, cash transactions are not reported. A cash transaction is settled in several smaller tranches so that the threshold for a report (EUR 10’000) is not reached. Such illegal practice is known in the legal terminology for combatting money-laundering as “smurfing”.

2. Switzerland: New Law on Tax Evasion

2.1. Qualified Tax Evasion is Tax Fraud

The net is closing in. As of 1 January 2016, two qualified tax evasion offences are newly defined as crimes. They have been included in the predicate catalogue with all offences creating the prerequisites of money-laundering. It does not matter whether the acts were committed in Switzerland or elsewhere.

From 1 January 2016, banks and asset managers (financial intermediaries) have to implement these new tightened tax laws. New reporting obligations have already been created.

2.2. Qualified Tax Evasion is a Crime

According to the new criminal law, in Switzerland, two new qualified offences relating to tax evasion have been included with penalties in the predicate catalogue on money laundering. They qualify as tax fraud and are a serious crime.

2.2.1. Legal Definition: Crime and Imprisonment

Crimes are acts that are sanctioned with more than three years imprisonment.

2.2.2. Legal definition: Offence

Offences are acts that are sanctioned with up to three years imprisonment and a fine.

The crime of money-laundering can objectively be accomplished if the predicate offence, i.e., a tax fraud, is a crime. The predicate offence will be sanctioned with more than three years imprisonment. Only crimes are included in the predicate catalogue. Simple tax evasion was until now, not qualified as a crime and therefore not eligible for legal assistance. Since there was no requirement for double criminality (in Switzerland and in the country of the requesting authority), until 31 December 2015, legal assistance was never granted for simple tax evasion. The statute of limitations for tax evasion must be accomplished in both countries, for example in Switzerland and in the foreign state. Legal assistance is granted only for the short limitation period. Legal aid is granted today if the following qualifying conditions are met:

- Newly defined as a crime – two qualified tax evasion offences

- Inclusion in the predicate catalogue – listing predicate crimes for money-laundering

- Offences can be committed everywhere in the world

Tax evasion is now qualified in Switzerland as tax fraud and as a crime as soon as fabricated documents are used for tax evasion (e.g. false receipts, business notes, wage cards, etc.) and a tax substrate of at least CHF 300,000 is evaded in the same tax period.

2.3. Qualified Tax Evasion is reportable

If a Swiss banker assumes that his client has evaded more than CHF 300,000 in the relevant tax period using fabricated or irregular documents, he must report this suspicious activity to the Money Laundering Reporting Office Switzerland (MROS) https://www.fedpol.admin.ch/fedpol/en/home/kriminalitaet/geldwaescherei.html as a suspected criminal tax evasion and money-laundering. The reporting is anonymous in connection with the account holder. Here, anonymous means that the bank customer will not be informed. The bank will qualify these funds as contaminated funds and they will be blocked.

“This qualified tax evasion is intended as a criminal tax fraud. Since 1 January 2016, qualified tax evasion in Switzerland has been included as a crime in the predicate offences catalogue for money laundering. Even if the qualified tax evasion has taken place outside Swiss territory.”

Tax evasion will also be punishable abroad and must meet the above qualifications (at least CHF 300,000 per tax period and fabricated documents) in accordance with Swiss law. The retroactive effect on facts occurred before 1 January 2016 was expressly excluded by the law.

2.4. Suspicious Activity Report (SAR) for money laundering

As of 1 January 2016, bankers, trustees and asset managers will have to report under the Money Laundering Act if there is a serious suspicion of qualified tax evasion. On the other hand, if there is a suspicion that does not need to be qualified as serious, then the financial intermediary has only a right to report (not a duty to report). But if he does not report a serious suspicion, he makes himself liable to prosecution.

2.5. What does this mean for a bank customer having black money in Switzerland?

A client of a Swiss bank that evades more than CHF 300,000 or its equivalent per tax period must expect it to be reported. Our advice to all black money customers is to legalize the funds as soon as possible. Depending on the country of residence of the account holder there are ongoing programs for a voluntary disclosure. Even in the event that a Voluntary disclosure program has expired, we advise becoming tax compliant. We strongly advise you, in any case, to make a deal with the tax agency and become tax-compliant. The tax authorities will discover you sooner or later.

2.6. Lex mitior

To assess tax avoidance prescription and its consequences, its duration must be compared in Switzerland and abroad. Only the shorter limitation period is decisive. If under Swiss law, an offence is no longer punishable as a result of a short limitation period, Switzerland may not render legal assistance to a country with a longer limitation period. The rule by which an individual is to benefit from the lighter penalty is known by the Latin phrase “lex mitior”.

2.7. Black money makes you sick

We have legalized hundreds of million USD and gained relevant experience in the field with an enormous number of clients. Not a single customer has ever regretted making a voluntary disclosure. Black money makes you sick. The pressure only gets worse. The tax agency of all over the world exchanged Tax-CD stolen from Swiss banks by criminals and sold to the tax agencies. Meanwhile, the stolen tax-CDs have been exchanged among the tax agencies of all high-tax countries having a preponderant interest to combat tax evasion. Tax evasion in India or tax evasion in UK or tax evasion in any other high-tax country will be discovered. It’s a question of time. Too much confidential bank information has been disclosed legally or illegally. Switzerland is serious about the white-money policy: OECD Automatic Exchange of Information (AEOI) and Common Reporting Standard (CRS) have been implemented by the Swiss banks. In September 2018, the first data will be exchanged automatically. It is very important for you to act now!

It is worth it, believe me. You will feel much better and sleep deeper. Whatever were the causes of tax evasion, our experience with customers has shown that black money creates health problems, especially for older people. Family members of those affected have confirmed to us several times, the health status has improved massively after the filing with the Voluntary Disclosure Program.

“If you have black money, you have to act immediately. Do not lose precious time. Tax problems are not like good wine getting better with age. Take the first step, solve your problem and feel better for it. That’s my personal guarantee to you.”

2.8. What is a legal loophole in tax law?

To find a loophole, you have to analyse the tax law carefully. As with tax avoidance, you have to create the conditions and facts, so that the exception for taxation in the tax law is met. The situation of the customer must be examined closely. Where and how can those prerequisites be created so that a specific situation is fulfilled and the requirements for the exception mentioned in the tax law are given? What should one look for, so that these exceptions can be easily documented? Often the tax law wants to anchor certain exceptions. The Law on Automatic Exchange of Information has about 40 loopholes. Here it is for the customer to be sure that he really falls under this exception. If you are not sure about the exceptional situation, you must consult a specialist. Every case has its characteristics. No case is the same.

In many cases, the best way is to collect a Tax Ruling. A tax ruling is a written assurance from the tax authority that a precisely defined situation does not constitute a tax liability. Tax rulings are very common in Switzerland. A Tax Ruling is an excellent instrument to have absolute certainty about the tax treatment for a specific situation. Before an investor starts with an investment in his company, he must find out from the tax authorities that there are no future tax liabilities. The Tax Ruling is a binding agreement between tax-payer and the tax agency.

3. Why will the Common Reporting Standard (CRS) and the AEOI not only hit Tax Evaders and Tax Fraudsters?

I had to pass many angry comments full of glee from dutiful taxpayers about me. I am a thorn in the side of certain people because I help account holders of undeclared money to legalize their assets based on a Voluntary Disclosure Program. Here everything is legal and in the interest of the government, which has launched the Voluntary Disclosure Program in their own interest. With the AEOI finally comes the day of reckoning for tax fraudsters, as people say. Unfortunately, the consequences of the AEOI are much more important and far-reaching.

3.1 Economic policy and protectionism of the USA and the OECD

It’s about tough economic policy, market dominance and protectionism. The USA has shown Europeans how to deal with FATCA and CRS. The USA and OECD countries want to prevent the money being invested abroad. The USA is using FATCA to request all bank information worldwide, under threat of drastic sanctions. The Swiss private Bank Wegelin, founded in 1741, had to cease its banking operations as a result of the blackmailed fines. The USA has criminalized and arrested a group of Swiss private bankers. The USA has forced Credit Suisse to accuse itself of being a criminal organization. The USA are preaching water but drinking wine. The USA refuses to stubbornly exchange information. They collect information from all countries of the world.

However, in return, the USA does not provide any information. The USA has successfully threatened Switzerland with heavy penalties, however, at the same time they have actively marketed its own tax havens. US Lawyers from New York openly promote Nevada, Wyoming, South Dakota and Miami as a tax haven for black money. A Russian oligarch can rest assured that his money in the United States is not being reviewed by either the US Treasury or the Russian authorities. Such strong bank secrecy for black money holders cannot even be offered by Vanuatu, but the USA can very well.

Brickell, the financial district in Miami, USA, is now called what Bahnhofstrasse in Zurich was to German investors in the golden years of Swiss bank secrecy.

3.2. Brickell: Miami’s Wall Street South

https://www.forbes.com/sites/scottbeyer/2015/05/07/welcome-to-brickell-miamis-wall-street-south/#42b834d131f3

Miami is the Wall Street of Latin America. When it was still possible a few years ago, many Germans moved their account from Switzerland to Miami. What the USA is imposing and pushing through with billions of draconian penalties – see penalties for Swiss banks – is something that they themselves do not have to follow. With the “USA Patriot Act” George Walker Bush Junior enforced the access to confidential account data worldwide after the terrorist attacks.

3.3. Financial Secrecy Index 2018

Requests for international legal assistance from other states addressed to the courts in the USA for offences with black money run into in the void. The US ranks second in the “Financial Secrecy Index 2018”. Switzerland is ranked in the first place, but not more for tax evasion.

https://www.financialsecrecyindex.com/introduction/fsi-2018-results

Strangely, no one can blacklist the United States.

With a company in Delaware and an account in Miami, you can achieve what investors in Switzerland used to get under the bank secrecy business model. Nowhere is it easier and faster to start a business than in Delaware. In Delaware, there are more shell companies domiciled than people. Today there are about 1’000’000 registered companies, three times more than 10 years ago. There you get a really anonymous account because even a passport copy is not necessary. The banks in Miami are used to avoid questions about the origin of the funds.

3.4. “Small Business” transactions in Miami

While today a USD 50,000 transfer to the Caribbean raises many questions, transfers in Miami are registered below USD 10 million as a “small business transactions”. The US bankers in Miami have private accounts, business accounts and small business accounts. Under USD 10 million, no US banker sweats.

Where are the brave German politicians who threatened little Switzerland? Why don’t they threaten the US now?

Since 2017, the USA has promised some relief. The USA must make some compromises if it wants to maintain a minimum of credibility. It has already partially introduced an accounting obligation and the Internal Revenue Service (IRS) wants to know the identity of the beneficial owner – after all, a start. However, this does not mean that these data will be delivered abroad due to a request for legal assistance.

If two states do the same, it is far from the same. Whether it’s banking, free access to the markets, or protecting your own industry, the USA is calling for market benefits that are harshly criticized elsewhere. The USA preaches water but drinks wine. The USA does not participate in the Automatic Exchange of Information (AEOI) and with Common Reporting Standard (CRS), although the rest of the world participate (over 100 countries). The USA may request all information based on FATCA (Foreign Account Tax Compliance Act) but does not have to provide any information itself.

3.5. Panama Papers: Why are American Celebrities not listed?

As part of the Panama Papers, 214 000 offshore companies in Panama were pilloried. Many celebrities from politics, sports, economics and show business were named after the principle “Name and Shame”, merely put and partly criminalized. Owning an offshore company is still perfectly legitimate today. Significantly, not a single American was present because the International Consortium of Investigative Journalists (ICIJ) is headquartered in the USA and is funded primarily by foundations domiciled in the USA. No further comment is necessary.

4. Tax Avoidance Strategy à la Tina Turner

With the strategy of tax avoidance, care is taken to ensure that no elements that justify a tax liability are fulfilled. Tina Turner has relocated to Switzerland thanks to the Golden Visa Program in Switzerland. At the same time, she opted for lump-sum taxation calculated according to the costs of living in Switzerland. Nevertheless, she has remained taxable in the United States because the USA make taxation based on nationality. As long as Tina Turner was a citizen of the USA holding a USA passport, she had to submit her tax declaration and pay taxes to the Internal Revenue Service (IRS) each year despite the fact that she lived in Switzerland.

What kind of tax avoidance strategy has Tina Turner implemented in order to stop paying taxes in the USA? Thanks to the marriage of her 27-year-old Swiss boyfriend, she was able to enjoy the simplified naturalization process and immediately got the attractive Swiss passport. Shortly thereafter, she gave back her USA passport to the United States Embassy in Berne through a special procedure (relinquishment under Article 349 of the Immigration and Nationality Act).

https://www.uscis.gov/ilink/docView/SLB/HTML/SLB/0-0-0-1/0-0-0-29/0-0-0-10446.html

With tax evasion, the tax-creating facts are already well accomplished but hidden from the tax authorities. One of the most effective tax avoidance strategies is moving the place of fiscal residence to another country. The change of residence is also the most lucrative method of resolving the problem of tax evasion and black money forever. At the new residence, the secret money is declared and is immediately legalized. Many countries such as the USA and Germany have an Exit Tax in place.

The Exit Tax is a departure tax. Many German emigrants had problems with the German tax agency, although they had given up residence in Germany for years. They did not plan the move or did not plan enough. As a result, they have not enough documentary evidence. Some of them have not moved directly to the destination country, but have planned a temporary home such as Dubai and did not disclose the definitive destination to the tax agency. They are involved in complex legal proceedings with the tax agency at home despite the fact that they are living outside Germany. A change of residence must be well planned and documented.

4.1. Tax optimization with Citizenship by Investment Program

After the financial crisis in 2008, several countries decided to offer a Citizenship by Investment Program:

- Cyprus

- Bulgaria

- Hungary

- Malta

- Antigua & Barbuda

- St. Kitts & Nevis

- Dominica

- St Lucia

- Grenada

4.2. Criminal Abuse with new Passport

Some of this Citizenship by Investment programs were not only used for tax optimization, visa-free travel in 130 countries and as a banking passport, but were, amongst others, used to by-passed US-sanctions. The USA protested because rich investors from Iran had bypassed US-sanctions against Iran.

Certain countries sold at the same time a name change for a fee. Anyone who procures a new passport with a new name has immediately bought a new identity. Certain countries also sell diplomatic passports, not only in the Caribbean but also in Eastern Europe. No wonder that international criminals also make use of it. If you open a bank account with a new passport and a new name, you can easily implement criminal plans. I deliberately do not count on what you can do with it. Otherwise, I am again attacked by certain media with the charge that I am spreading instructions on illegal activities.

The cheapest deal comes from Dominica. With 100’000 USD direct investment or USD 200’000 real estate investment you are already there. The USA has heavily targeted Dominica because Dominica sold the Citizenship by Investment Program to Iranians. The Iranians have circumvented the Iran Embargo and the US-sanctions of the US Office of Foreign Assets Control.

4.2.1 OFAC Sanctions

https://www.treasury.gov/resource-center/sanctions/Programs/Pages/iran.aspx

The sanctions, which include a US embargo on aircraft and their replacement parts, are known in banking jargon as OFAC Sanctions. We are engaged in several cases of international transactions involving OFAC sanctions. We work closely with an OFAC lawyer in Washington, DC, who has a law firm opposite the White House and exclusively deals with OFAC sanctions. Dominica, the land destroyed by the hurricanes, survived thanks to this program. The European Union has not been long in coming. It has targeted Cyprus, Bulgaria and Italy. Many Russians have abused the Citizenship by Investment Program in Cyprus. They bought an EU passport in Cyprus without actually living in Cyprus moving subsequently to Switzerland or to London.

4.3. Problem Tax Evasion solved – with Golden Visa Program

If you only want to settle for a tax-efficient residence and do not need a new passport at once, you will be well served by the Golden Visa Programs. Twelve countries offer a Golden Visa for a direct investment with the government, a real estate investment or a business investment.

4.4. Golden Visa Country List

- Switzerland

- United Kingdom of Great Britain: Minimum Investment USD 3’000’000

- USA

- Singapore

- Portugal

- Spain

- Cyprus

- Greece

- Ireland

- Malta

- Australia

- Belgium

- Cyprus

- Belize

- Panama

4.5. Why are Golden Visa and Citizenship by Investment Programs so attractive?

The main customers are HNWI from China, Russia and the Arab states. They suffer immensely under the current visa restrictions. Their freedom of travel is severely limited so that international business travel is impossible in the short term. Above all, citizens from the US prefer countries in the Caribbean. As soon as they have a passport, they give up their US passport and save a lot of taxes. The main reason for the relocation of EU citizens is the high tax burden. EU citizens seek the attractive Non-Dom tax status, which does not tax income outside the state of residence.

5. Non-Dom Status: move abroad and save taxes

Anyone who has ever wondered why so many Russian oligarchs live in London gets the answer here: the non-domiciled status (“Non-domiciled Status”). All Russians who settled in London with non-domicile taxation do not pay taxes in London for any income they receive outside of the UK. A non-domiciled Russian resident in London (resident but non-domiciled) with a 20 million custody account in Switzerland does not pay taxes on the income from the Swiss custody account in London. It depends on the difference between the two terms to the definition of residence according to UK tax law: “Residence” and “Domicile”.

5.1. Frequently used Tax Jargons are important to know

These terms are important in understanding the non-Dom tax status introduced by the English in 1799. In order to encourage investment in the colonies, income from the colonies was not taxed as long as they were not distributed to England. If the money earned in the colonies was nevertheless shifted to London, the tax liability was also incurred.

The Non-Dom concept applies today only to taxpayers having no British citizenship. If you are not of British origin, you may reside in the United Kingdom and be a resident of the United Kingdom without becoming permanently domiciled. Anyone who is considered a “domiciled person” with the intention of living in U. K. until the end of his life must pay taxes on his world income. The Non-Domes in U. K. only pay tax on their income from British sources (onshore income). Income from a source outside of the U. K. (offshore income) will not be taxed unless it is moved to the UK. All offshore income remains tax-free as long as it remains offshore. Offshore income is income that is not generated in the UK.

However, a non-domicile must be careful that the foreign income is not paid out to the UK, invested or otherwise spent, for example, with a foreign credit card. The rule of thumb is that everything that goes to Britain has to be taxed there too. All assets remaining outside are not subject to UK taxation.

5.2. Investment Banking Team at Goldman Sachs moved to Milano

Non-Dom status exists not only in the U. K., but in Ireland, Malta, Cyprus, Switzerland, and since 2017 also in Italy. Italy introduced a Golden Visa program with a lump-sum tax of EUR 100,000 granting a Non-Dome status last year. The investment banking team at Goldman Sachs in London relocated to Milano opting for the new residence based on the Golden Visa Italy program. More than 100,000 Non-Domes from all over the world are registered in the United Kingdom.

All types of income such as that from investment, interest, license income, commissions, rent and income from working abroad are exempt from personal taxation, due to the Non-Dom tax status. The source of the income should not be located in the state of residence. The wealth that was already present in the country of residence before the day of relocation remains un-taxed in the State of residence. It is important that you are in a position to immediately prove based on documentary evidence that the wealth was already located there before the relocation.

5.3. Case Studies based on different Countries with Non-Dom Status

- Mr Schumacher is living in London as a resident with the attractive Non-Dom status. He is the sole shareholder of his holding company in Malta. The holding company in Malta holds various participations in Cyprus, Malta and Switzerland. The holding company in Malta collects a total amount of EUR 1’000’000 dividends from the investments. The Maltese holding company does not pay any taxes. Mr Schumacher pays EUR 1’000’000 into his account in Switzerland. The money in the Swiss private bank coming from Switzerland should be spent only outside of the UK, for example for expensive adventure travel holidays.

- Ms Schneider is living in Malta. She owns 50% of a U. K. Limited Company offering internet services to U. K. clients. The U. K. limited company makes a profit of EUR 1’000’000 and then pays 20% corporation tax in Great Britain. Ms Schneider collects EUR 400’000 net dividend with her private account in London. With the money, she makes a real estate investment in London. There are no taxes in Malta.

- Mr Smith is living in Dublin. He owns a portfolio worth EUR 5’000’000 in a private account in Zurich with a private bank. He is investing in blue chips and bonds. The portfolio generates a performance of EUR 200’000 per year. The income is reinvested with the private bank in Zurich. There is no taxation in Ireland.

- Mr Brown is living in London. He works 3 months a year for a hedge-fund in the Cayman Islands. The money earned there he can pay off in Switzerland at a private bank. The account will not be touched from London. The money in the Swiss account may not be spent in England. He does not pay taxes on the money earned in the Cayman Islands in London, as long as he does not spend or invest that money in England.

In all Non-Dom countries, income transferred from abroad to the state of residence must be declared on the tax return and taxed at normal tax rates. Hence the name: “Remittance Basis Taxation”.

6. Legalized Black Money – thanks to Golden Visa Switzerland

Switzerland is still the dream destination of many High Net Worth Individuals (HNWI). Above all Russian citizens and recently also Turkish citizens (Erdogan Effect) are attracted by Switzerland. Vladimir Putin started fighting tax evasion. For some years now, there has been a so-called “de-offshorization program” in Russia, but only on paper. The Russian clients of Swiss banks are reluctant to making use of it. They don’t trust the government of the Russian Federation. They are afraid of disclosing their assets. The Russian entrepreneurs prefer cutting off their arms, rather than disclosing their private account in Switzerland. Almost all Russian entrepreneurs are arduous patriots. They love Russia and Putin. However, when it comes to the voluntary disclosure of their secret Swiss bank accounts, the patriotism comes to its limits.

6.1. Extra Bonus for Swiss Private Bankers for each legalized Client

On the other hand, Swiss private bankers are actively convincing Russian investors to relocate to Switzerland to legalize the assets on the account. Swiss private bankers sell to foreign bank account holders the transfer of their residency to Switzerland as the best way to legalize their black money. The transfer of residence with flat-rate taxation in Switzerland is regarded as a supreme discipline by both private bankers and customers of Swiss private banks, in order to definitely eliminate the problem of tax evasion for Russian customers. With the move to Switzerland, Russian clients of Swiss private banks legalize all offshore accounts at one. The private bankers have an eminent interest that their customers no longer have black money.

Banks are putting enormous pressure on private bankers to eliminate tax evasion and legalize their accounts in line with the officially declared white money policy. Above all, private banks with large amounts of black money pay their private bankers a special bonus for each legalized account. It is, therefore, no wonder that Swiss private bankers aggressively market the transfer of residency to Switzerland with lump-sum taxation – with success. More than 5’000 foreign individuals are living in Switzerland based on the lump-sum taxation regime.

6.2. Lump-sum Taxation is calculated based on the Cost of Living in Switzerland

The calculation for lump-sum taxation is not based on the worldwide income, but on the annual cost of living multiplied by a factor of 7. Three years ago, it was only a factor of 5. At the end of 2014, there were 5,382 individuals in Switzerland, paying a total of CHF 740 million in taxes. Each taxable person paid an average of 137’495 CHF taxes in 2014. Today, it will cost much more. Last year, we successfully relocated a total of 4 families with the lump-sum taxation in Switzerland (from Russia, Turkey and Saudi Arabia).

Residing in Switzerland is not cheap compared to other countries offering a Golden Visa program. However, there are other reasons such as the high quality of life that speaks for Switzerland as the No 1 place for residency. Switzerland has 3 cities ranking amongst the top 10 cities in the world. This has also been announced in the Mercer 2018 Quality of Life Ranking: Zurich, Geneva and Basle.

6.3. Mercer 2018 Quality of Life Ranking

https://mobilityexchange.mercer.com/Insights/quality-of-living-rankings

Thanks to the offers with Golden Visa and Citizenship by Investment, a new industry with impressive growth rates has developed in the past 5 years. Malta, Cyprus, Ireland, Bulgaria, Portugal, Spain, Switzerland and Italy are growing in popularity for successful entrepreneurs from Europe and Asia. More and more entrepreneurs from countries with high tax burdens, such as Germany, Denmark and France, are considering a change of residency.

Demographically speaking, there is still no migration of populations in terms of numbers. For example, anyone who knows the distribution of income in Germany also knows that only 200,000 German taxpayers earn more than EUR 250,000 a year. That’s less than 1% of all taxpayers in Germany.

What would happen if a few thousand left Germany every year?

Some politicians in Germany are already preparing severe measures to extend the tax liabilities.

“Tax evasion in Germany is a serious crime. Tax avoidance with the transfer of residency is legal. Germany should have the option to connect the tax liability to the nationality as it is the case in the USA. If the trend to transfer the tax residence in the tax havens will not stop, Germany should take measures amending the tax law. The tax liability has to be connected to the nationality.” Sven Giegold, Die Grünen 2014

6.4. Reasons for a Change of Residency

- Globalization

- European Union’s constitutional right of personal freedom of movement

- Financial Crisis 2008

- Increased mobility due to low-cost flights

- International education and training on-the-job opportunities

- Political uncertainty

- Exorbitant tax burden

- Asset Protection

- Golden Visa Program as a solution to legalize black money

All the above reasons make a change of residency even more attractive than ever before.

If you are considering relocation to another country, you should be serious about it. After having finished your research on the Internet, call us for a second opinion. The matter is highly sophisticated. The correct legal structure to consider for your specific situation is a moving target. Together, we will find the best possible solution for you and your family.

“The transfer of residency abroad simplifies so many things. It is therefore definitely worthwhile to consider all your options. Starting with an income of EUR 500’000 per year, you will save several million with a change of your residence, in a few years. Instead of paying the exorbitant amount of taxes and losing a substantial part of your income to the tax agency, you could use it to enlarge your private bank account in Switzerland or buy an attractive investment property.”

The transfer of your residence abroad is certainly a radical intervention in the life of your family. To benefit from it all you need to seek advice. Successful people are always actively seeking advice. Our consulting fee is negligible compared to the losses caused by your wrong decision.

6.5. Avoiding the Exit Tax

Everything has to be planned carefully in order to avoid unpleasant surprises. Above all, people who move away from high-tax countries such as Germany, Denmark, France, Italy, etc., must already plan how to move out avoiding problems with the exit tax. Most countries have an exit tax in place for a period of 5 years after relocation. The exit tax preserves the tax liability in favour of the old country of residence. If you do not plan your move, you risk disputes with the tax authority. You have to expect your tax agency claiming that your centre of life has not shifted. However, you need to prepare some specific documentary evidence. You have to demonstrate that you made a clear and definitive cut with the old place of residence. You have to provide documentary evidence that your new place of residence constitutes the uncontested centre of your life.

We have an international network of battle-proven real estate agents, helping you to set-up a new and appropriate residence in the new country. We support you in the search for an appropriate international private school for your children and advise you which area is more appropriate with your living standards.

Most importantly, however, we will help you to save millions of dollars in your taxes. We will arrange a tax-optimized structure with the most tax-efficient locations. We negotiate the best possible deal with the local tax authorities – for your unique benefit.